October 2024's Leading Growth Companies With Insider Influence

As global markets experience a mix of highs and uncertainties, with U.S. indices reaching record levels amidst inflation concerns and economic shifts in Europe and China, investors are increasingly focusing on companies where insider ownership aligns closely with growth potential. In this context, stocks that combine robust growth prospects with significant insider influence are seen as particularly compelling, offering a blend of strategic vision and vested interest that can be advantageous in navigating today's complex market landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 40.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

FB Financial (NYSE:FBK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: FB Financial Corporation, with a market cap of $2.23 billion, operates as a bank holding company for FirstBank, offering a range of commercial and consumer banking services to businesses, professionals, and individuals.

Operations: Unfortunately, the specific revenue segments for FB Financial Corporation were not provided in the text.

Insider Ownership: 25.5%

Earnings Growth Forecast: 23.6% p.a.

FB Financial demonstrates potential as a growth company with high insider ownership, despite recent challenges. Its earnings are forecast to grow significantly at 23.6% annually, outpacing the US market average. The company trades at a substantial discount to its estimated fair value and reports faster-than-market revenue growth projections of 12.8% per year. However, recent earnings showed a decline in net income for the third quarter compared to last year, highlighting some financial volatility.

- Take a closer look at FB Financial's potential here in our earnings growth report.

- The valuation report we've compiled suggests that FB Financial's current price could be quite moderate.

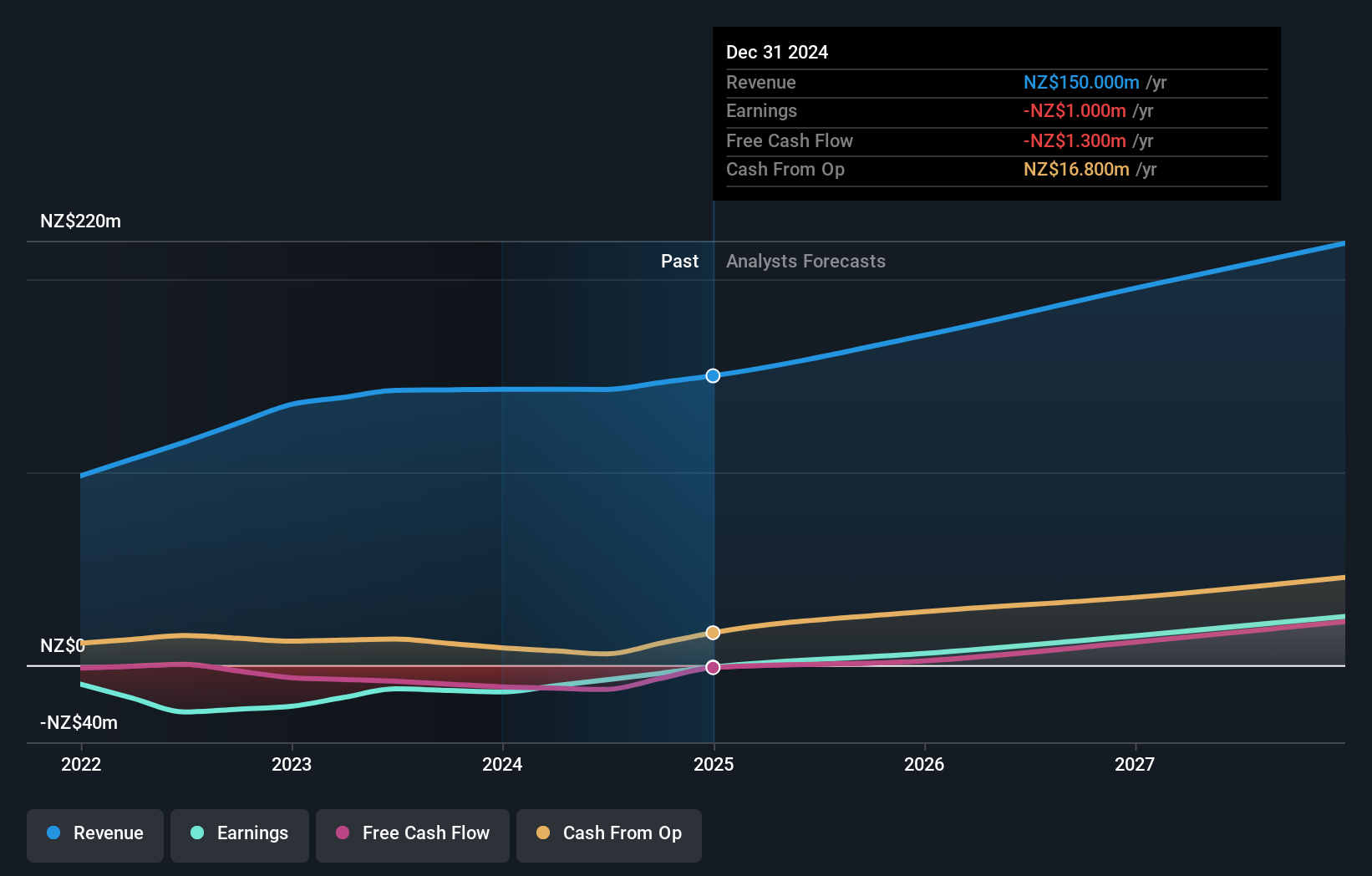

Vista Group International (NZSE:VGL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vista Group International Limited offers software and data analytics solutions to the global film industry, with a market capitalization of NZ$741.55 million.

Operations: Vista Group International Limited generates its revenue through software and data analytics solutions tailored for the global film industry.

Insider Ownership: 10%

Earnings Growth Forecast: 59.9% p.a.

Vista Group International shows promise with its forecasted revenue growth of 12.5% annually, surpassing the NZ market average. The company is trading at a significant discount to its estimated fair value and is expected to become profitable within three years, indicating above-average market profit growth. Recent investor activism has led to board nomination challenges, while earnings guidance for 2024 was lowered slightly, reflecting some operational uncertainties amidst improving financial performance from last year.

- Click here to discover the nuances of Vista Group International with our detailed analytical future growth report.

- According our valuation report, there's an indication that Vista Group International's share price might be on the cheaper side.

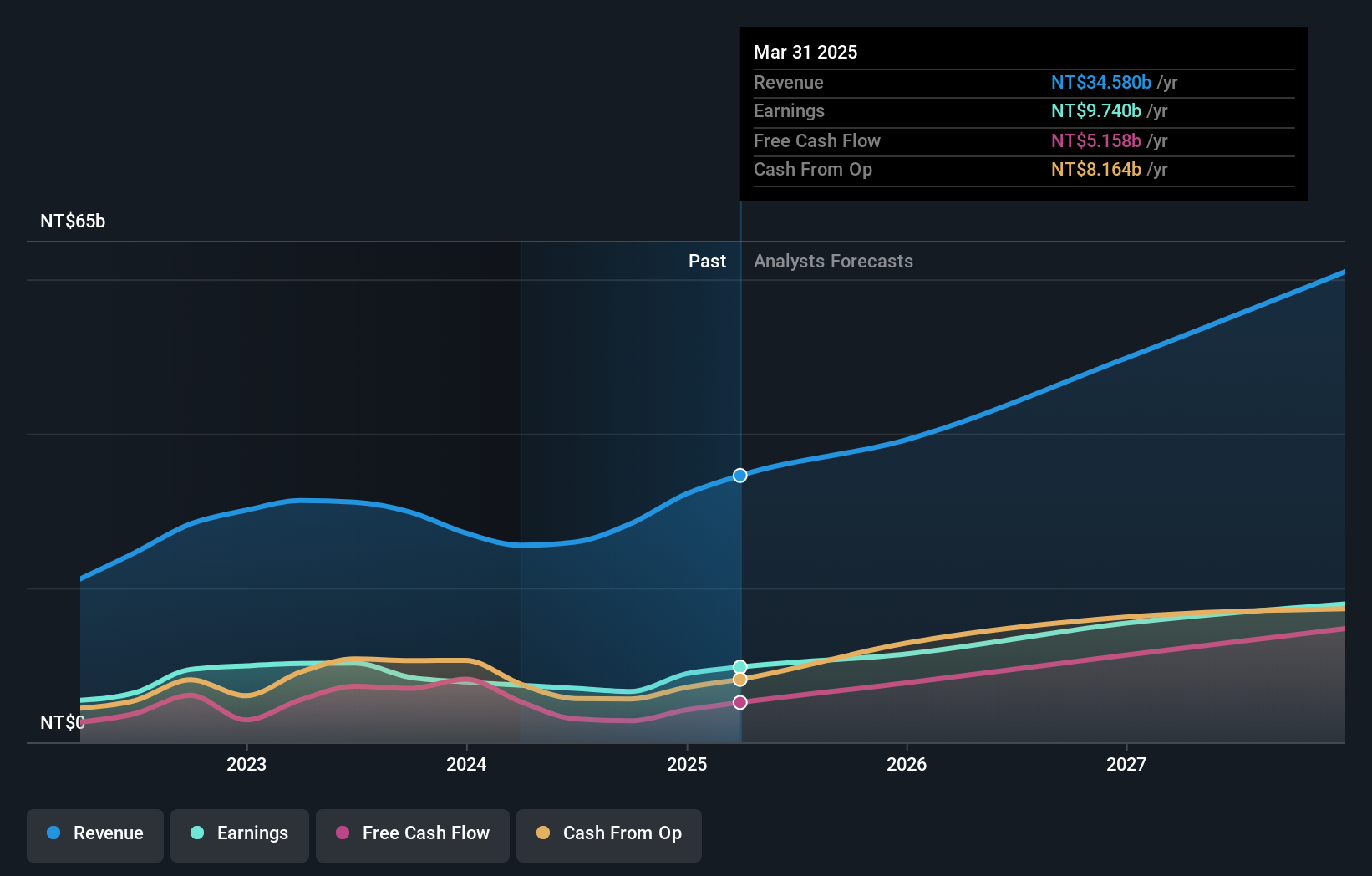

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

Overview: E Ink Holdings Inc. researches, develops, manufactures, and sells electronic paper display panels globally, with a market capitalization of NT$350.34 billion.

Operations: The company generates revenue from its Electronic Components & Parts segment, amounting to NT$25.95 billion.

Insider Ownership: 10.8%

Earnings Growth Forecast: 35.8% p.a.

E Ink Holdings is poised for substantial growth, with revenue expected to increase by 31.4% annually, outpacing the Taiwan market. The company's earnings are projected to grow significantly at 35.8% per year, and it trades below its estimated fair value. Recent developments include a TWD 12 billion syndicated loan to bolster capital and the launch of the T2000 ASIC, enhancing ePaper technology efficiency and performance across various applications.

- Navigate through the intricacies of E Ink Holdings with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that E Ink Holdings is priced higher than what may be justified by its financials.

Summing It All Up

- Get an in-depth perspective on all 1486 Fast Growing Companies With High Insider Ownership by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal