Discovering South Korea's Undiscovered Gems This October 2024

In the last week, the South Korean market has remained flat, yet over the past 12 months, it has experienced a modest rise of 3.8%, with earnings forecasted to grow by an impressive 30% annually. In this environment, identifying stocks that are poised for growth can be particularly rewarding as they may offer unique opportunities amid stable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

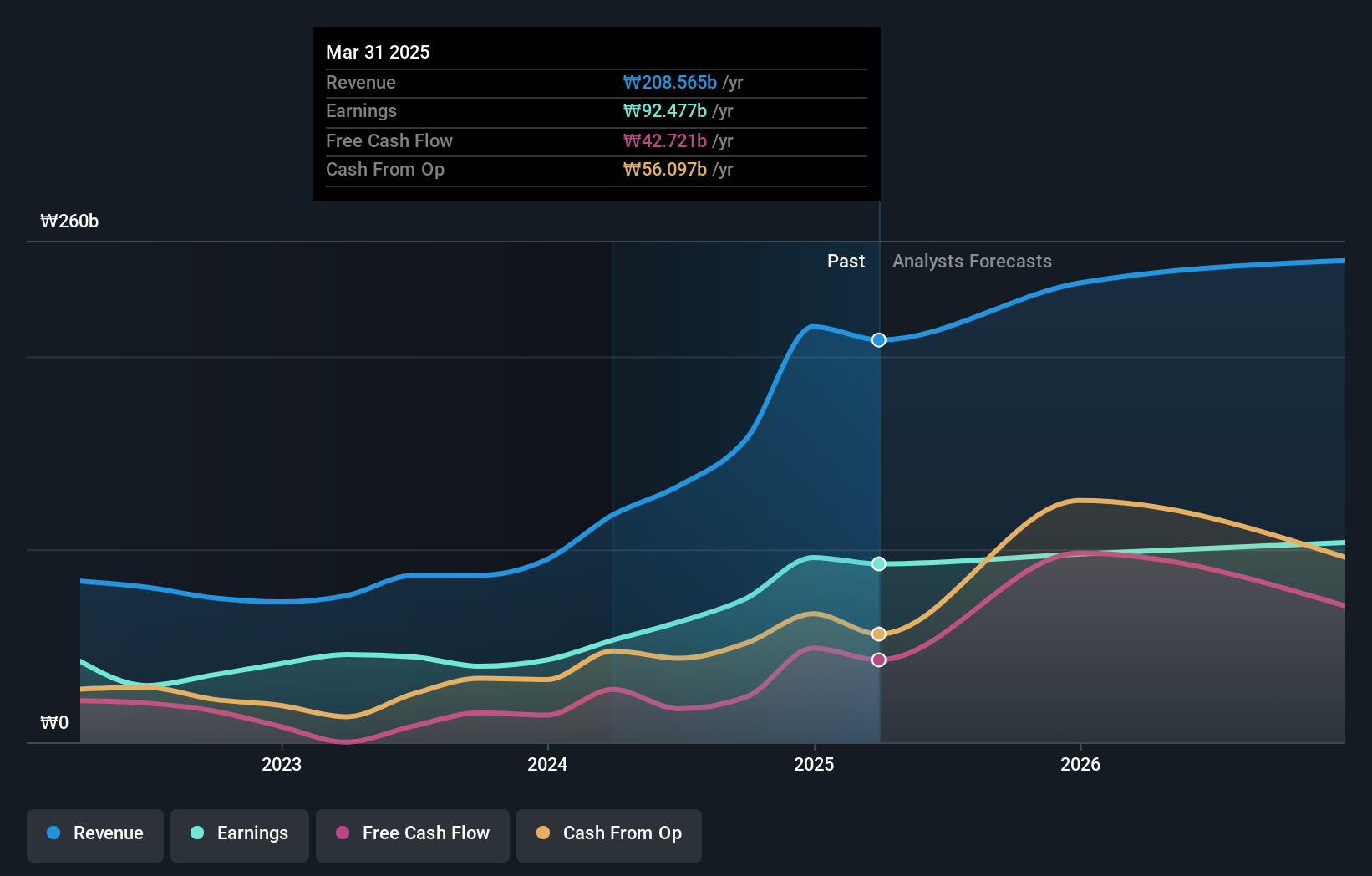

Overview: PSK HOLDINGS Inc. is engaged in the global manufacturing and sale of semiconductor and flat panel display equipment, with a market cap of ₩1.12 trillion.

Operations: PSK HOLDINGS derives its revenue primarily from the sale of semiconductor manufacturing equipment, generating ₩132.98 billion from this segment.

PSK Holdings, a small player in the semiconductor industry, recently joined the S&P Global BMI Index. Its earnings surged by 40.8% over the past year, outpacing the industry's -10%. Despite a one-off gain of ₩26.4 billion impacting results, it remains profitable with more cash than debt and free cash flow positive. However, shareholders experienced dilution last year and share price volatility has been notable over recent months. Earnings are forecast to grow 20.74% annually moving forward.

- Navigate through the intricacies of PSK HOLDINGS with our comprehensive health report here.

Gain insights into PSK HOLDINGS' past trends and performance with our Past report.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

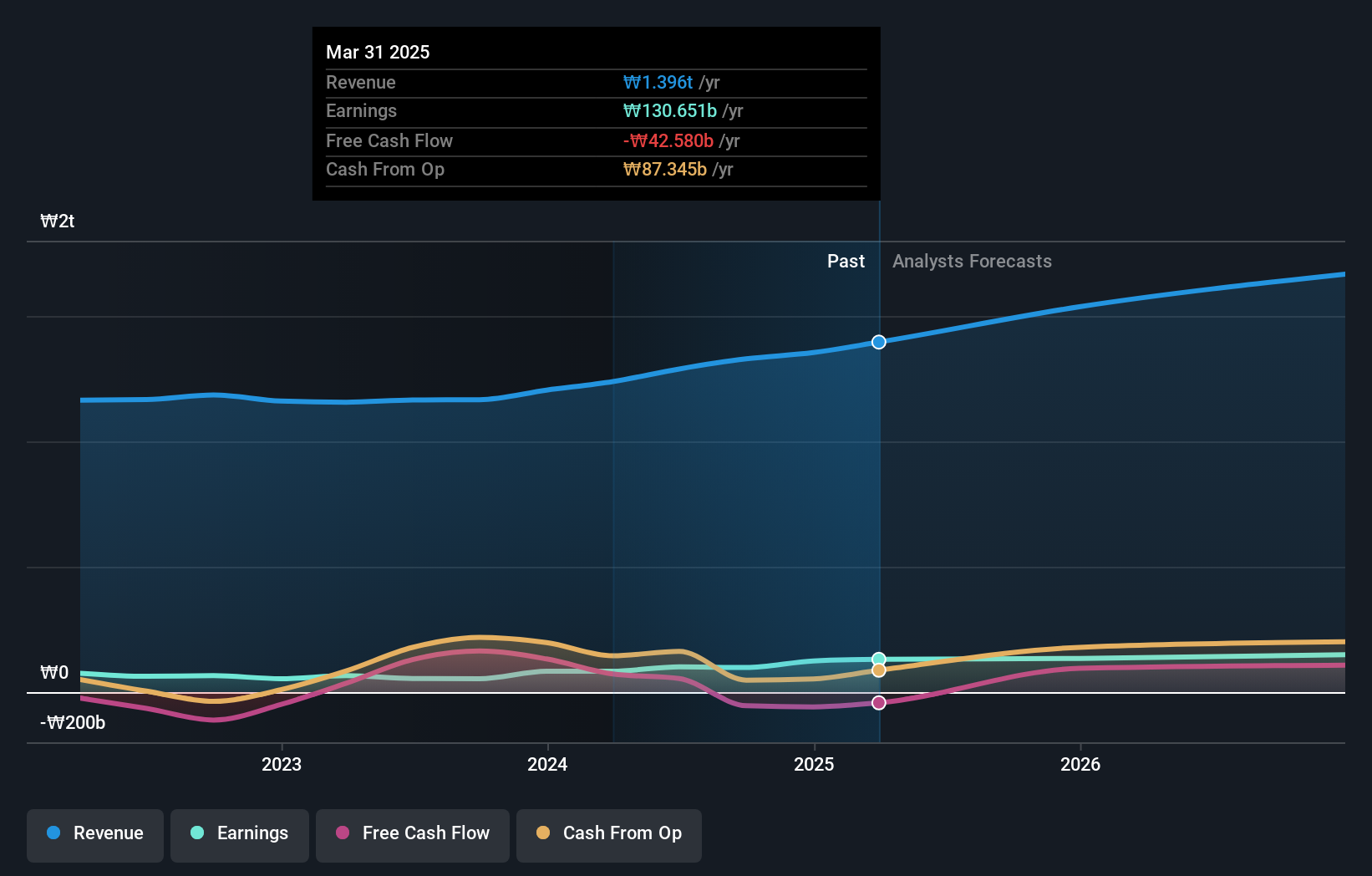

Overview: Kyung Dong Navien Co., Ltd. is a South Korean company that specializes in the manufacturing and sale of machinery and heat combustion equipment, with a market capitalization of ₩1.24 trillion.

Operations: Kyung Dong Navien generates revenue primarily from the air conditioning manufacturing and sale segment, which contributes ₩1.29 billion.

Kyung Dong Navien, a notable player in South Korea's heating solutions sector, has shown impressive earnings growth of 85.5% over the past year, significantly outpacing the building industry's average of 28.5%. The company's net debt to equity ratio stands at a satisfactory 6.5%, reflecting prudent financial management. Furthermore, interest payments are well covered with EBIT covering them 27 times over, highlighting strong operational efficiency. With high-quality earnings and positive free cash flow, Kyung Dong Navien seems well-positioned for continued stability and potential growth within its niche market.

- Click to explore a detailed breakdown of our findings in Kyung Dong Navien's health report.

Understand Kyung Dong Navien's track record by examining our Past report.

KCTech (KOSE:A281820)

Simply Wall St Value Rating: ★★★★★★

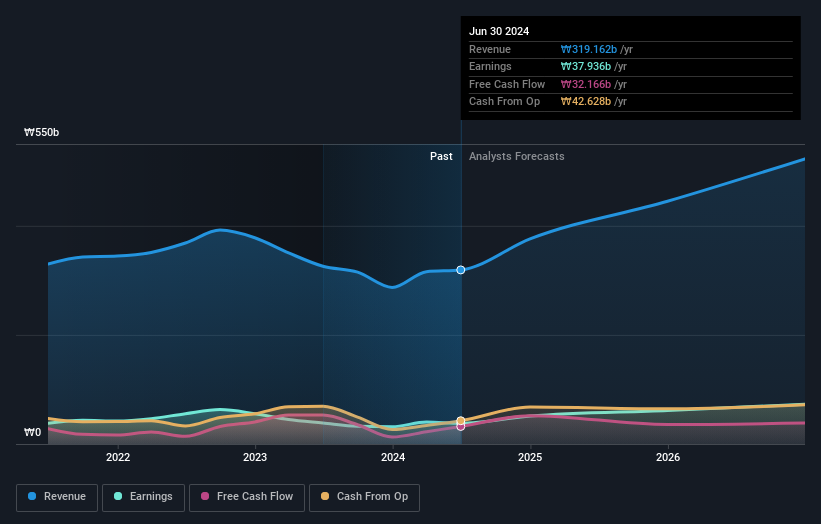

Overview: KCTech Co., Ltd. is a South Korean company that manufactures and distributes semiconductor systems, display systems, and electronic materials, with a market cap of ₩812.56 billion.

Operations: KCTech generates revenue primarily from semiconductor systems and display systems. The company's net profit margin is 12.5%.

KCTech, a nimble player in the semiconductor industry, is debt-free and boasts high-quality earnings despite a recent -1.5% dip in growth compared to the sector's -10%. The company is set for a promising trajectory with earnings forecasted to grow by 24.54% annually. KCTech has announced share repurchase programs worth up to ₩10 billion (US$7.5 million), aimed at boosting shareholder value and stabilizing its volatile stock price over recent months.

Turning Ideas Into Actions

- Explore the 188 names from our KRX Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal