What's in the Cards for Steel Dynamics Stock in Q3 Earnings?

Steel Dynamics, Inc. STLD is set to release third-quarter 2024 results after the closing bell on Oct. 16.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in two of the last four quarters while missed twice. It has a trailing four-quarter earnings surprise of roughly 1.1%, on average. The company posted an earnings surprise of around 1.9% in the last reported quarter. Its third-quarter results are likely to have been impacted by lower profitability in steel operations.

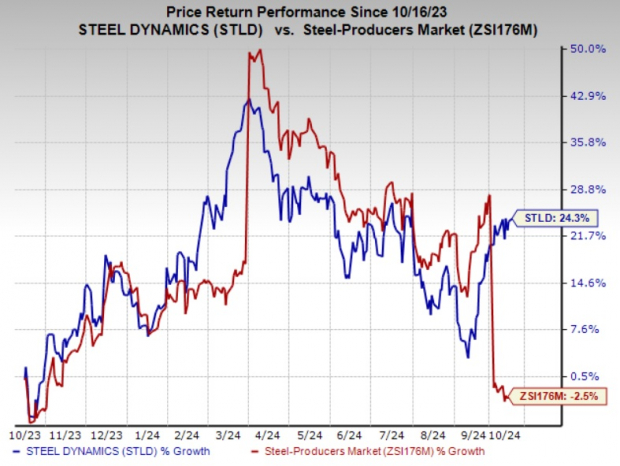

Shares of STLD have gained 24.3% in the past year compared with a 2.5% decline of the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

What do STLD’s Estimates Say?

Steel Dynamics envisions third-quarter earnings in the range of $1.94-$1.98 per share.

The Zacks Consensus Estimate for revenues for Steel Dynamics for the to-be-reported quarter is pinned at $4,251.3 million, suggesting a year-over-year decline of 7.3%.

Factors at Play for STLD Stock

Lower profitability in the company’s steel operations is expected to have weighed on its third-quarter results. Lower prices are likely to have hurt the segment’s performance. Demand is expected to have remained firm in major end markets in the third quarter, supporting shipments. Our estimate for total steel shipments is pegged at roughly 3.25 million tons for the third quarter, up 3.3% on a year-over-year basis.

Steel Dynamics, last month, said that it sees profitability in its steel operations to be significantly lower than the second quarter due to reduced average realized pricing in the flat rolled operations. Approximately 80% of this business is contract-based, linked to lagging pricing indices. Flat-rolled steel prices have stabilized and are showing improvement, with underlying demand remaining consistent.

Meanwhile, U.S. steel prices have seen a sharp decline this year due to a slowdown in end-market demand after a strong run in late 2023 that extended into early 2024. The benchmark hot-rolled coil (HRC) prices are down more than 40% since reaching $1,200 per short ton at the start of 2024. The downside has been influenced by a concoction of factors, including a pullback in steel mill lead times, an oversupply of steel exacerbated by increased imports, reduced demand from key industries and economic uncertainties.

Sluggish industrial production and construction activities also contributed to the decline. While the recent steel mill price hikes have led to a modest uptick in HRC prices, a significant recovery is not expected over the near term given the weak manufacturing backdrop and demand weakness. Prices are currently hovering around the $700 per short ton level.

Lower average realized selling prices are likely to have hurt STLD’s margins in the quarter to be reported. Our estimate for third-quarter average external selling price for the company’s steel operations stands at $1,124, suggesting a 5.6% year-over-year decline a 1.2% sequential decrease.

What Our Model Unveils for STLD

Our proven model does not conclusively predict an earnings beat for Steel Dynamics this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP: Earnings ESP for Steel Dynamics is 0.00%. The Zacks Consensus Estimate for earnings for the third quarter is currently pegged at $1.98. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: STLD currently carries a Zacks Rank #3.

Basic Materials Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

Agnico Eagle Mines Limited AEM, scheduled to release earnings on Oct. 30, has an Earnings ESP of +4.38% and carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for AEM’s earnings for the third quarter is currently pegged at 96 cents.

CF Industries Holdings, Inc. CF, slated to release earnings on Oct. 30, has an Earnings ESP of +10.58% and carries a Zacks Rank #1 at present.

The consensus mark for CF’s third-quarter earnings is currently pegged at $1.04.

Kinross Gold Corporation KGC, scheduled to release third-quarter earnings on Nov. 5, has an Earnings ESP of +13.92%.

The Zacks Consensus Estimate for Kinross Gold's earnings for the third quarter is currently pegged at 16 cents. KGC currently carries a Zacks Rank #3.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD): Free Stock Analysis Report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal