US Growth Companies With High Insider Ownership In October 2024

As the U.S. stock market experiences fluctuations, with major indexes like the S&P 500 and Dow Jones Industrial Average sliding due to declines in technology and energy stocks, investors are keenly observing economic indicators and corporate earnings for signs of stability. In this environment, growth companies with high insider ownership can be appealing as they often indicate confidence from those closest to the business in its long-term potential amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.5% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 26% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.4% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 34.6% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 37.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

We're going to check out a few of the best picks from our screener tool.

Kanzhun (NasdaqGS:BZ)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kanzhun Limited, with a market cap of $7.48 billion, operates in the People's Republic of China offering online recruitment services through its subsidiaries.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, amounting to CN¥6.81 billion.

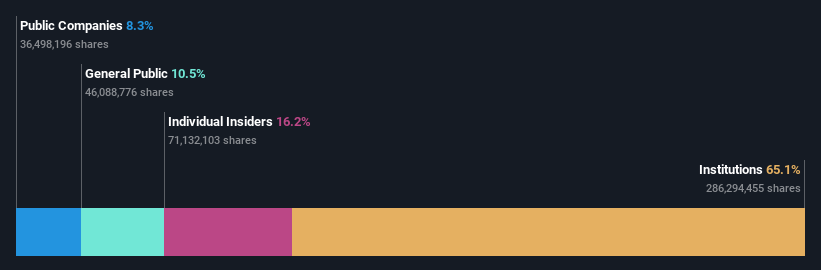

Insider Ownership: 16.2%

Earnings Growth Forecast: 21.2% p.a.

Kanzhun's insider ownership aligns with its growth trajectory, as evidenced by a 285.6% earnings increase over the past year and projected annual earnings growth of 21.18%, outpacing the US market. Despite high share price volatility, Kanzhun trades at 47.4% below estimated fair value, suggesting potential undervaluation. Recent revenue guidance indicates an expected increase of up to 19.5%, reflecting positive operational conditions in China amidst ongoing corporate restructuring efforts including executive changes.

- Click here and access our complete growth analysis report to understand the dynamics of Kanzhun.

- The valuation report we've compiled suggests that Kanzhun's current price could be quite moderate.

Zscaler (NasdaqGS:ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $30.23 billion.

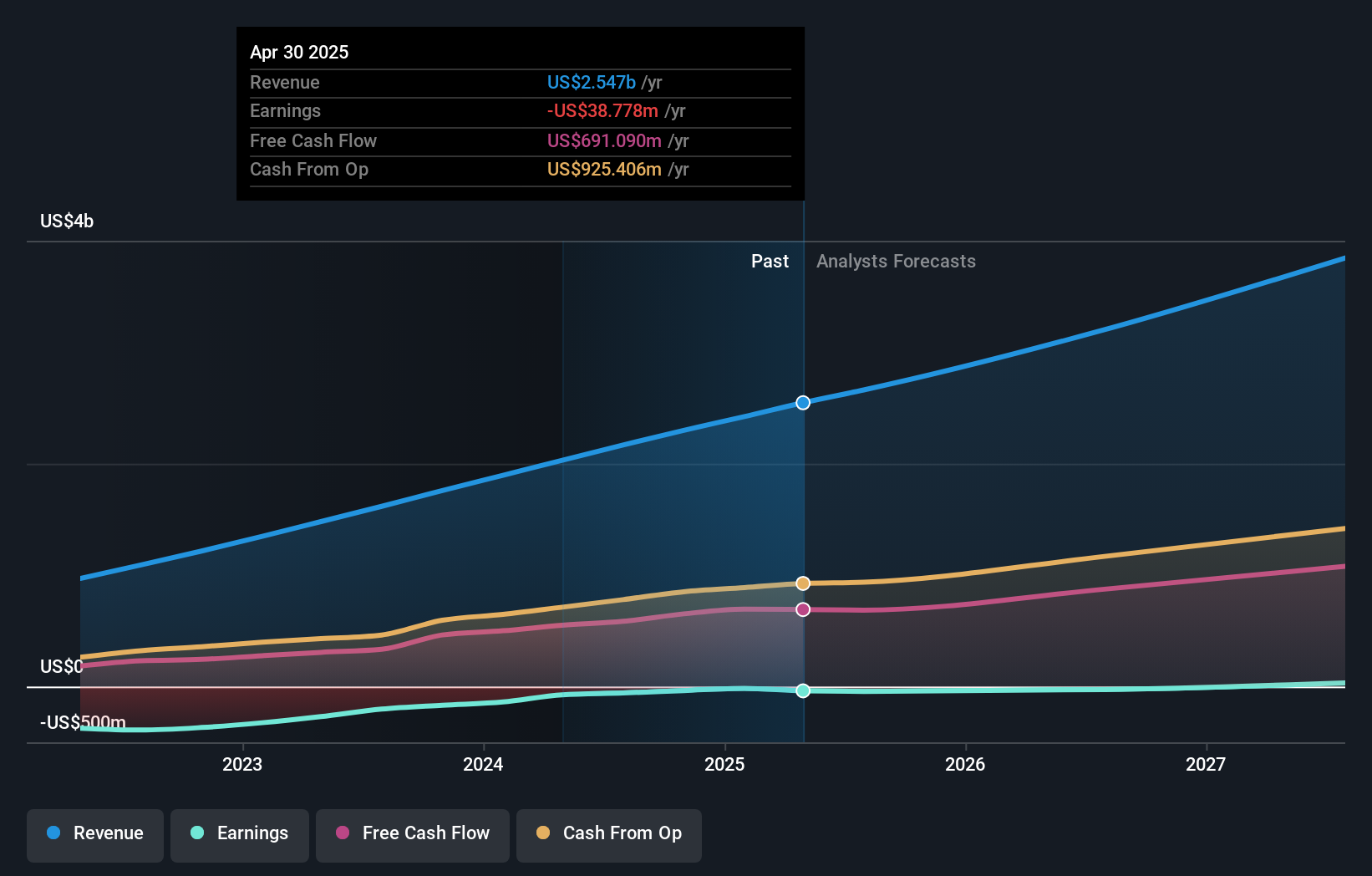

Operations: The company's revenue primarily comes from sales of subscription services to its cloud platform and related support services, totaling approximately $2.17 billion.

Insider Ownership: 37.8%

Earnings Growth Forecast: 40.2% p.a.

Zscaler's growth trajectory is underpinned by strategic partnerships and leadership changes, such as the recent collaboration with Airtel Business to enhance cybersecurity solutions in India. Despite a net loss reduction from US$202.34 million to US$57.71 million over the past year, Zscaler's revenue grew significantly, reaching US$2.17 billion for fiscal 2024. While insider selling has occurred recently, the company is trading below its estimated fair value and anticipates continued revenue growth above market rates at 16.3% annually.

- Navigate through the intricacies of Zscaler with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Zscaler's shares may be trading at a premium.

Fiverr International (NYSE:FVRR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fiverr International Ltd. operates a global online marketplace and has a market cap of approximately $833.46 million.

Operations: The company generates revenue of $372.22 million from its Internet Software & Services segment.

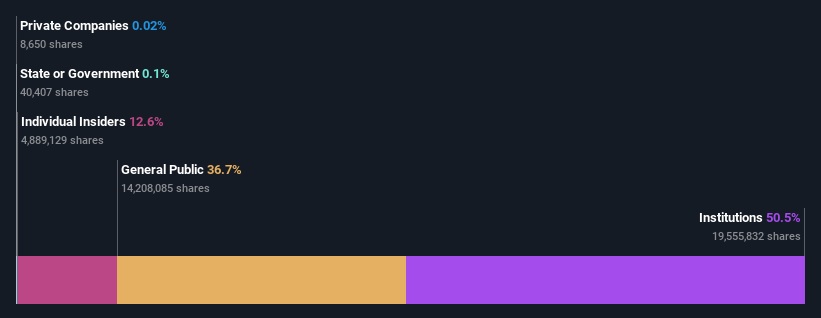

Insider Ownership: 13.9%

Earnings Growth Forecast: 42.9% p.a.

Fiverr International's growth is driven by strong earnings projections, with expected annual profit growth of 42.9%, outpacing the US market. The company has become profitable this year and trades at 46.2% below its estimated fair value, suggesting potential upside. Recent activities include a significant share buyback of 11.47% for US$100 million and raised revenue guidance for 2024 to between US$383 million and US$387 million, reflecting strategic financial management.

- Take a closer look at Fiverr International's potential here in our earnings growth report.

- Our expertly prepared valuation report Fiverr International implies its share price may be lower than expected.

Turning Ideas Into Actions

- Unlock our comprehensive list of 181 Fast Growing US Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal