Undiscovered Gems in Australia for October 2024

The Australian market has remained flat over the past week but has shown a robust 17% increase over the last year, with earnings projected to grow by 12% annually in the coming years. In this context, identifying stocks that are not only poised for growth but also remain underappreciated can offer unique opportunities for investors seeking to capitalize on emerging potential within this dynamic market.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Catalyst Metals (ASX:CYL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Catalyst Metals Limited is engaged in the exploration and evaluation of mineral properties in Australia, with a market capitalization of approximately A$697.67 million.

Operations: Catalyst Metals Limited generates revenue primarily from its operations in Western Australia (A$243.77 million) and Tasmania (A$75.08 million).

Catalyst Metals, a dynamic player in Australia's mining scene, recently turned profitable with net income reaching A$23.56 million for the year ending June 2024, a significant shift from the previous year's loss of A$15.63 million. The company has more cash than total debt and its interest payments are well covered by EBIT at 6.3 times coverage. With earnings projected to grow annually by 45.83%, Catalyst is trading at a substantial discount of 86% below estimated fair value, offering potential for future appreciation.

- Dive into the specifics of Catalyst Metals here with our thorough health report.

Review our historical performance report to gain insights into Catalyst Metals''s past performance.

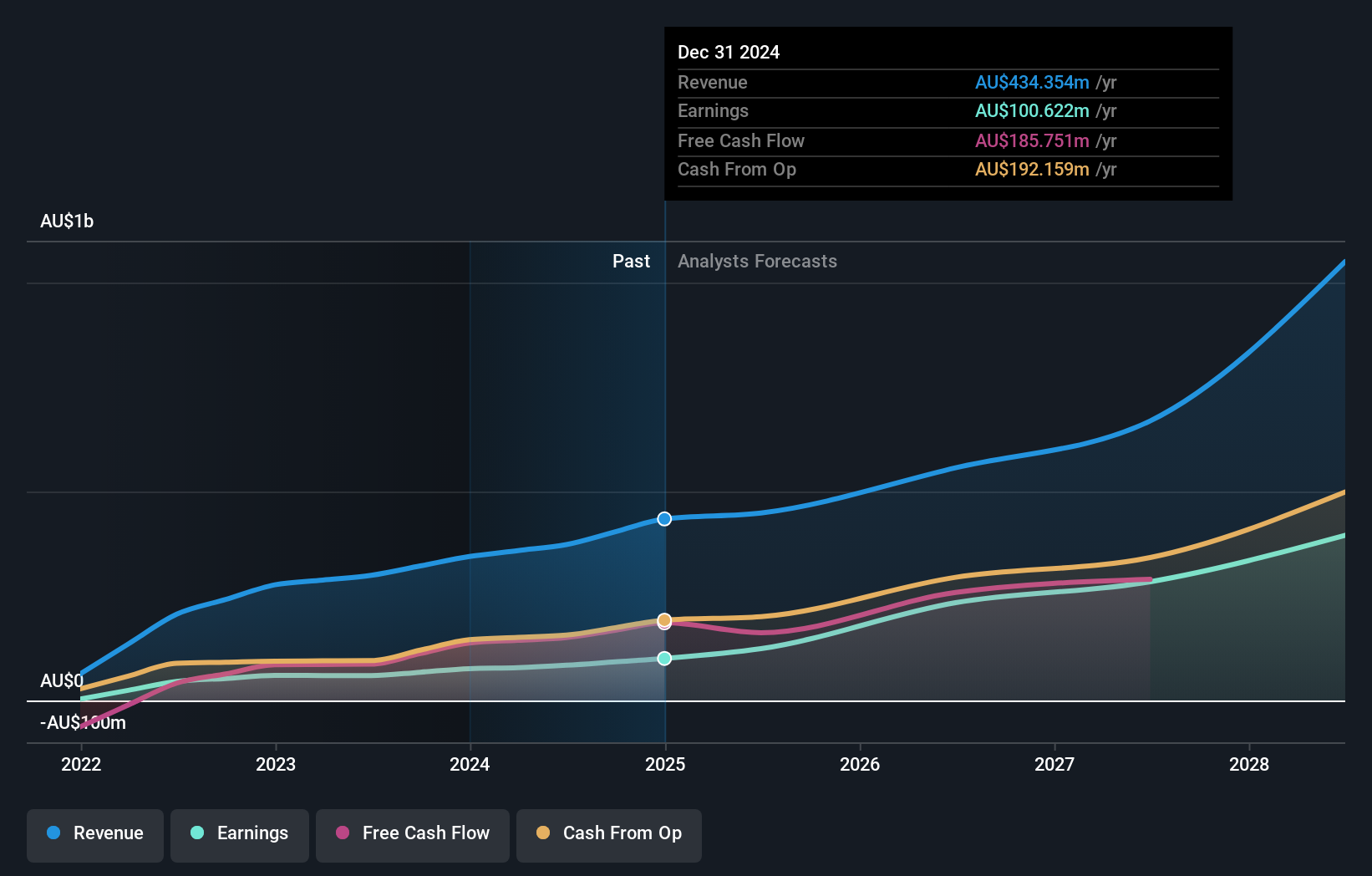

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market capitalization of A$2.73 billion.

Operations: Emerald Resources generates revenue primarily from mine operations, amounting to A$366.04 million. The company's financial performance can be analyzed through its net profit margin, which reflects the efficiency of converting revenue into actual profit after all expenses are accounted for.

Emerald Resources, a dynamic player in the mining sector, reported impressive earnings growth of 41.9% last year, outpacing the industry average of 1.6%. With sales reaching A$371.07 million and net income at A$84.27 million for the year ending June 2024, its profitability is evident. The company enjoys high-quality earnings and an EBIT coverage ratio of 18.6x for interest payments, indicating strong financial health despite a debt-to-equity increase to 8.5% over five years.

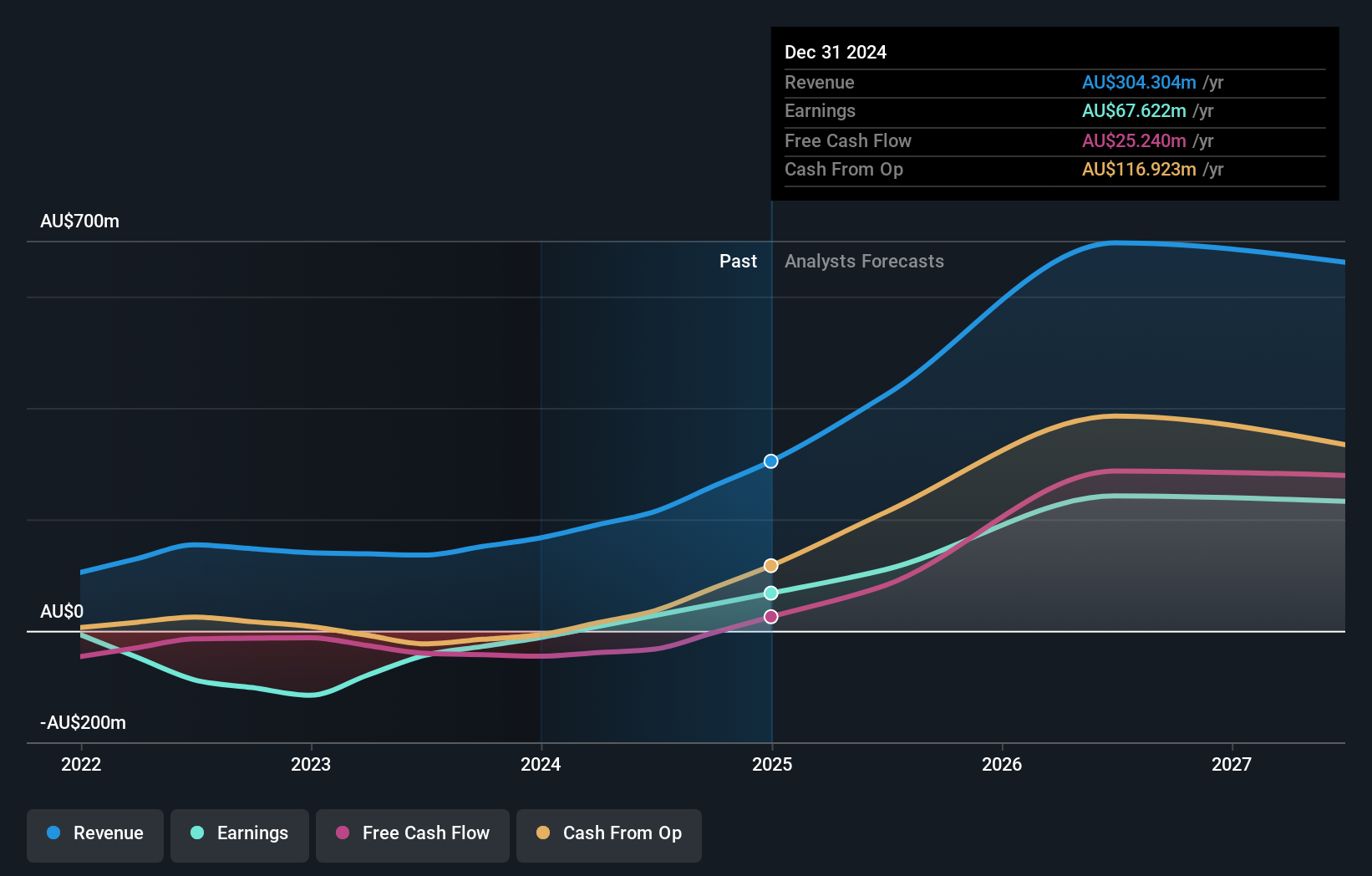

Ora Banda Mining (ASX:OBM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ora Banda Mining Limited focuses on the exploration, operation, and development of mineral properties in Australia with a market capitalization of A$1.24 billion.

Operations: Ora Banda Mining generates revenue primarily from gold mining, amounting to A$214.24 million.

Ora Banda Mining, a nimble player in the mining sector, has seen its debt to equity ratio rise to 4.1% over five years but maintains strong interest coverage at 7.8 times EBIT. The company recently turned profitable with net income of A$27.57 million for the year ending June 2024, reversing a previous loss of A$44.13 million. Despite shareholder dilution last year, it trades significantly below estimated fair value and anticipates robust earnings growth ahead.

- Click here and access our complete health analysis report to understand the dynamics of Ora Banda Mining.

Evaluate Ora Banda Mining's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 55 ASX Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal