Microsoft [NasdaqGS:MSFT] Unveils Healthcare AI Innovations, Strengthening Strategic Alliances for Growth

Microsoft (NasdaqGS:MSFT) is currently experiencing a period of significant transformation, driven by strategic investments in AI and cloud technologies, alongside challenges such as the impact of the Activision acquisition on operating income. Recent developments include a remarkable milestone in cash flow from operations and innovative product introductions like Copilot+ PCs. In the following discussion, we will explore Microsoft's competitive advantages, potential constraints, emerging opportunities, and external threats to provide a comprehensive analysis of the company's current business dynamics.

Take a closer look at Microsoft's potential here.

Competitive Advantages That Elevate Microsoft

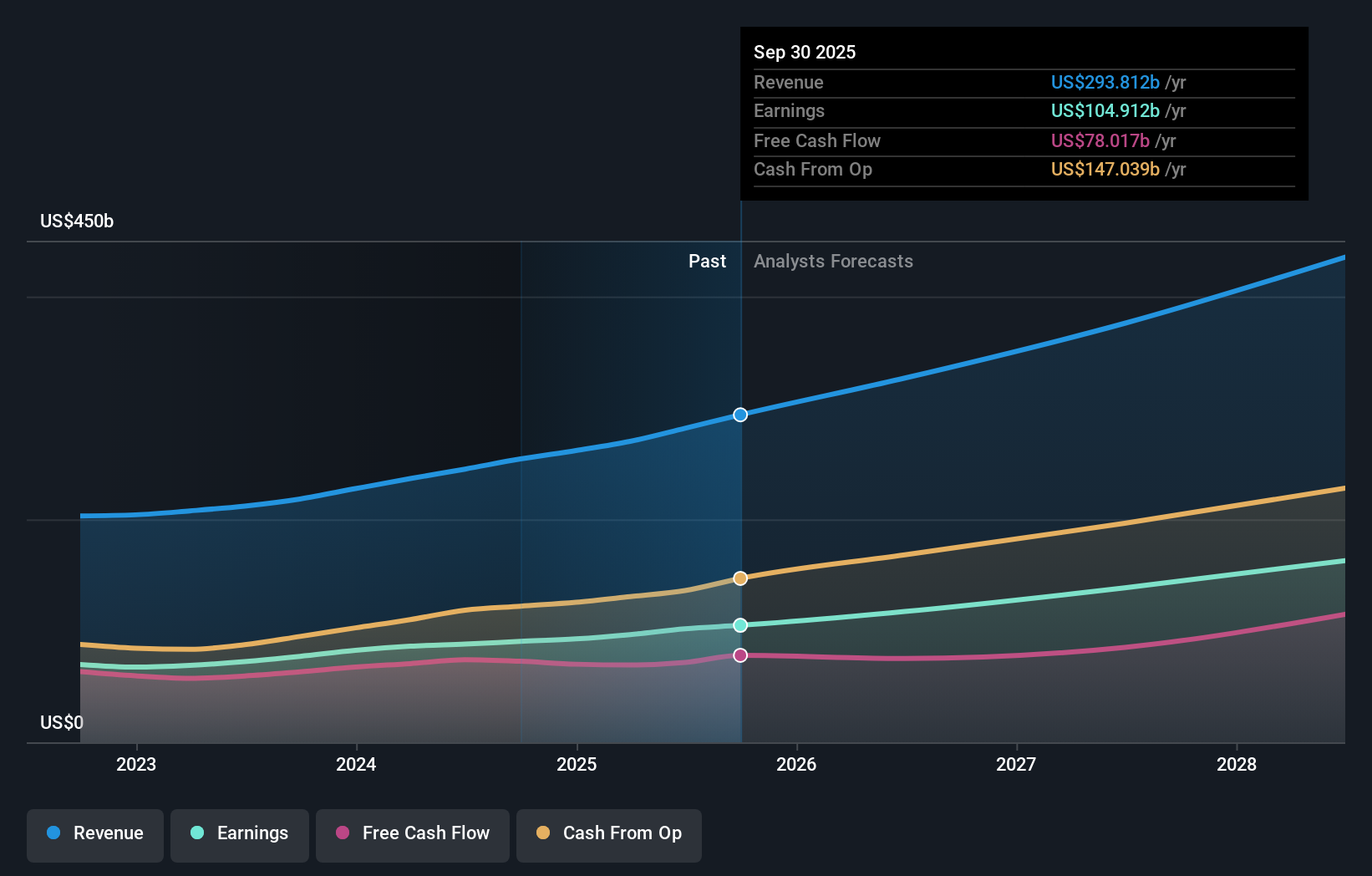

Microsoft's financial health is underscored by its impressive cash flow from operations, which reached $119 billion, marking a significant milestone for the company. This financial strength supports its strategic initiatives, including investments in AI and cloud expansion across four continents. The company's leadership, particularly under Satya Nadella, has been instrumental in driving growth, with annual revenue surpassing $245 billion, a 15% increase year-over-year. Microsoft's valuation also suggests potential upside, as it trades at 26.9% below its estimated fair value of $573.39. While its Price-To-Earnings Ratio of 35.3x is higher than peer averages, it remains favorable compared to the US Software industry average of 40.4x.

Challenges Constraining Microsoft's Potential

Microsoft faces several challenges that could constrain its growth. The company's operating income growth was negatively impacted by the Activision acquisition, which contributed a net impact of approximately 3 points to revenue growth but was a 2-point drag on operating income. Additionally, there has been a 9% decline in Office Commercial licensing, reflecting a shift towards cloud offerings. The devices segment also saw a revenue decrease of 11%, highlighting potential vulnerabilities in hardware sales. Furthermore, Microsoft's AI capacity constraints could hinder its ability to fully capitalize on the growing demand for AI solutions.

Emerging Markets Or Trends for Microsoft

Microsoft is well-positioned to capitalize on emerging opportunities, particularly in AI integration and new product launches. The introduction of Copilot+ PCs and the expansion of Azure AI provide access to a diverse selection of models, enhancing Microsoft's competitive edge in the AI space. LinkedIn's accelerated member growth and record engagement further bolster Microsoft's market position. The company's strategic alliances, such as the collaboration with KT Corporation to drive AI and ICT transformation in Korea, exemplify its commitment to expanding its global footprint and leveraging AI to enhance customer experiences across various sectors.

External Factors Threatening Microsoft

Several external factors pose threats to Microsoft's continued growth and market share. Intense market competition, particularly in the AI and cloud sectors, remains a significant challenge. Economic factors, such as the slightly lower-than-expected growth in some European regions, could impact overall performance. Additionally, regulatory issues, including a higher-than-anticipated effective tax rate due to recent state tax law changes, may affect profitability. Operational risks, particularly related to AI capacity constraints, could limit Microsoft's ability to meet the increasing demand for its AI-driven solutions.

To gain deeper insights into Microsoft's historical performance, explore our detailed analysis of past performance. To dive deeper into how Microsoft's valuation metrics are shaping its market position, check out our detailed analysis of Microsoft's Valuation.Conclusion

Microsoft's substantial cash flow and strategic leadership under Satya Nadella have positioned the company to effectively invest in AI and cloud expansion, supporting its impressive revenue growth. Challenges such as the impact of the Activision acquisition and declines in certain segments remain. Microsoft's focus on AI integration and strategic alliances offers significant opportunities for future growth. The company's current share price, trading 26.9% below its estimated fair value, alongside a Price-To-Earnings Ratio that is more favorable than the US Software industry average, suggests potential for appreciation. However, external threats, including intense competition and regulatory challenges, may impact its ability to fully capitalize on these opportunities, necessitating strategic agility to maintain its competitive edge.

Turning Ideas Into Actions

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal