Microsoft (NasdaqGS:MSFT) unveils healthcare AI innovations, boosting strategic alliances and growth potential

Take a closer look at Microsoft's potential here.

Key Assets Propelling Microsoft Forward

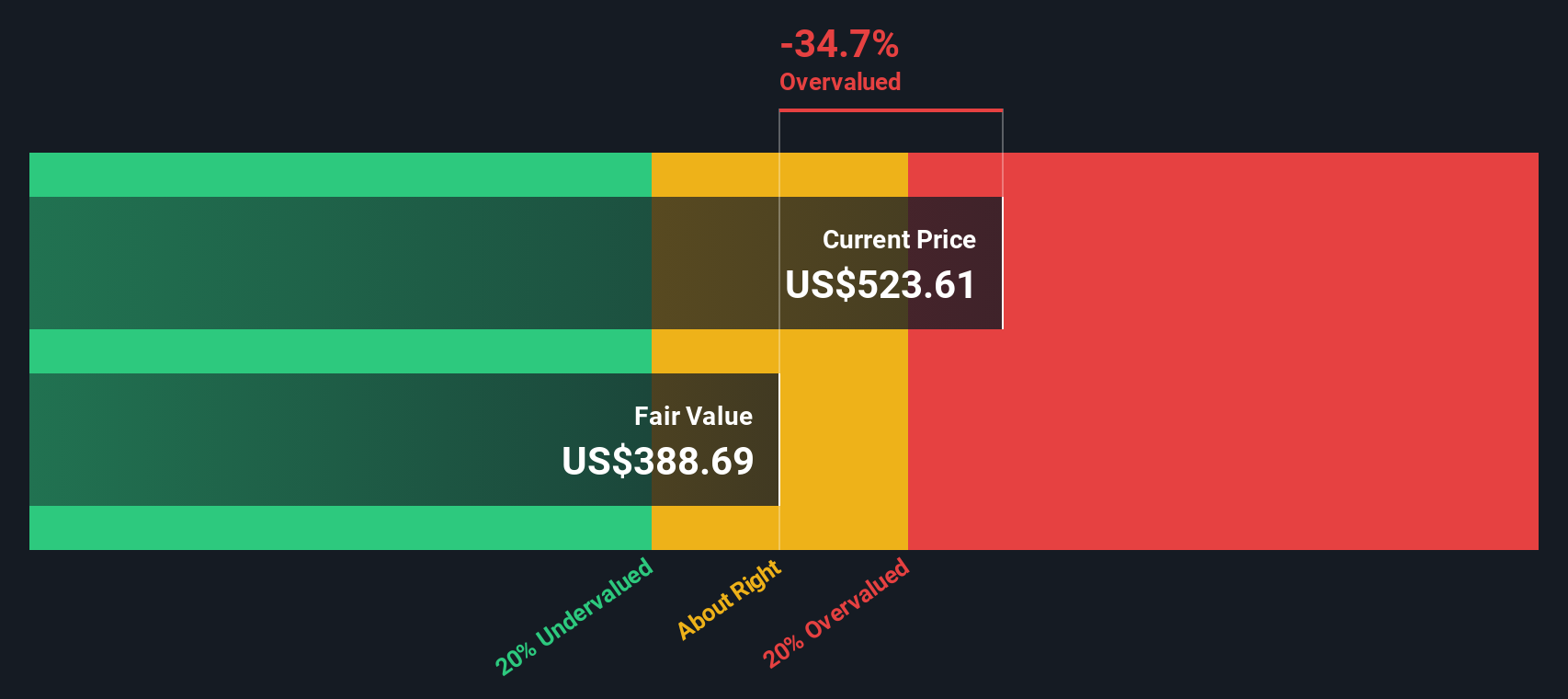

Microsoft's financial health is strong, with a significant revenue increase to $245 billion, marking a 15% year-over-year growth. The Microsoft Cloud segment alone generated $135 billion, a 23% rise, reflecting high demand in cloud services. Under the leadership of Satya Nadella, the company has seen substantial adoption of its AI tools, with Azure AI customer usage growing by nearly 50% and GitHub Copilot adoption surging by 180%. This strategic focus on AI and cloud services aligns with the company's long-term growth objectives. Moreover, Microsoft is currently trading at $419.14, which is below its estimated fair value of $573.39, indicating it is undervalued based on discounted cash flow analysis. This suggests a strong market positioning and potential for future appreciation.

Challenges Constraining Microsoft's Potential

Microsoft faces certain challenges. The company's cloud gross margin percentage decreased by roughly 2 points to 69%, reflecting potential pricing pressures or increased costs. Office Commercial licensing revenue saw a 9% decline, indicating a shift towards cloud-based solutions. Additionally, the Xbox hardware segment experienced a significant revenue drop of 42%, highlighting competitive pressures in the gaming industry. Microsoft's Price-To-Earnings Ratio of 35.3x, while favorable compared to the US Software industry average of 40.4x, is higher than the peer average of 32.8x, suggesting it may be perceived as expensive relative to some competitors.

Growth Avenues Awaiting Microsoft

Microsoft is poised to capitalize on numerous growth opportunities. The company is expanding its data center footprint across four continents, which will enhance its global reach and service capabilities. Investing in long-term fundamentals, innovation, and human capital is expected to drive future growth. Strategic partnerships, such as those with KT Corporation and Infosys, are set to accelerate the adoption of AI and cloud technologies, providing a competitive edge. The company's commitment to increasing capital expenditures in FY '25 further underscores its strategy to strengthen its market position and capture emerging opportunities.

Regulatory Challenges Facing Microsoft

External factors pose potential threats to Microsoft's growth trajectory. The company reported slightly lower-than-expected growth in certain European regions, which could signal regional economic challenges or regulatory hurdles. Additionally, constraints on AI capacity may limit the company's ability to fully capitalize on the growing demand for AI solutions. The PC market remains stable, with a 4% increase in Windows OEM revenue, but ongoing volatility in equity investments could impact financial performance. These challenges highlight the need for Microsoft to navigate regulatory environments and manage operational risks effectively.

To gain deeper insights into Microsoft's historical performance, explore our detailed analysis of past performance.To dive deeper into how Microsoft's valuation metrics are shaping its market position, check out our detailed analysis of Microsoft's Valuation.Conclusion

Microsoft's strategic emphasis on AI and cloud services is driving significant growth, evidenced by a 15% year-over-year revenue increase and substantial gains in Azure AI and GitHub Copilot adoption. While the company faces challenges such as declining cloud margins and competitive pressures in gaming, its expansion in data centers and strategic partnerships are set to bolster its market position. Microsoft's current trading price of $419.14, compared to its estimated fair value of $573.39, suggests that the market may not fully recognize its future growth potential. As the company navigates regulatory and operational challenges, its commitment to innovation and strategic investments is likely to sustain its growth trajectory and enhance shareholder value.

Seize The Opportunity

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal