Microsoft (NasdaqGS:MSFT) leverages strategic alliances and AI innovations for growth and market leadership.

Get an in-depth perspective on Microsoft's performance by reading our analysis here.

Key Assets Propelling Microsoft Forward

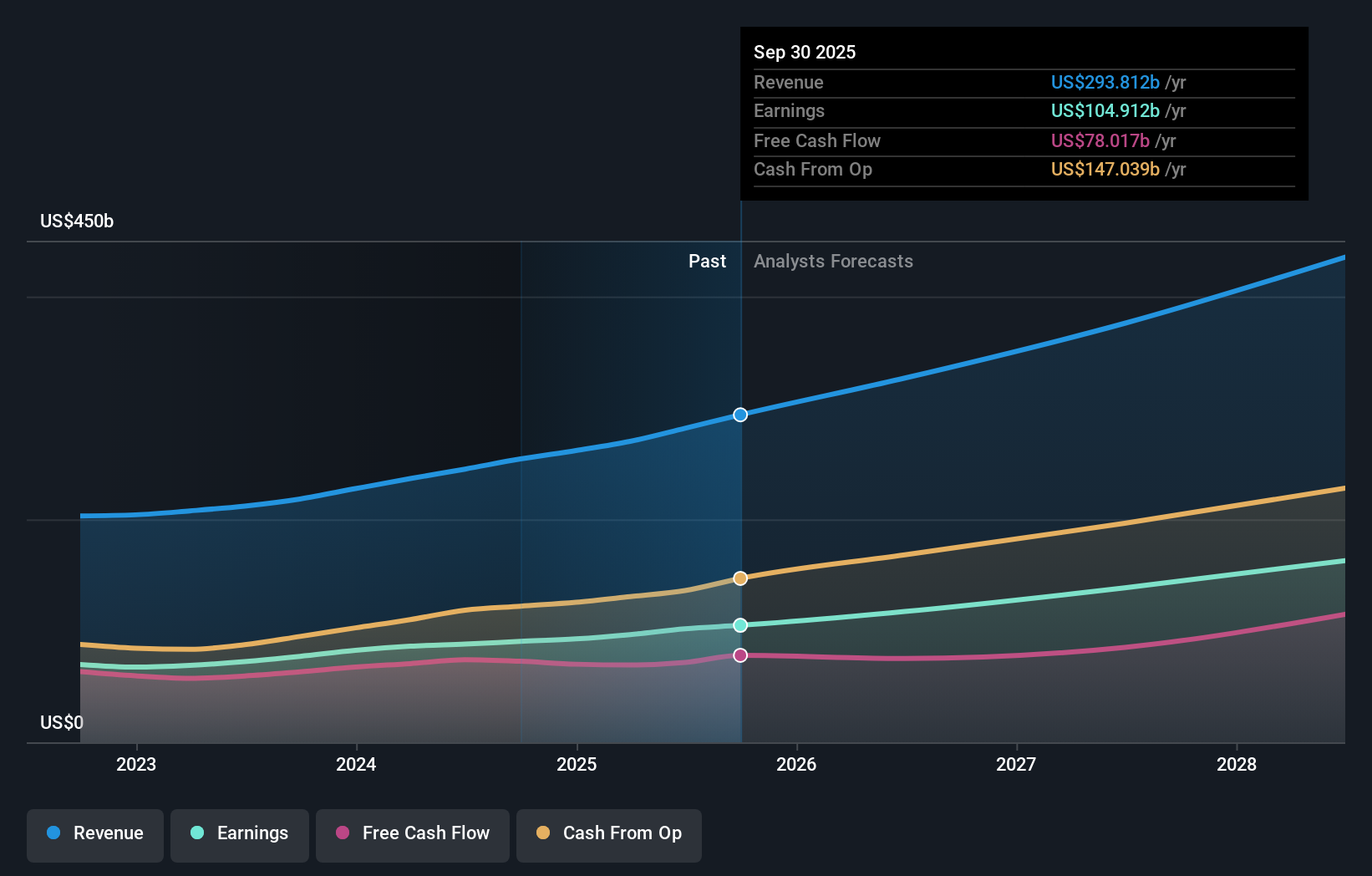

Microsoft has demonstrated strong financial health, with a total shareholder equity of $268.5 billion and a low debt-to-equity ratio of 19.2%, indicating financial stability. The company's cash flow from operations reached $119 billion, showcasing its ability to generate substantial cash. This financial strength supports strategic initiatives, such as the share repurchase program worth $60 billion, reflecting confidence in its long-term growth. Additionally, the recent 10% increase in quarterly dividends underscores its commitment to returning value to shareholders. Microsoft's current trading price of $419.14 is below the estimated fair value of $573.39, suggesting potential for appreciation. The management team's seasoned experience, with an average tenure of 6.7 years, further bolsters the company's strategic direction and execution capabilities.

Internal Limitations Hindering Microsoft's Growth

Despite its strong financial position, Microsoft faces challenges in certain areas. The company's Price-To-Earnings Ratio of 35.3x is higher than the peer average of 32.8x, indicating a potential overvaluation compared to peers. Furthermore, Microsoft's earnings growth of 12.4% per year is projected to lag behind the US market's 15.9% growth rate, suggesting a slower pace of expansion. Additionally, the recent acquisition of Activision, while contributing to revenue growth, has exerted a 2-point drag on operating income growth, highlighting integration challenges. The decline in Office Commercial licensing by 9% reflects a shift towards cloud offerings, which may impact traditional revenue streams.

Potential Strategies for Leveraging Growth and Competitive Advantage

Microsoft's strategic alliances and product-related announcements present significant opportunities for growth. The company's investment in AI and cloud expansion, as highlighted by CEO Satya Nadella, positions it to capitalize on emerging market trends. The introduction of Copilot+ PCs and the expansion of its gaming content pipeline demonstrate its commitment to innovation and meeting evolving consumer demands. Furthermore, collaborations with partners like KT Corporation and Infosys aim to enhance AI capabilities and drive digital transformation across industries. These initiatives, coupled with Microsoft's leadership in generative AI solutions, strengthen its competitive advantage and market position.

Competitive Pressures and Market Risks Facing Microsoft

Microsoft must navigate various external threats that could impact its growth trajectory. The competitive environment in AI and search, as noted by Nadella, presents challenges from rivals like Apple and other tech giants. Economic factors, particularly in Europe, pose risks to growth, as highlighted by CFO Amy Hood. Additionally, capacity constraints in AI investments may limit the company's ability to fully capitalize on market opportunities. The significant insider selling over the past three months raises concerns about potential internal challenges. These factors underscore the importance of strategic agility and innovation to maintain Microsoft's market leadership.

To gain deeper insights into Microsoft's historical performance, explore our detailed analysis of past performance.To dive deeper into how Microsoft's valuation metrics are shaping its market position, check out our detailed analysis of Microsoft's Valuation.Conclusion

Microsoft's strong financial position, characterized by substantial shareholder equity and impressive cash flow from operations, provides a solid foundation for its strategic initiatives and shareholder value enhancement. The company's current trading price of $419.14, which is below its estimated fair value of $573.39, suggests a potential for stock price appreciation, aligning with its long-term growth prospects. However, challenges such as a higher Price-To-Earnings Ratio compared to peers and integration issues from the Activision acquisition indicate areas for improvement. Microsoft's focus on AI and cloud innovations, along with strategic partnerships, positions it well to leverage emerging market trends and maintain its competitive edge, despite facing external pressures and market risks. These factors collectively imply that while Microsoft has a promising growth trajectory, it must continue to innovate and adapt to fully realize its potential.

Taking Advantage

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal