Microsoft's Cloud Innovations and Strategic Alliances Propel [NasdaqGS:MSFT] Forward in AI and Healthcare

Microsoft (NasdaqGS:MSFT) is experiencing a period of significant growth and innovation, driven by its expanding cloud and AI capabilities, yet it faces hurdles such as rising operating expenses and regulatory challenges. Recent developments include a 10% dividend increase and strategic partnerships enhancing its AI offerings, while declines in traditional revenue streams and insider selling raise concerns. In the discussion that follows, we will explore Microsoft's key assets, challenges, future prospects, and regulatory issues to provide a thorough analysis of its current market position.

Click here and access our complete analysis report to understand the dynamics of Microsoft.

Key Assets Propelling Microsoft Forward

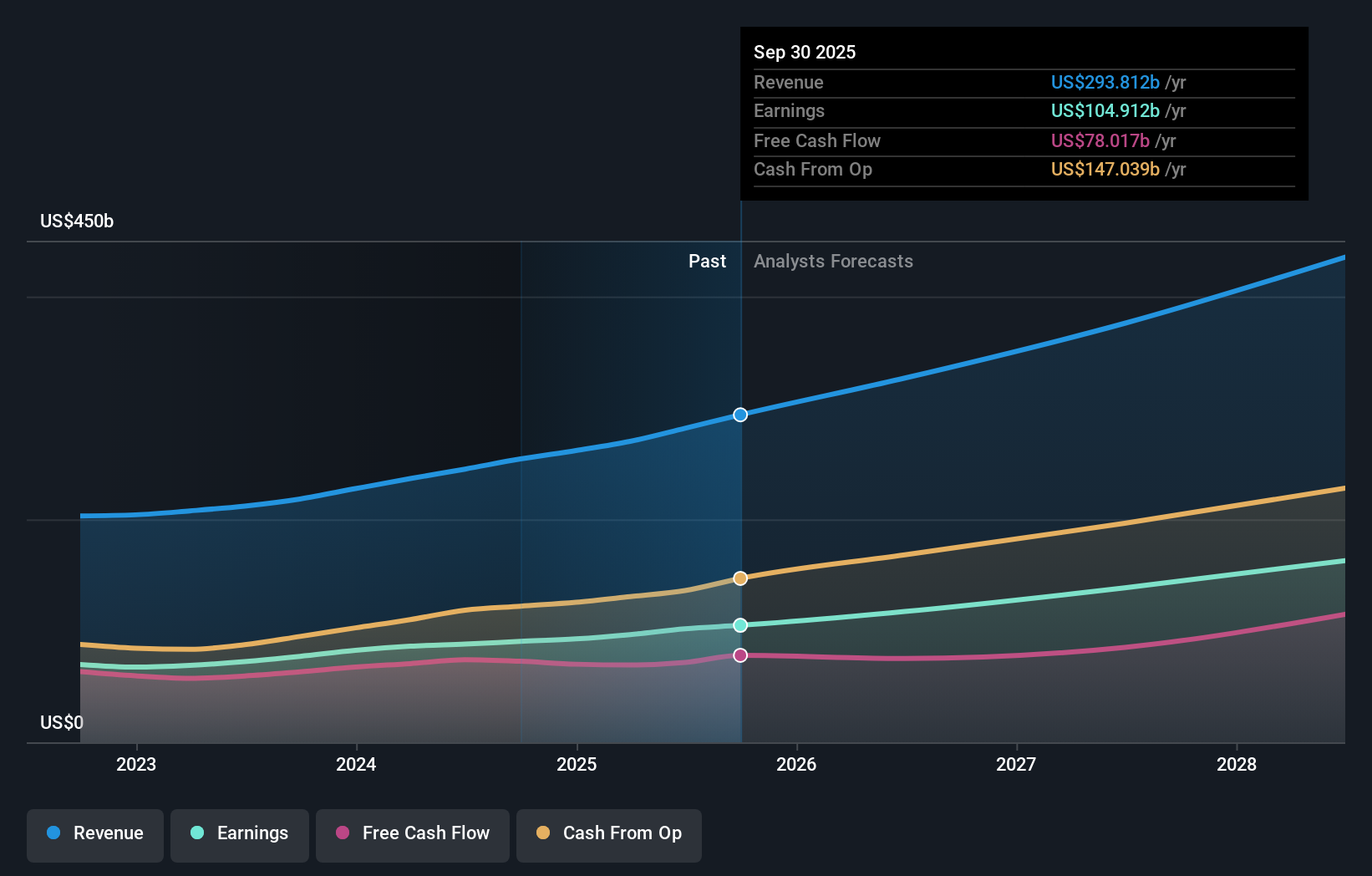

Microsoft's strong financial health is underscored by its impressive revenue growth, with annual revenues reaching $245 billion, a 15% increase year-over-year. This growth is fueled by its cloud segment, which generated $135 billion, marking a 23% increase. The company's strategic alliances, such as collaborations with Infosys and Enbridge, enhance its AI capabilities and market reach, particularly in sectors like healthcare and energy. Microsoft's management team, with an average tenure of 6.7 years, brings seasoned leadership that drives strategic initiatives effectively. Additionally, Microsoft's dividend increase of 10% reflects its commitment to returning value to shareholders. Notably, Microsoft is trading below its estimated fair value of $573.39, suggesting potential undervaluation despite its high SWS fair ratio of 35.3x compared to peers.

Challenges Constraining Microsoft's Potential

Despite its growth, Microsoft faces challenges, particularly in managing operating expenses, which rose by 13%, partly due to the Activision acquisition. The decline in Office Commercial licensing by 9% highlights the shift towards cloud offerings, which could impact traditional revenue streams. Moreover, Xbox hardware revenue saw a significant 42% decline, indicating potential weaknesses in the gaming segment. The company's high SWS fair ratio compared to peers suggests it may be perceived as expensive, potentially limiting investor interest. Additionally, Microsoft's reliance on external borrowing, making up 100% of its liabilities, presents a higher risk profile.

Future Prospects for Microsoft in the Market

Microsoft's future prospects are bolstered by its focus on AI and cloud innovations, as evidenced by the recent launch of healthcare AI models in Azure AI Studio. This initiative, along with strategic partnerships like the one with KT Corporation, positions Microsoft to capitalize on emerging opportunities in AI and cloud services. The expansion of its data center footprint across four continents further enhances its market position. Microsoft's introduction of new product categories, such as Copilot+ PCs, and the continued growth of LinkedIn, with record engagement, underscore its ability to innovate and expand its customer base.

Regulatory Challenges Facing Microsoft

The company faces regulatory challenges, particularly in Europe, where growth has been slightly lower than expected. Capacity constraints in AI also pose a threat to Microsoft's ability to meet increasing demand. Regulatory risks are further highlighted by the need to update forward-looking statements, as noted by Brett Iversen. Additionally, significant insider selling over the past three months could indicate potential concerns among insiders. These external factors, coupled with competitive pressures from rivals like Apple, which is also investing in AI, could threaten Microsoft's market share and growth trajectory.

To gain deeper insights into Microsoft's historical performance, explore our detailed analysis of past performance. To dive deeper into how Microsoft's valuation metrics are shaping its market position, check out our detailed analysis of Microsoft's Valuation.Conclusion

Microsoft's impressive revenue growth, driven by its cloud segment and strategic alliances, highlights its ability to capitalize on emerging opportunities in AI and cloud services, positioning the company for continued market expansion. However, challenges such as rising operating expenses and declines in traditional revenue streams like Office Commercial licensing and Xbox hardware indicate areas that require strategic focus to maintain profitability and market share. Despite these challenges, Microsoft's trading price below its estimated fair value of $573.39, with a target price less than 20% higher than the current share price, suggests potential for appreciation, even as its high Price-To-Earnings Ratio may deter some investors. As Microsoft navigates regulatory challenges and competitive pressures, its seasoned management team and commitment to innovation remain pivotal in sustaining its growth trajectory and delivering value to shareholders.

Seize The Opportunity

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal