3 Growth Companies With High Insider Ownership And 21% Earnings Growth

As global markets navigate a complex landscape marked by record highs in U.S. indices and mixed economic signals, investors are increasingly focused on earnings growth as a key driver of stock performance. In this environment, companies that combine robust insider ownership with strong earnings growth potential stand out as particularly compelling opportunities for those seeking alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.5% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Here we highlight a subset of our preferred stocks from the screener.

Capitec Bank Holdings (JSE:CPI)

Simply Wall St Growth Rating: ★★★★☆☆

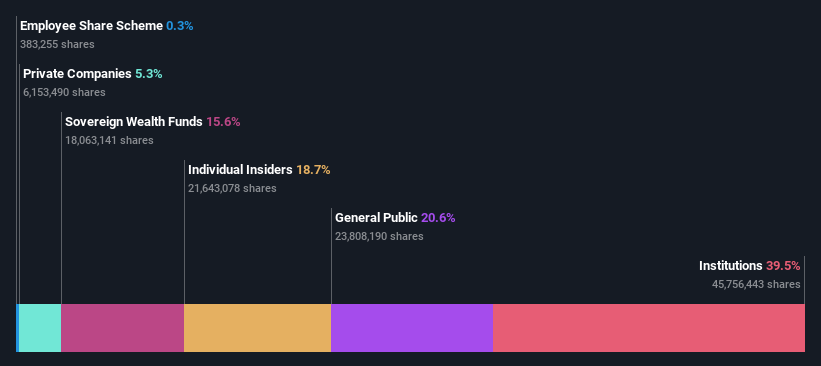

Overview: Capitec Bank Holdings Limited, with a market cap of ZAR372.97 billion, operates in South Africa offering a range of banking products and services through its subsidiaries.

Operations: The company's revenue is derived from several segments, including Retail Banking at ZAR18.99 billion, Insurance at ZAR3.38 billion, and Business Banking at ZAR1.18 billion.

Insider Ownership: 18.7%

Earnings Growth Forecast: 16.7% p.a.

Capitec Bank Holdings demonstrates robust growth potential with its revenue forecasted to rise by 20.6% annually, outpacing the South African market's 3.5%. Recent half-year earnings show a significant increase in net income to ZAR 6.42 billion from ZAR 4.70 billion year-on-year, reflecting strong financial performance. However, challenges include a high level of bad loans at 25% and low allowance for these loans at 94%, which may impact future profitability despite an increased interim dividend payout.

- Click here to discover the nuances of Capitec Bank Holdings with our detailed analytical future growth report.

- Our valuation report unveils the possibility Capitec Bank Holdings' shares may be trading at a premium.

NOTE (OM:NOTE)

Simply Wall St Growth Rating: ★★★★☆☆

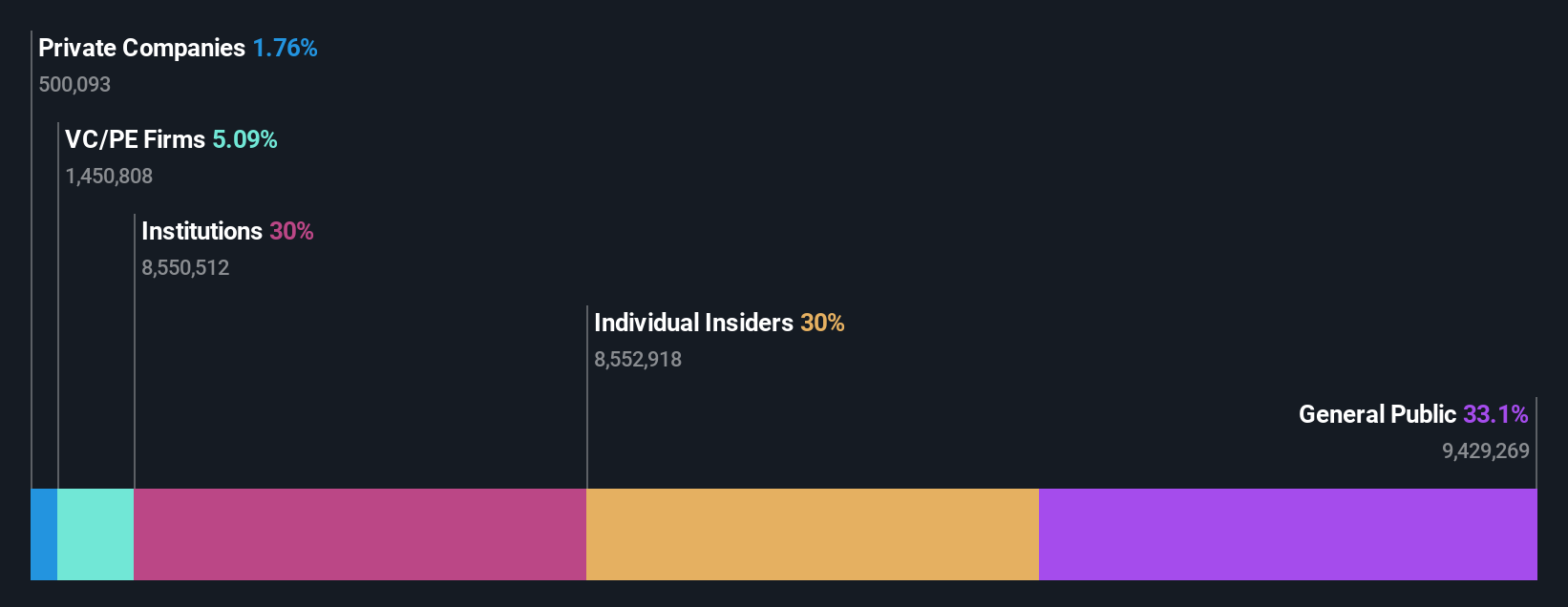

Overview: NOTE AB (publ) offers electronics manufacturing services across Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China and other international markets with a market cap of SEK3.81 billion.

Operations: The company's revenue segments include electronics manufacturing services in Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and other international markets.

Insider Ownership: 27.4%

Earnings Growth Forecast: 20.1% p.a.

NOTE AB shows promising growth prospects with earnings expected to grow significantly at 20.1% annually, outpacing the Swedish market's 15.6%. Despite recent declines in Q3 sales and net income to SEK 809 million and SEK 43 million respectively, NOTE trades at a good value, approximately 27.3% below its estimated fair value. Insider activity reveals more substantial buying than selling recently, although significant insider selling was noted over the past quarter.

- Delve into the full analysis future growth report here for a deeper understanding of NOTE.

- In light of our recent valuation report, it seems possible that NOTE is trading behind its estimated value.

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★★☆

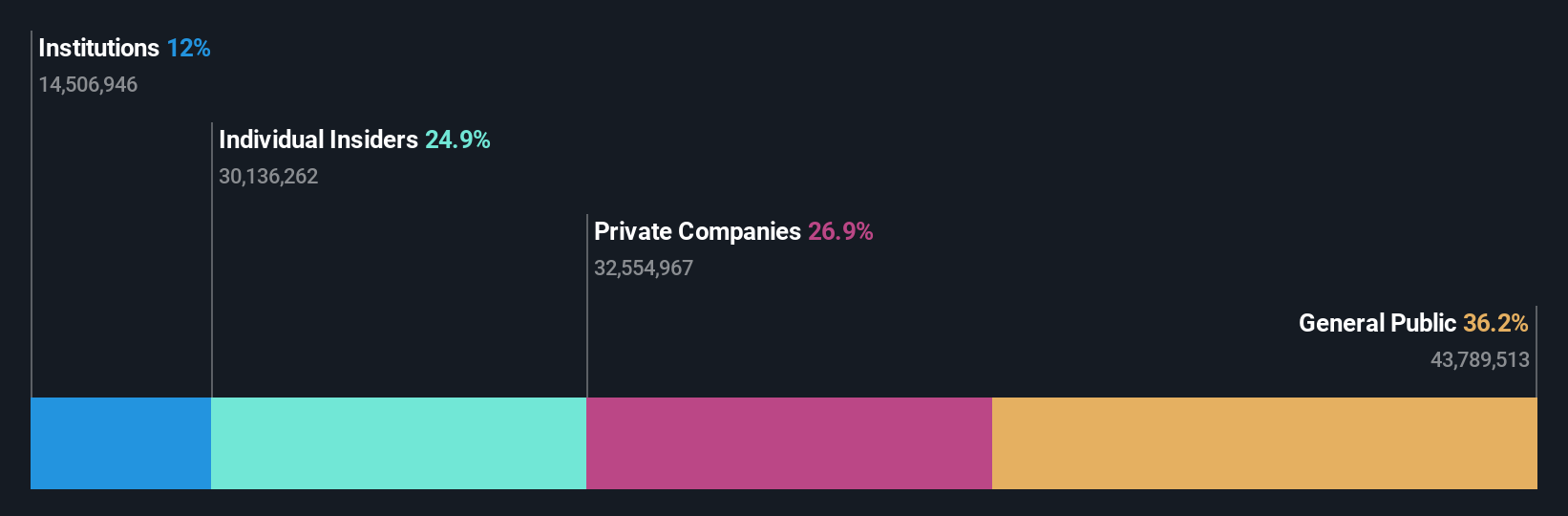

Overview: Chenbro Micom Co., Ltd. is involved in the research, design, manufacture, and trading of computer peripherals and systems globally, with a market cap of NT$33.70 billion.

Operations: The company's revenue primarily comes from its computer peripherals segment, which generated NT$13.47 billion.

Insider Ownership: 25.1%

Earnings Growth Forecast: 21.7% p.a.

Chenbro Micom demonstrates strong growth potential with earnings increasing by 86.4% over the past year and forecasts predicting a 21.66% annual growth rate, surpassing Taiwan's market average. The company's recent Q2 results showed substantial revenue and net income improvements, with sales reaching TWD 3.61 billion and net income at TWD 453.32 million. However, its share price has been highly volatile recently, and it lacks a stable dividend track record despite no significant insider trading activity in the last three months.

- Take a closer look at Chenbro Micom's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Chenbro Micom is trading beyond its estimated value.

Summing It All Up

- Reveal the 1482 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal