The music is extremely sad! Bank of America Survey: Global Stock Markets Flash Selling Signals

Investors have become so bullish that it may be time to sell off global stocks, according to a Bank of America survey.

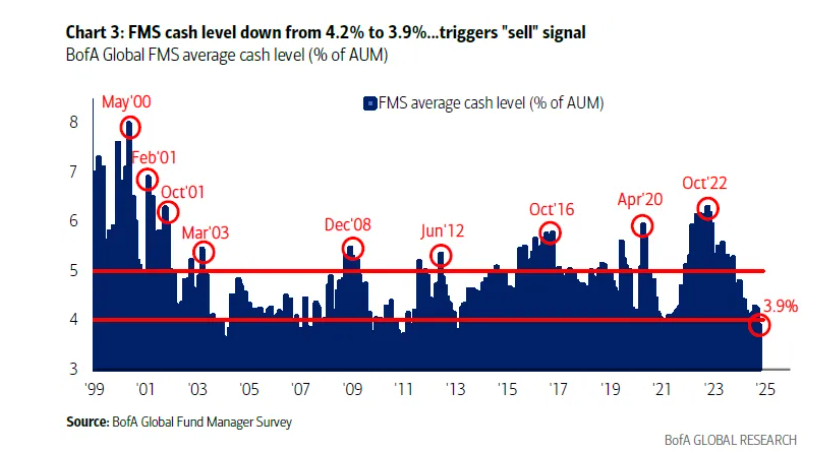

A strategist led by Michael Hartnett (Michael Hartnett) wrote on Tuesday that investors' allocation to stocks increased dramatically in October, while bond exposure declined, and the cash ratio in global portfolios fell to 3.9% from 4.2% last month, triggering a “sell signal” in global stock markets.

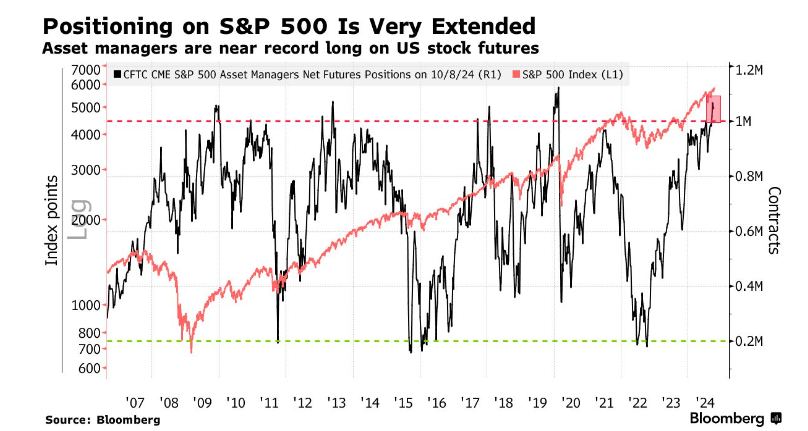

Hartnett and his team wrote that the October survey showed that “investors' optimism about the Fed's interest rate cut, China's stimulus measures, and a soft landing in the global economy showed the biggest jump since June 2020.” Stock exposure nearly tripled from the previous month, with a net increase of 31%. There was a record high fluctuation in bond exposure and experienced a 15% net reduction in holdings.

Similar sell-off signals have appeared 11 times since 2011. Global stock markets fell by an average of 2.5% in one month after the sell-off signal was triggered, and fell by an average of 0.8% within three months. The team said “the bubble is widening,” but Bank of America's Bull & Bear Indicator (Bull & Bear Indicator) is still below 8. This level shows that the rise has gone too far, sending a reverse sell signal.

The global stock market continued its bullish trend after a round of fluctuations in early September, spurred by the Federal Reserve's interest rate cuts, the resilience of the US economy, and China's fiscal and monetary stimulus measures. Driven by the strengthening of the US stock market, the MSCI Global Index hit a record high on Monday.

The third-quarter earnings season for US stocks also started well. The performance of major banks calmed the market last week. The S&P 500 index continued its five-week rise on Monday, hitting its 46th all-time closing high this year.

This optimism was reflected in the influx of respondents into emerging markets, non-essential goods and industrial stocks, and the withdrawal of defensive stocks such as essential goods and utilities. The survey showed that the biggest winners of China's economic stimulus plan were emerging market stocks and commodities, while the biggest losers were government bonds and Japanese stocks.

The survey was conducted from October 4 to October 10, and involved 195 participants with cumulative assets of US$503 billion. Here are other key findings:

About one-third of investors will increase their hedging ahead of the US election, which they believe will drive bond yields and the dollar soar while hitting the S&P 500 index.

Growth expectations are the fifth largest increase on record. 76% of investors expect the economy to land softly, and only 8% expect the economy to land hard.

Investors expect the Federal Reserve to cut interest rates by an average of 160 basis points over the next 12 months.

Most popular trades: go long on the “Big Seven” (43%), go long on gold (17%), and go long on Chinese stocks (14%).

The biggest tail risks: geopolitical conflict (33%), accelerated inflation (26%), US recession (19%), US elections (14%), and systemic credit crisis (8%).

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal