Wall Street's Most Accurate Analysts Weigh In On 3 Consumer Stocks With Over 5% Dividend Yields

Benzinga · 10/15 12:15

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer discretionary sector.

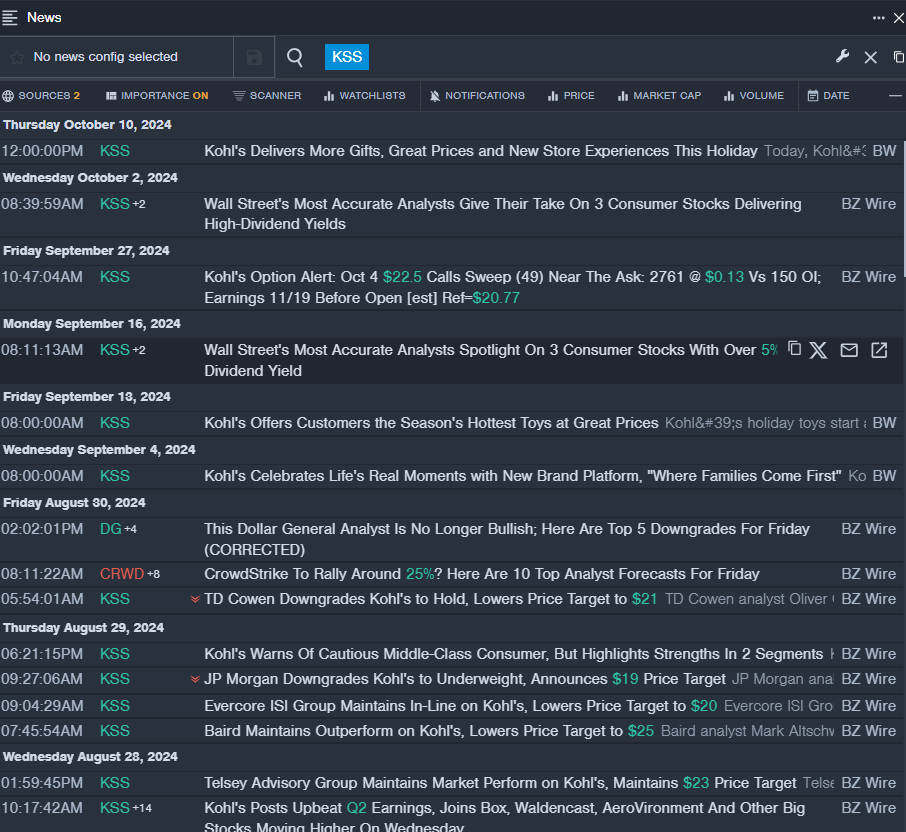

Kohl’s Corporation (NYSE:KSS)

- Dividend Yield: 10.36%

- JP Morgan analyst Matthew Boss downgraded rating on the stock from Neutral to Underweight with a price target of $19 on Aug. 29. This analyst has an accuracy rate of 69%.

- Evercore ISI Group analyst Michael Binetti maintained an In-Line rating and cut the price target from $22 to $20 on Aug. 29. This analyst has an accuracy rate of 61%

- Recent News: On Aug. 28, Kohl’s posted better-than-expected second-quarter financial results.

- Benzinga Pro's real-time newsfeed alerted to latest Kohl’s news.

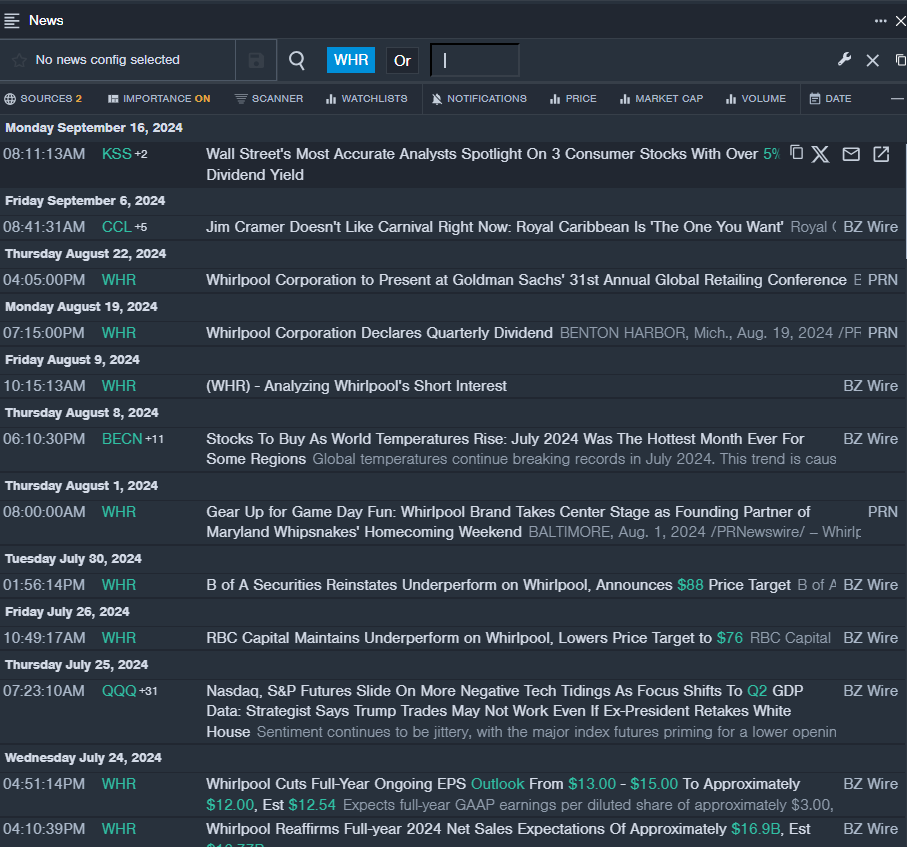

Whirlpool Corporation (NYSE:WHR)

- Dividend Yield: 5.19%

- B of A Securities analyst Rafe Jadrosich reinstated an Underperform rating with a price target of $88 on July 30. This analyst has an accuracy rate of 73%.

- RBC Capital analyst Mike Dahl maintained an Underperform rating and lowered the price target from $79 to $76 on July 26. This analyst has

- an accuracy rate of 72%.

- Recent News: On Aug. 19, Whirlpool declared a quarterly dividend of $1.75 per share on the Company's common stock.

- Benzinga Pro's real-time newsfeed alerted to latest WHR news.

Ford Motor Company (NYSE:F)

- Dividend Yield: 5.49%

- Goldman Sachs analyst Mark Delaney upgraded the stock from Neutral to Buy and raised the price target from $12 to $13 on Oct. 1. This analyst has an accuracy rate of 74%.

- Morgan Stanley analyst Adam Jonas downgraded the stock from Overweight to Equal-Weight and cut the price target from $16 to $12 on Sept. 25. This analyst has an accuracy rate of 61%.

- Recent News: National Highway Traffic Safety Administration (NHTSA) has opened an investigation into 368,309 units of model year 2015-2017 of Ford's Edge SUVs over concerns of loss of braking ability, the U.S. auto safety regulator said on Friday.

- Benzinga Pro’s charting tool helped identify the trend in Ford stock.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal