3 TSX Stocks That May Be Priced Below Their Estimated Value In October 2024

The Canadian market has shown resilience with a 1.3% increase over the past week and an impressive 23% rise in the last year, supported by forecasts of a 15% annual earnings growth. In this environment, identifying stocks that may be priced below their estimated value can offer investors potential opportunities for growth while leveraging current market momentum.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$188.17 | CA$360.32 | 47.8% |

| Computer Modelling Group (TSX:CMG) | CA$12.05 | CA$21.88 | 44.9% |

| VersaBank (TSX:VBNK) | CA$20.69 | CA$41.31 | 49.9% |

| Trisura Group (TSX:TSU) | CA$43.92 | CA$87.82 | 50% |

| Kinaxis (TSX:KXS) | CA$158.07 | CA$284.23 | 44.4% |

| Endeavour Mining (TSX:EDV) | CA$31.52 | CA$55.43 | 43.1% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Sandstorm Gold (TSX:SSL) | CA$8.10 | CA$13.82 | 41.4% |

| Blackline Safety (TSX:BLN) | CA$6.38 | CA$10.98 | 41.9% |

| Boyd Group Services (TSX:BYD) | CA$212.00 | CA$343.76 | 38.3% |

We'll examine a selection from our screener results.

Endeavour Mining (TSX:EDV)

Overview: Endeavour Mining plc, along with its subsidiaries, is a gold mining company operating in West Africa with a market cap of CA$7.70 billion.

Operations: The company's revenue segments include the Houndé Mine generating $612.70 million, Sabodala Massawa Mine with $509.60 million, Mana Mine Burkina Faso contributing $308.40 million, and Ity Mine Côte D’Ivoire producing $708.10 million.

Estimated Discount To Fair Value: 43.1%

Endeavour Mining appears undervalued based on cash flows, trading at a significant discount to its estimated fair value of CA$55.43. Despite recent net losses, the company is forecasted to become profitable in three years with revenue growth expected at 11.1% annually, outpacing the Canadian market average. Recent production achievements and strategic divestments enhance its operational outlook, although insider selling raises some concerns about internal confidence in sustaining dividends or future performance.

- According our earnings growth report, there's an indication that Endeavour Mining might be ready to expand.

- Dive into the specifics of Endeavour Mining here with our thorough financial health report.

Nuvei (TSX:NVEI)

Overview: Nuvei Corporation offers payment technology solutions to merchants and partners across various regions including North America, Europe, the Middle East and Africa, Latin America, and the Asia Pacific, with a market cap of CA$6.54 billion.

Operations: The company's revenue from providing payment technology solutions to merchants and partners is $1.31 billion.

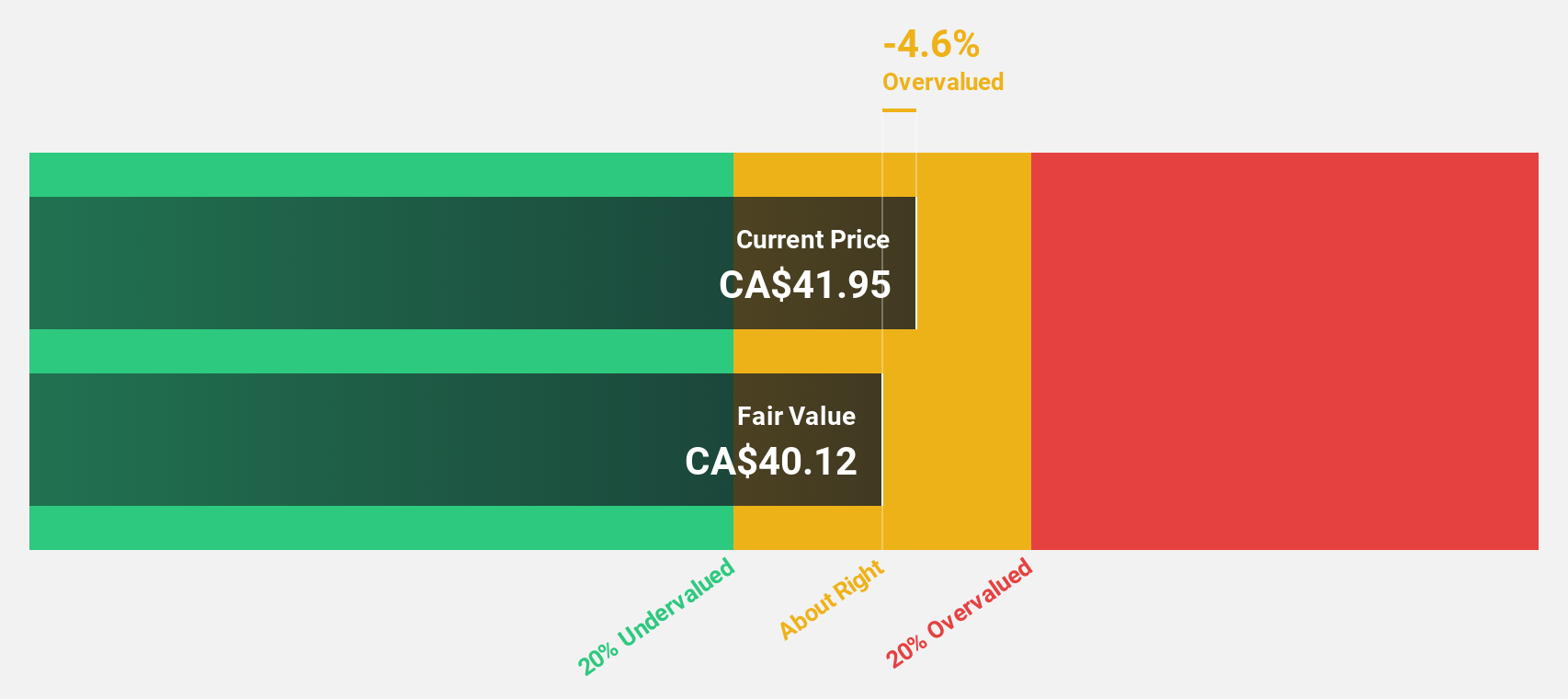

Estimated Discount To Fair Value: 23.7%

Nuvei is trading at a discount to its estimated fair value of CA$60.35, with the current price at CA$46.06, highlighting potential undervaluation based on discounted cash flow analysis. Despite recent net losses and shareholder dilution, Nuvei's revenue is forecasted to grow faster than the Canadian market at 14.1% annually, and it is expected to achieve profitability within three years. Strategic partnerships in APAC could bolster its financial performance further.

- In light of our recent growth report, it seems possible that Nuvei's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Nuvei.

OceanaGold (TSX:OGC)

Overview: OceanaGold Corporation is a gold and copper producer involved in the exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand with a market cap of CA$2.78 billion.

Operations: The company generates revenue of $1.00 billion from its Metals & Mining segment, specifically focusing on gold and other precious metals.

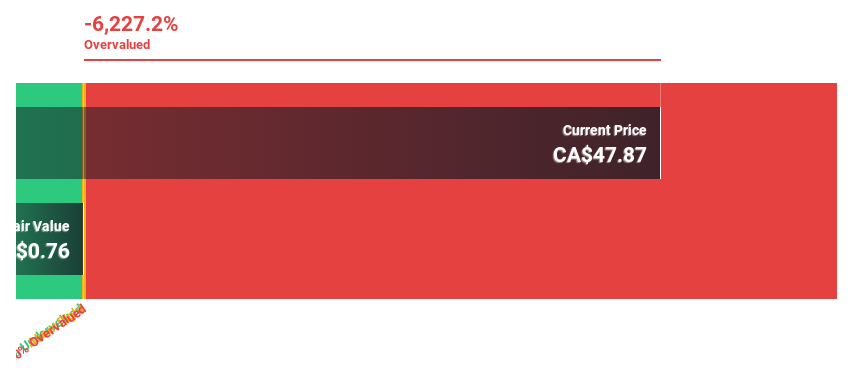

Estimated Discount To Fair Value: 24%

OceanaGold is trading at CA$3.93, significantly below its estimated fair value of CA$5.17, suggesting it may be undervalued based on discounted cash flow analysis. Despite a decline in profit margins from 14.2% to 0.1%, earnings are forecast to grow substantially at 64.5% annually, outpacing the Canadian market average of 14.7%. Recent exploration successes and strategic resource conversion initiatives could enhance future cash flows and economic viability of mining projects like Haile and WKP.

- Our comprehensive growth report raises the possibility that OceanaGold is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of OceanaGold.

Turning Ideas Into Actions

- Discover the full array of 27 Undervalued TSX Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal