Undiscovered Canadian Gems with Promising Potential October 2024

Over the last 7 days, the Canadian market has risen by 1.3%, contributing to a robust 23% increase over the past year, with earnings projected to grow by 15% annually in the coming years. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering undiscovered gems that align well with current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Lithium Chile | NA | nan | 30.02% | ★★★★★★ |

| Tornado Global Hydrovacs | 14.62% | 24.52% | 64.90% | ★★★★★☆ |

| Firan Technology Group | 15.52% | 6.50% | 32.07% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Hammond Power Solutions Inc., with a market cap of CA$1.79 billion, designs, manufactures, and sells various transformers across Canada, the United States, Mexico, and India.

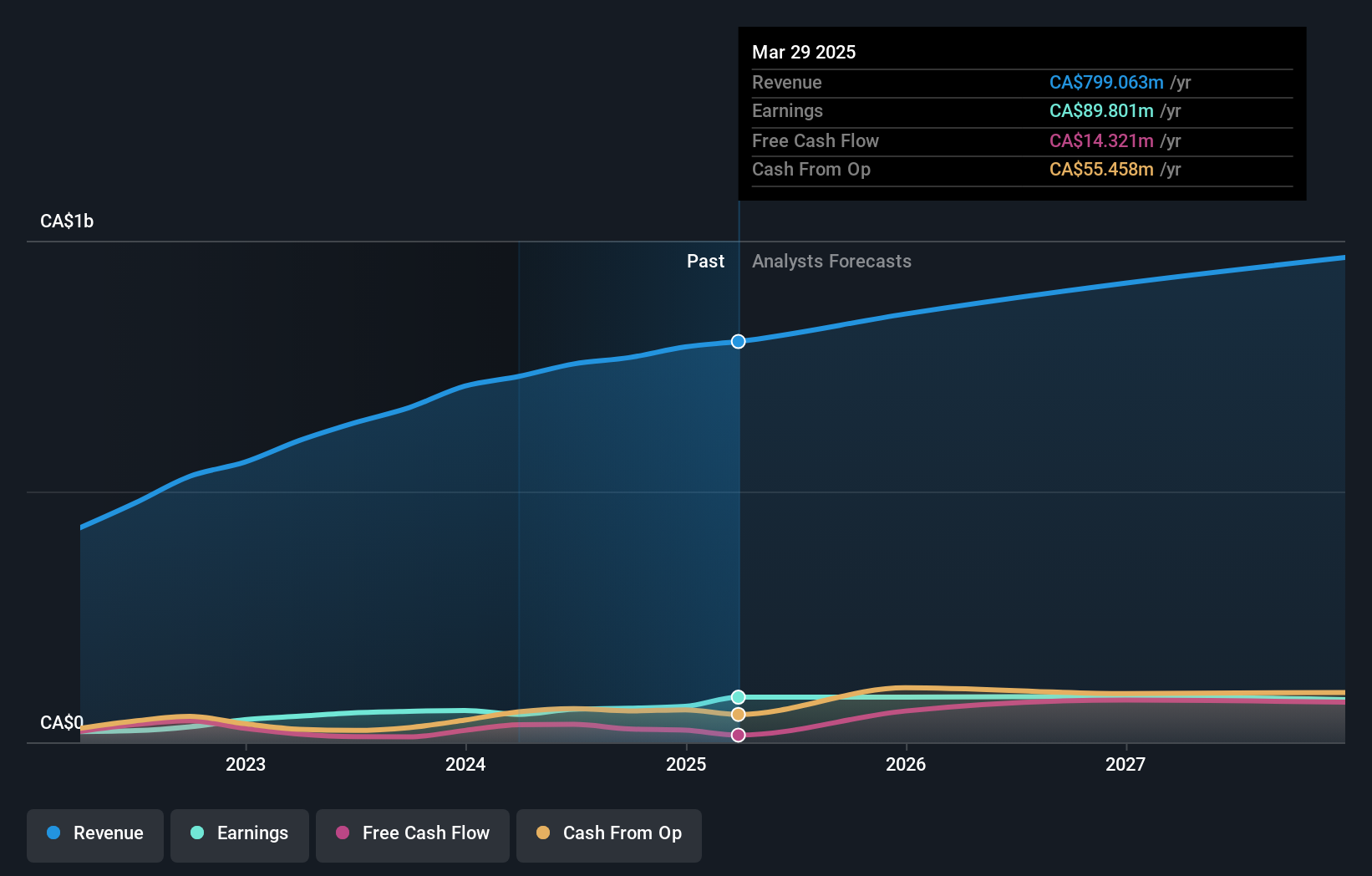

Operations: Hammond Power Solutions generates revenue primarily from the manufacture and sale of transformers, amounting to CA$754.37 million.

Hammond Power Solutions, a promising player in the Canadian market, showcases robust financial health with earnings growth of 12.3% over the past year, surpassing its industry peers. The company's debt-to-equity ratio improved significantly from 27.7% to 5% in five years, indicating prudent financial management. Despite significant insider selling recently, it trades at a 35% discount to estimated fair value and has strong interest coverage at 87.6 times EBIT, reflecting solid operational performance.

- Navigate through the intricacies of Hammond Power Solutions with our comprehensive health report here.

Understand Hammond Power Solutions' track record by examining our Past report.

TerraVest Industries (TSX:TVK)

Simply Wall St Value Rating: ★★★★★☆

Overview: TerraVest Industries Inc. is a company that manufactures and sells goods and services across various sectors including energy, agriculture, mining, and transportation in Canada and the United States, with a market capitalization of CA$1.98 billion.

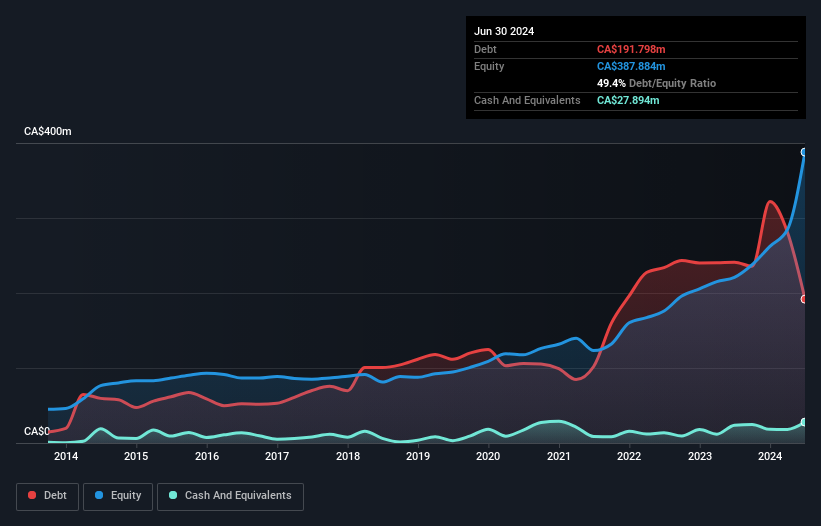

Operations: TerraVest Industries generates revenue through segments including Compressed Gas Equipment (CA$243.77 million), HVAC and Containment Equipment (CA$292.90 million), Processing Equipment (CA$117.58 million), and Service (CA$201.78 million). The Corporate segment reflects a minor negative contribution of CA$0.93 million to the overall revenue structure.

TerraVest Industries, a Canadian player in the energy sector, has shown impressive financial strides with earnings surging 43.6% over the past year, outpacing its industry peers who saw a -6.7% change. Its debt to equity ratio improved significantly from 117.9% to 49.4%, although the net debt remains high at 42.3%. Recently added to the S&P Global BMI Index, TerraVest reported CAD $238 million in third-quarter revenue and CAD $11.92 million in net income, reflecting robust growth and potential value for investors seeking emerging opportunities within Canada's market landscape.

- Unlock comprehensive insights into our analysis of TerraVest Industries stock in this health report.

Standard Lithium (TSXV:SLI)

Simply Wall St Value Rating: ★★★★★★

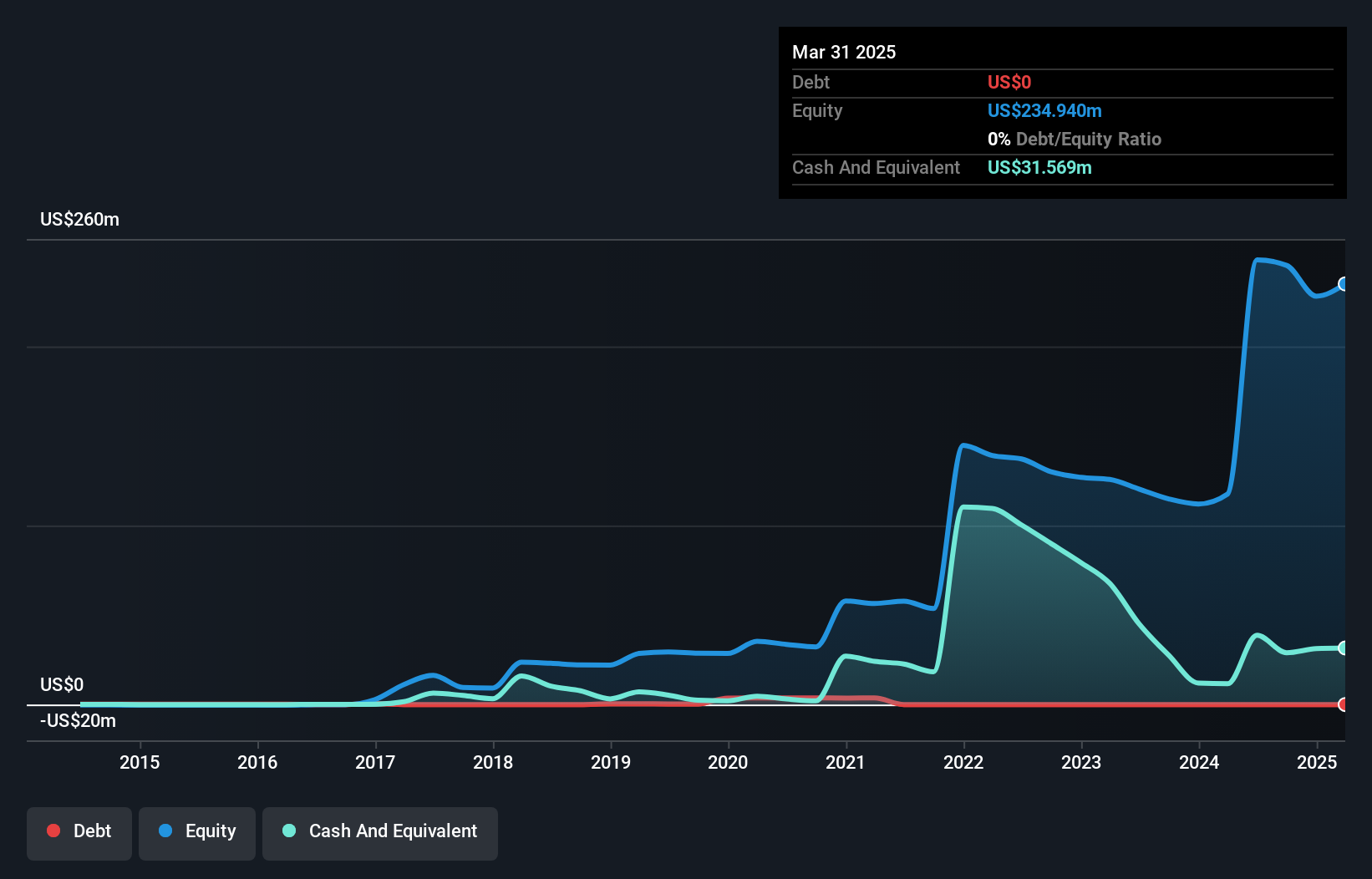

Overview: Standard Lithium Ltd. focuses on the exploration, development, and processing of lithium brine properties in the United States with a market cap of CA$609.12 million.

Operations: Standard Lithium Ltd. currently does not report any revenue streams, as indicated by the absence of revenue segments in its financial data.

Standard Lithium, a promising player in the lithium sector, recently turned profitable with net income reaching CA$147 million from a prior loss of CA$42 million. Its price-to-earnings ratio of 4.1x suggests good value against the Canadian market average of 15.7x. Despite significant insider selling and shareholder dilution over the past year, it remains debt-free and is poised for growth with a potential US$225 million DOE grant to expand its Arkansas project.

- Dive into the specifics of Standard Lithium here with our thorough health report.

Gain insights into Standard Lithium's past trends and performance with our Past report.

Summing It All Up

- Navigate through the entire inventory of 48 TSX Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal