Floor & Decor Holdings (NYSE:FND) Takes On Some Risk With Its Use Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Floor & Decor Holdings, Inc. (NYSE:FND) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Floor & Decor Holdings

How Much Debt Does Floor & Decor Holdings Carry?

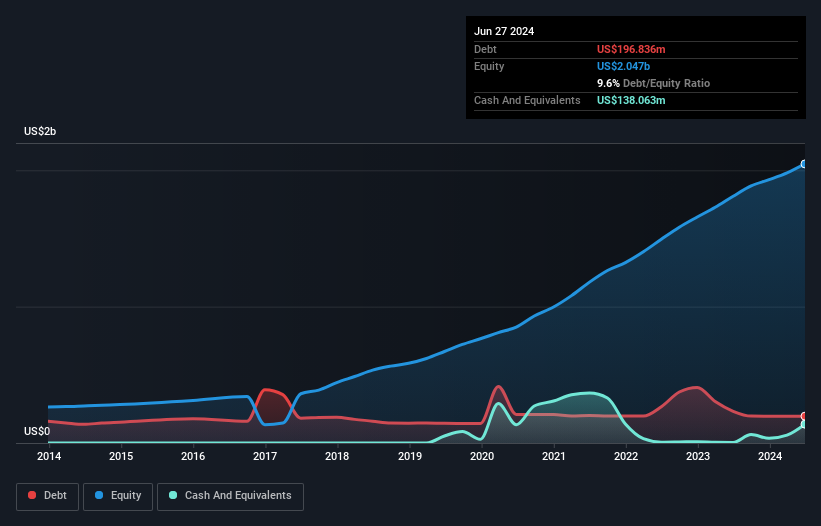

As you can see below, Floor & Decor Holdings had US$196.8m of debt at June 2024, down from US$232.2m a year prior. However, it does have US$138.1m in cash offsetting this, leading to net debt of about US$58.8m.

A Look At Floor & Decor Holdings' Liabilities

Zooming in on the latest balance sheet data, we can see that Floor & Decor Holdings had liabilities of US$1.15b due within 12 months and liabilities of US$1.62b due beyond that. Offsetting these obligations, it had cash of US$138.1m as well as receivables valued at US$113.4m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.52b.

This deficit isn't so bad because Floor & Decor Holdings is worth a massive US$12.0b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. But either way, Floor & Decor Holdings has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Floor & Decor Holdings has a low net debt to EBITDA ratio of only 0.12. And its EBIT covers its interest expense a whopping 55.7 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The modesty of its debt load may become crucial for Floor & Decor Holdings if management cannot prevent a repeat of the 32% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Floor & Decor Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Floor & Decor Holdings saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

While Floor & Decor Holdings's EBIT growth rate has us nervous. For example, its interest cover and net debt to EBITDA give us some confidence in its ability to manage its debt. When we consider all the factors discussed, it seems to us that Floor & Decor Holdings is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal