Is Synchronoss Technologies (NASDAQ:SNCR) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Synchronoss Technologies, Inc. (NASDAQ:SNCR) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Synchronoss Technologies

How Much Debt Does Synchronoss Technologies Carry?

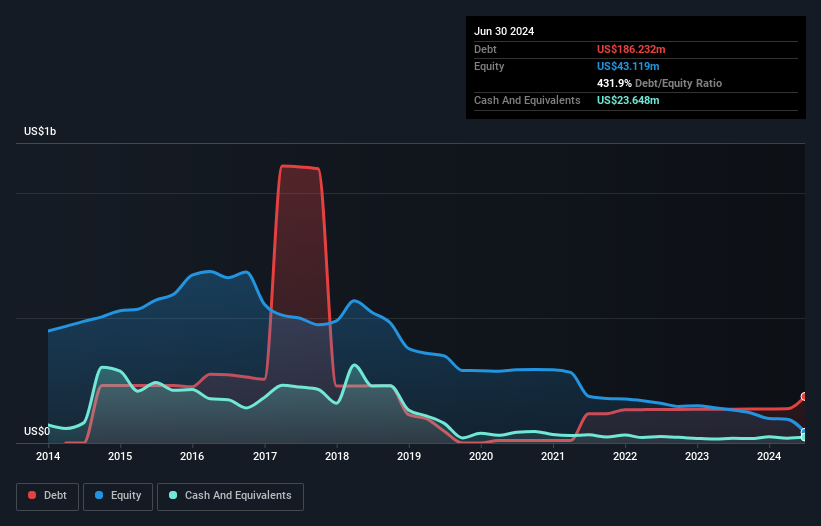

The image below, which you can click on for greater detail, shows that at June 2024 Synchronoss Technologies had debt of US$186.2m, up from US$135.4m in one year. On the flip side, it has US$23.6m in cash leading to net debt of about US$162.6m.

How Strong Is Synchronoss Technologies' Balance Sheet?

The latest balance sheet data shows that Synchronoss Technologies had liabilities of US$42.4m due within a year, and liabilities of US$210.2m falling due after that. On the other hand, it had cash of US$23.6m and US$19.9m worth of receivables due within a year. So its liabilities total US$209.0m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the US$132.5m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Synchronoss Technologies would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Synchronoss Technologies shareholders face the double whammy of a high net debt to EBITDA ratio (20.9), and fairly weak interest coverage, since EBIT is just 0.79 times the interest expense. This means we'd consider it to have a heavy debt load. However, the silver lining was that Synchronoss Technologies achieved a positive EBIT of US$11m in the last twelve months, an improvement on the prior year's loss. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Synchronoss Technologies's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. In the last year, Synchronoss Technologies created free cash flow amounting to 10% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

To be frank both Synchronoss Technologies's net debt to EBITDA and its track record of covering its interest expense with its EBIT make us rather uncomfortable with its debt levels. Having said that, its ability to grow its EBIT isn't such a worry. After considering the datapoints discussed, we think Synchronoss Technologies has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Synchronoss Technologies is showing 3 warning signs in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal