Undiscovered Gems With Strong Fundamentals For October 2024

The United States market has shown robust performance, rising 1.5% over the last week and an impressive 33% over the past year, with earnings projected to grow by 16% annually in the coming years. In this thriving environment, identifying stocks with strong fundamentals can be crucial for investors seeking opportunities that may not yet be widely recognized.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| QDM International | 36.42% | 107.08% | 78.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

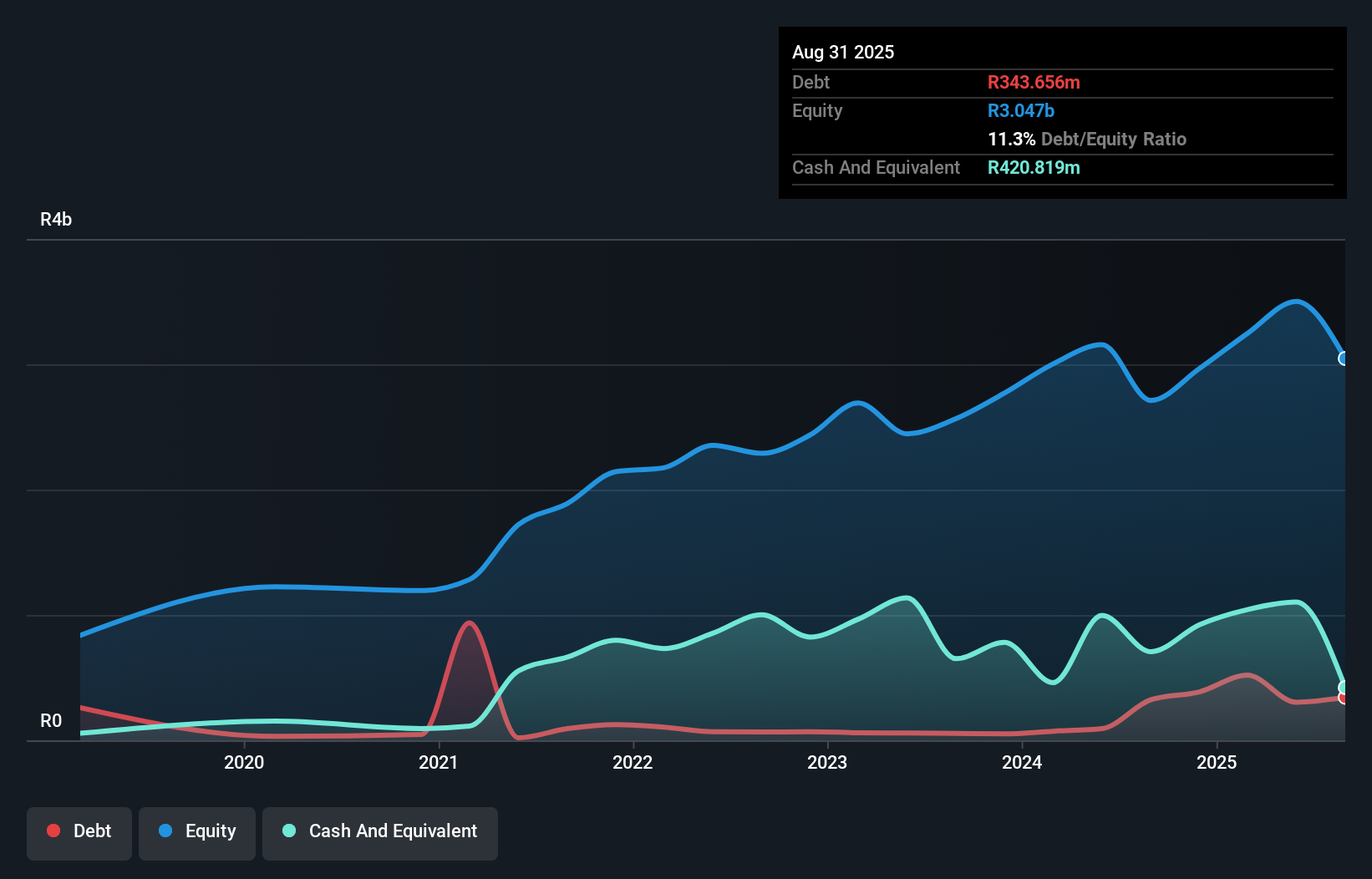

Karooooo (NasdaqCM:KARO)

Simply Wall St Value Rating: ★★★★★★

Overview: Karooooo Ltd. is a company that offers a mobility software-as-a-service (SaaS) platform for connected vehicles across various regions including South Africa, the rest of Africa, Europe, the Asia-Pacific, the Middle East, and the United States with a market capitalization of approximately $1.35 billion.

Operations: Karooooo generates revenue primarily from its Cartrack segment, which contributes ZAR 3.74 billion, followed by Karooooo Logistics at ZAR 355.99 million.

Karooooo, a dynamic player in the tech space, has shown impressive financial health with earnings growth of 33.5% over the past year, outpacing its industry peers. The company boasts a robust balance sheet, having reduced its debt to equity ratio from 21.7% to 3% over five years and is trading at nearly 31% below fair value estimates. Despite recent share price volatility and auditor changes, Karooooo's strong free cash flow and profitability suggest solid footing for future endeavors.

- Click here to discover the nuances of Karooooo with our detailed analytical health report.

Review our historical performance report to gain insights into Karooooo's's past performance.

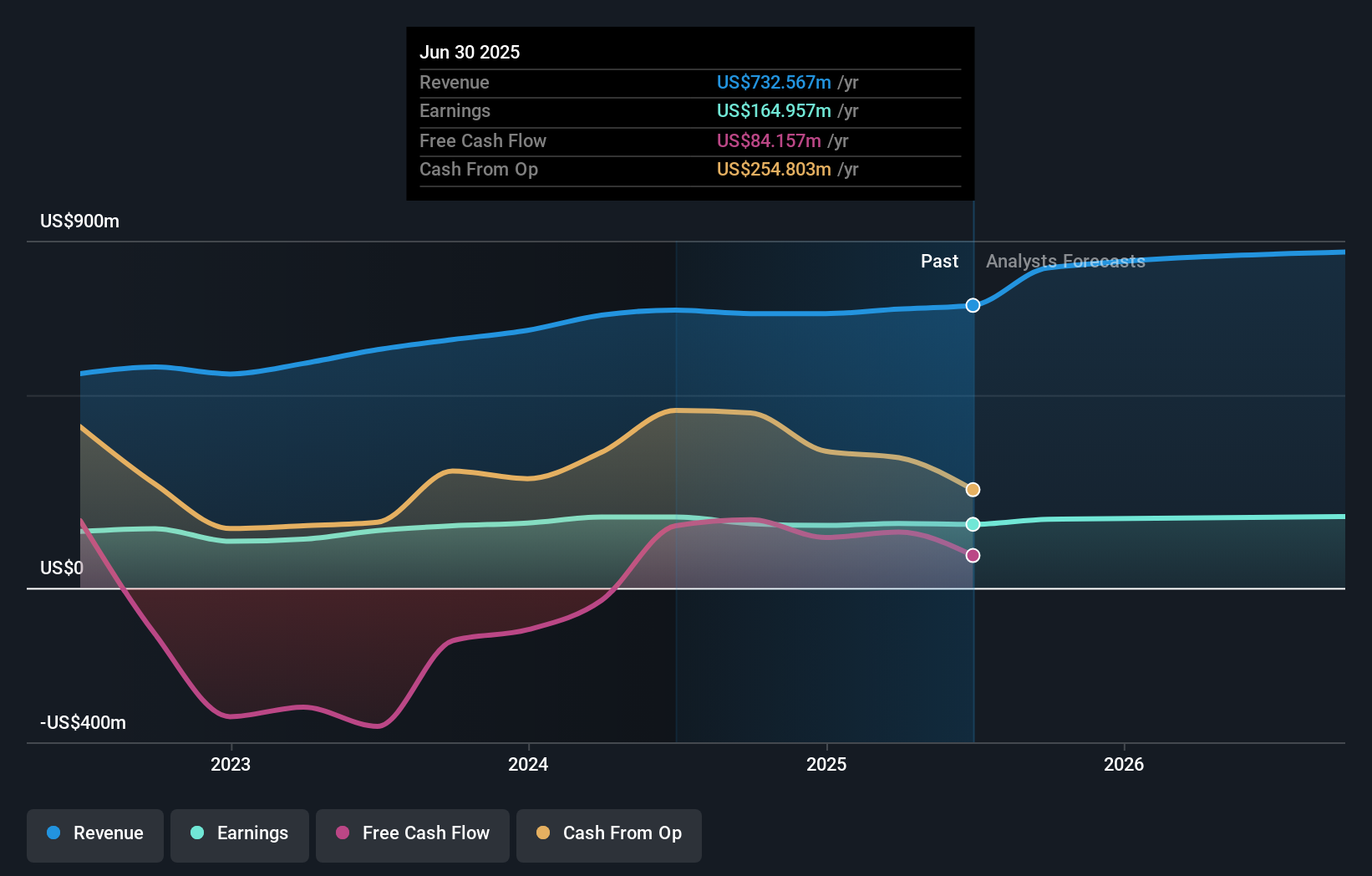

Pathward Financial (NasdaqGS:CASH)

Simply Wall St Value Rating: ★★★★★★

Overview: Pathward Financial, Inc. is a bank holding company for Pathward, National Association, offering a range of banking products and services in the United States with a market capitalization of approximately $1.85 billion.

Operations: Pathward Financial generates revenue primarily from its Consumer segment at $401.69 million and Commercial segment at $248.43 million, with additional contributions from Corporate Services at $46.78 million.

Pathward Financial, with assets totaling US$7.5 billion and equity of US$765.2 million, is a noteworthy player in its sector. The bank's deposits stand at US$6.4 billion while loans reach US$4.5 billion, reflecting a solid foundation supported by low-risk funding sources comprising 95% customer deposits. Its allowance for bad loans is robust at 179%, and it trades significantly below estimated fair value by 67%. Recent activities include share repurchases worth US$14.99 million, enhancing shareholder value amidst strategic divestments like selling its commercial insurance premium finance business.

- Get an in-depth perspective on Pathward Financial's performance by reading our health report here.

Explore historical data to track Pathward Financial's performance over time in our Past section.

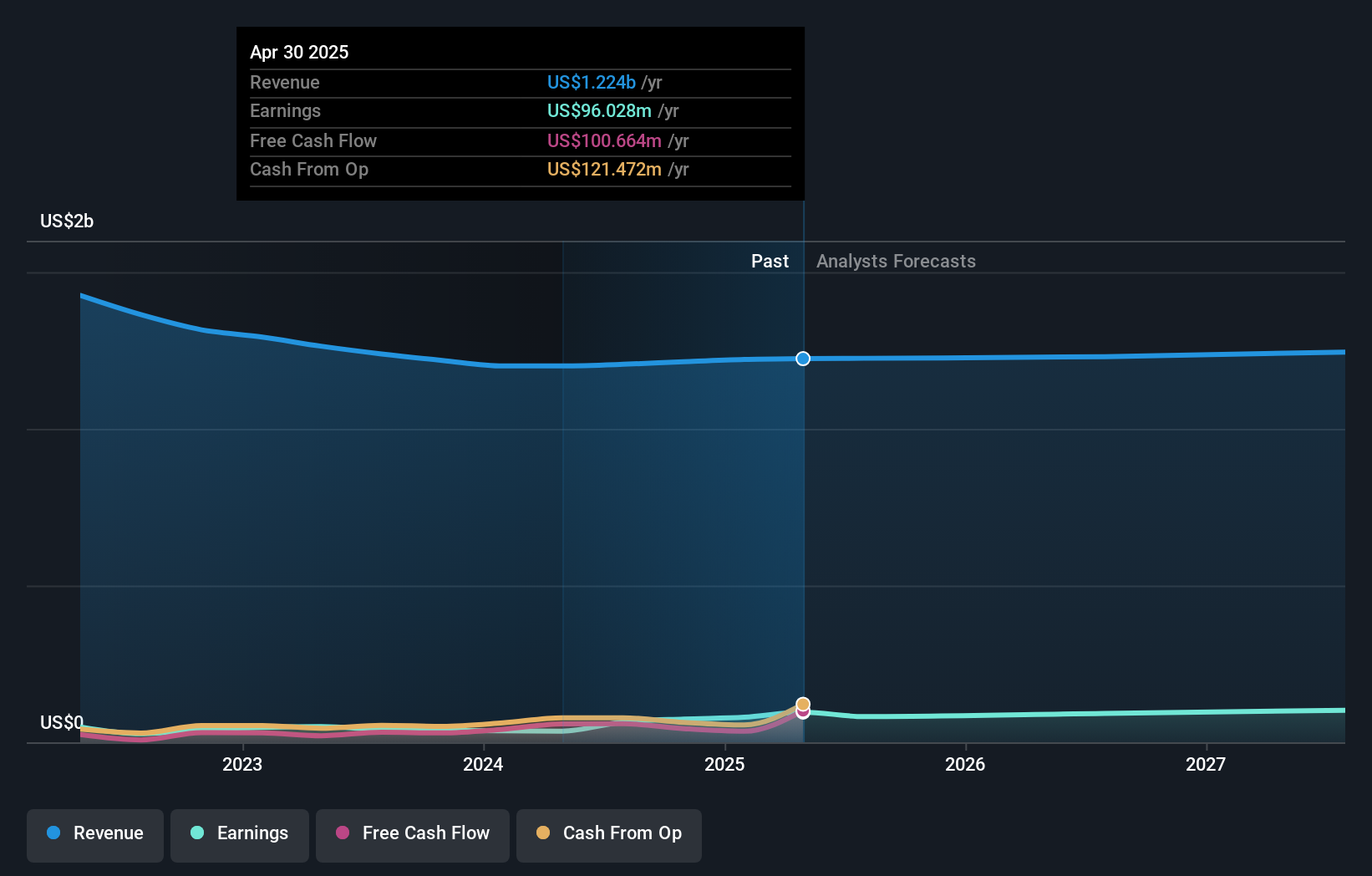

IDT (NYSE:IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation offers communications and payment services across the United States, the United Kingdom, and internationally, with a market cap of approximately $1.21 billion.

Operations: IDT generates revenue primarily from its Traditional Communications segment, contributing $899.60 million, followed by Fintech at $120.70 million. The company also earns from Net2phone and National Retail Solutions (NRS), with revenues of $82.30 million and $103.10 million, respectively.

IDT Corporation, with a market presence in telecommunications, showcases intriguing potential. Over the past year, earnings surged by 59%, far outperforming the industry average of -18%. The company is debt-free and trades at about 73% below its estimated fair value. Despite significant insider selling recently, IDT's high-quality earnings and positive free cash flow suggest robust financial health. Recent buybacks included over 94,000 shares for US$3.4 million within three months ending July 2024.

- Dive into the specifics of IDT here with our thorough health report.

Examine IDT's past performance report to understand how it has performed in the past.

Key Takeaways

- Click through to start exploring the rest of the 216 US Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal