US Exchange Stocks Priced Below Estimated Value

As the S&P 500 and Dow Jones Industrial Average reach record highs, driven by robust performances in the technology sector, investors are increasingly on the lookout for opportunities that may be undervalued amidst this market rally. Identifying stocks priced below their estimated value can provide potential avenues for growth, especially when major indices are experiencing such significant upward momentum.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MidWestOne Financial Group (NasdaqGS:MOFG) | $28.59 | $57.11 | 49.9% |

| Associated Banc-Corp (NYSE:ASB) | $22.09 | $43.81 | 49.6% |

| Tompkins Financial (NYSEAM:TMP) | $62.35 | $122.74 | 49.2% |

| Avidbank Holdings (OTCPK:AVBH) | $19.42 | $38.14 | 49.1% |

| STAAR Surgical (NasdaqGM:STAA) | $33.00 | $65.60 | 49.7% |

| EVERTEC (NYSE:EVTC) | $33.34 | $65.80 | 49.3% |

| Reddit (NYSE:RDDT) | $74.87 | $149.15 | 49.8% |

| Cytek Biosciences (NasdaqGS:CTKB) | $5.32 | $10.63 | 49.9% |

| SunOpta (NasdaqGS:STKL) | $6.37 | $12.65 | 49.6% |

| Viking Holdings (NYSE:VIK) | $37.79 | $74.68 | 49.4% |

Let's dive into some prime choices out of the screener.

DoorDash (NasdaqGS:DASH)

Overview: DoorDash, Inc. operates a commerce platform facilitating connections between merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of approximately $61.50 billion.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, generating $9.61 billion.

Estimated Discount To Fair Value: 32.8%

DoorDash appears undervalued, trading at US$150.02, significantly below its estimated fair value of US$223.23. Although the company has experienced shareholder dilution recently and insider selling, it is expected to achieve profitability within three years with earnings growth forecasted at 58.51% annually. Recent partnerships with Wegmans and Mattress Firm highlight its expanding market presence, potentially enhancing cash flows despite slower revenue growth compared to some peers in the sector.

- Our earnings growth report unveils the potential for significant increases in DoorDash's future results.

- Unlock comprehensive insights into our analysis of DoorDash stock in this financial health report.

GlobalFoundries (NasdaqGS:GFS)

Overview: GlobalFoundries Inc. is a semiconductor foundry offering a variety of mainstream wafer fabrication services and technologies globally, with a market cap of approximately $22.54 billion.

Operations: The company's revenue segment is primarily derived from its semiconductor operations, which generated $6.89 billion.

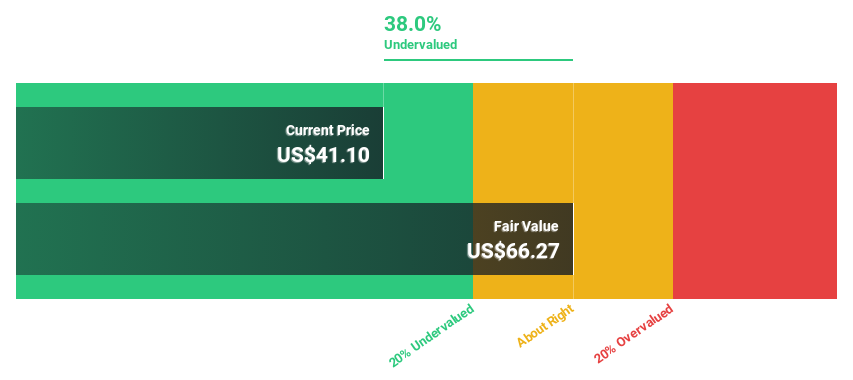

Estimated Discount To Fair Value: 37.4%

GlobalFoundries is trading at US$41.33, significantly below its estimated fair value of US$66.01, highlighting its undervaluation based on cash flows. Despite a decline in profit margins and revenue compared to the previous year, its earnings are forecasted to grow 23% annually over the next three years, outpacing the broader U.S. market. Strategic partnerships with Finwave Semiconductor and Efficient could bolster future growth by enhancing technological capabilities and expanding market reach.

- Our expertly prepared growth report on GlobalFoundries implies its future financial outlook may be stronger than recent results.

- Take a closer look at GlobalFoundries' balance sheet health here in our report.

Equifax (NYSE:EFX)

Overview: Equifax Inc. is a data, analytics, and technology company with a market cap of $35.29 billion.

Operations: The company's revenue segments include International at $1.32 billion, Workforce Solutions at $2.35 billion, and U.S. Information Solutions at $1.80 billion.

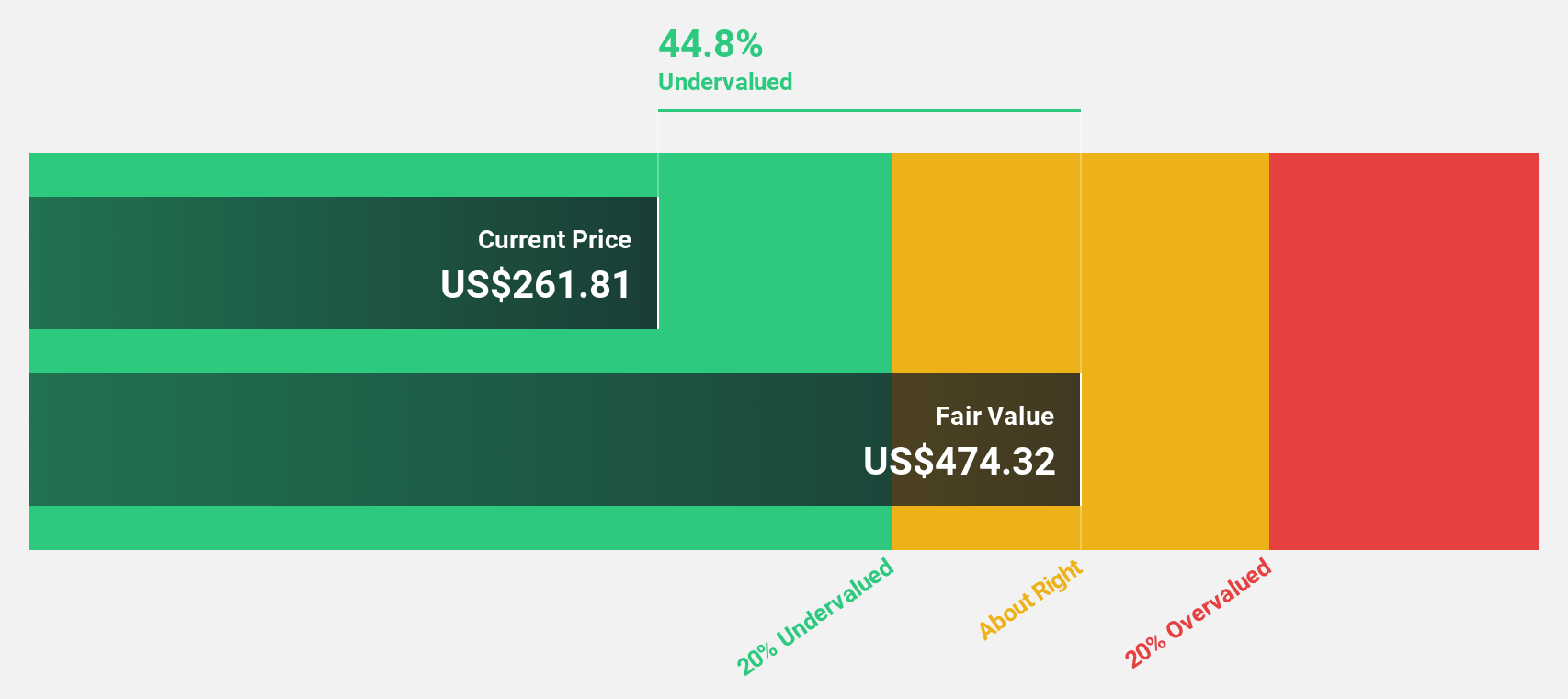

Estimated Discount To Fair Value: 42.3%

Equifax is trading at US$291.16, significantly below its estimated fair value of US$504.73, indicating substantial undervaluation based on cash flows. The company's earnings are projected to grow 25.1% annually over the next three years, surpassing the U.S. market average of 15.9%. Recent partnerships with Google Cloud and Workday enhance data accessibility and verification services, potentially driving innovation and operational efficiency despite high debt levels that may pose financial risks.

- Insights from our recent growth report point to a promising forecast for Equifax's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Equifax.

Make It Happen

- Get an in-depth perspective on all 197 Undervalued US Stocks Based On Cash Flows by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal