Ericsson Q3 Earnings: Gains From AT&T Boost, CEO Signals North American Recovery

Ericsson (NASDAQ:ERIC) reported third-quarter fiscal 2024 results.

Sales declined 4% year-over-year to 61.8 billion Swedish Krona, driven by strong growth in the North American market. In USD, sales of $5.93 billion beat the analyst consensus estimate of $5.72 billion.

Group organic sales declined by 1% Y/Y.

Also Read: T-Mobile Partners with NVIDIA, Ericsson, And Nokia to Pioneer AI-Driven Mobile Networks

Ericsson’s partnership with AT&T Inc boosted the telecom equipment company’s quarterly print. AT&T inked a five-year $14 billion deal with Ericsson to lead the US in commercial-scale open radio access network (Open RAN) deployment.

Under the deal, Ericsson will leverage its USA 5G Smart Factory in Lewisville, Texas, to manufacture 5G equipment. AT&T is committed to building a telecom network that leverages ORAN technology.

Adjusted gross margin improved to 46.3% from 39.2% Y/Y, driven primarily by improved gross margin in Networks.

Adjusted EBIT margin was 11.9% versus (43.5)% Y/Y due to a non-cash impairment loss relating to the Vonage acquisition. Adjusted EBITA margin improved to 12.6% from 7.3% a year ago.

Ericsson reported an EPS of SEK 1.14 versus SEK (9.21) Y/Y. In USD, EPS of $0.11 beat the analyst consensus estimate of $0.09.

Free cash flow before M&A was SEK 12.94 billion in the quarter, benefiting from the operational improvements.

As of September 30, 2024, net cash stood at SEK 25.53 billion.

CEO Börje Ekholm noted signs of the overall market stabilizing, with North America, as an early adopter market, returning to growth. He expects Networks sales to stabilize Y/Y during the fourth quarter, driven by North America. He also flagged further near-term sales pressure in Enterprise due to its focus on profitable segments.

The weakness in demand from North American mobile operators in the last two years affected Ericsson and its peers, prompting them to shift focus to developing markets like India, often compromising their profits.

Outlook: Ericsson expects a fourth-quarter adjusted gross margin of 47%-49% and restructuring charges of SEK 4.0 billion in 2024.

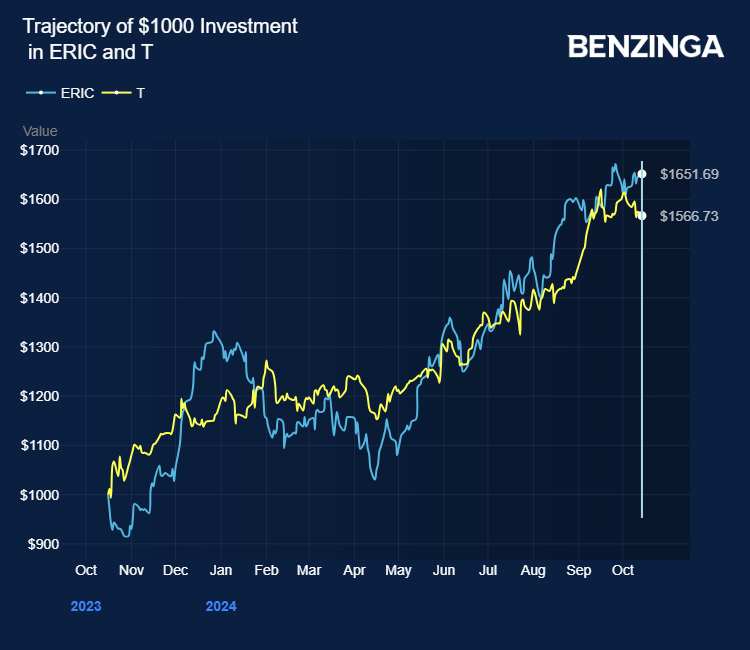

Ericsson stock gained over 58% in the last 12 months. Investors can gain exposure to the stock through First Trust NASDAQ Technology Dividend Index Fund (NASDAQ:TDIV) and iShares US Digital Infrastructure and Real Estate ETF (NYSE:IDGT).

Price Action: ERIC stock traded higher by 9.68% at $8.27 premarket at the last check Tuesday.

Photo by Mats Wiklund via Shutterstock

Also Read:

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal