Should You Think About Buying Bel Fuse Inc. (NASDAQ:BELF.A) Now?

Bel Fuse Inc. (NASDAQ:BELF.A), is not the largest company out there, but it led the NASDAQGS gainers with a relatively large price hike in the past couple of weeks. The recent jump in the share price has meant that the company is trading at close to its 52-week high. Less-covered, small caps sees more of an opportunity for mispricing due to the lack of information available to the public, which can be a good thing. So, could the stock still be trading at a low price relative to its actual value? Today we will analyse the most recent data on Bel Fuse’s outlook and valuation to see if the opportunity still exists.

See our latest analysis for Bel Fuse

What's The Opportunity In Bel Fuse?

The stock seems fairly valued at the moment according to our valuation model. It’s trading around 18% below our intrinsic value, which means if you buy Bel Fuse today, you’d be paying a reasonable price for it. And if you believe that the stock is really worth $128.08, then there’s not much of an upside to gain from mispricing. Although, there may be an opportunity to buy in the future. This is because Bel Fuse’s beta (a measure of share price volatility) is high, meaning its price movements will be exaggerated relative to the rest of the market. If the market is bearish, the company’s shares will likely fall by more than the rest of the market, providing a prime buying opportunity.

Can we expect growth from Bel Fuse?

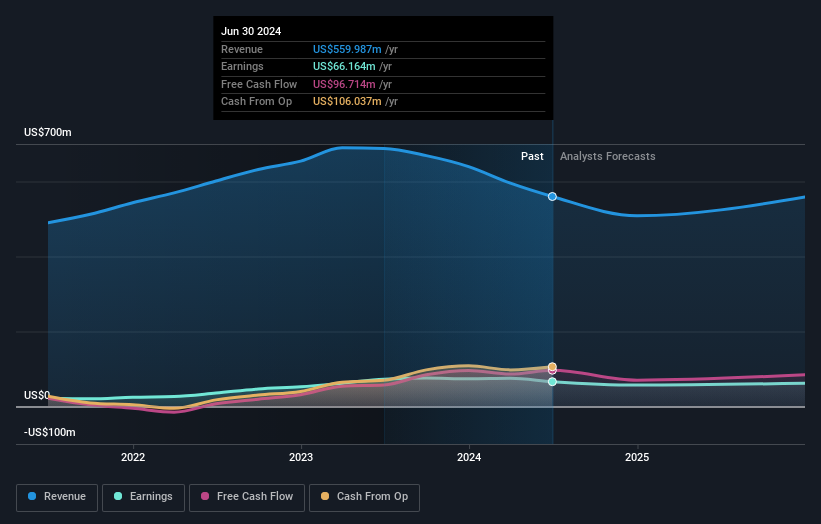

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. However, with a negative profit growth of -10.0% expected next year, near-term growth certainly doesn’t appear to be a driver for a buy decision for Bel Fuse. This certainty tips the risk-return scale towards higher risk.

What This Means For You

Are you a shareholder? Currently, BELF.A appears to be trading around its fair value, but given the uncertainty from negative returns in the future, this could be the right time to reduce the risk in your portfolio. Is your current exposure to the stock optimal for your total portfolio? And is the opportunity cost of holding a negative-outlook stock too high? Before you make a decision on the stock, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping an eye on BELF.A for a while, now may not be the most optimal time to buy, given it is trading around its fair value. The stock appears to be trading at fair value, which means there’s less benefit from mispricing. In addition to this, the negative growth outlook increases the risk of holding the stock. However, there are also other important factors we haven’t considered today, which can help gel your views on BELF.A should the price fluctuate below its true value.

Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example - Bel Fuse has 1 warning sign we think you should be aware of.

If you are no longer interested in Bel Fuse, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal