If EPS Growth Is Important To You, Light & Wonder (NASDAQ:LNW) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Light & Wonder (NASDAQ:LNW), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Light & Wonder

Light & Wonder's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Light & Wonder's EPS went from US$0.50 to US$3.45 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

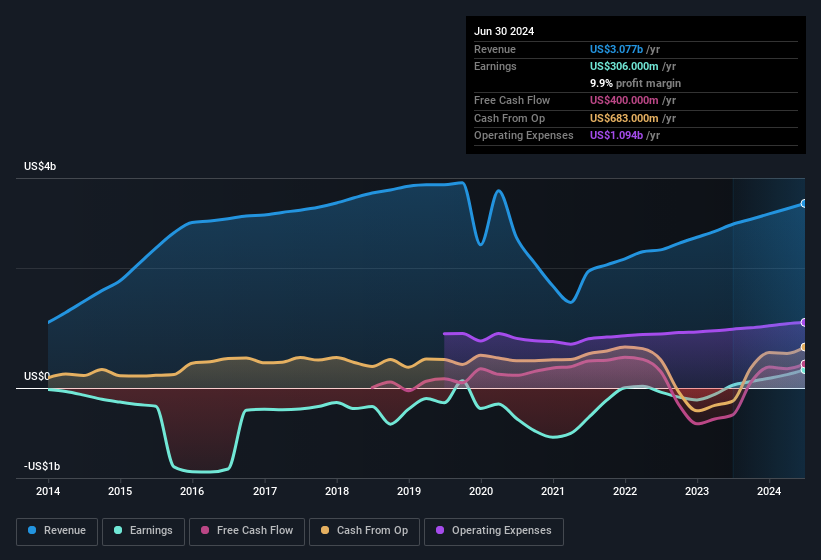

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Light & Wonder is growing revenues, and EBIT margins improved by 3.5 percentage points to 25%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Light & Wonder's future EPS 100% free.

Are Light & Wonder Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$8.4b company like Light & Wonder. But we do take comfort from the fact that they are investors in the company. Holding US$51m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Light & Wonder, with market caps between US$4.0b and US$12b, is around US$8.1m.

The Light & Wonder CEO received US$6.7m in compensation for the year ending December 2023. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Light & Wonder To Your Watchlist?

Light & Wonder's earnings per share growth have been climbing higher at an appreciable rate. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Light & Wonder certainly ticks a few boxes, so we think it's probably well worth further consideration. We should say that we've discovered 2 warning signs for Light & Wonder (1 is a bit concerning!) that you should be aware of before investing here.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal