Elixirr International And 2 Other Undiscovered Gems with Solid Foundations

The United Kingdom market has remained flat over the past week but has shown a 7.5% increase over the past year, with earnings projected to grow by 14% annually. In this environment, identifying stocks with solid foundations and growth potential can be particularly rewarding, as they may offer stability and opportunity amidst broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

We'll examine a selection from our screener results.

Elixirr International (AIM:ELIX)

Simply Wall St Value Rating: ★★★★★★

Overview: Elixirr International plc is a management consultancy firm operating through its subsidiaries in the United Kingdom, the United States, and internationally, with a market capitalization of £321.13 million.

Operations: Elixirr generates revenue primarily from management consulting services, totaling £97.37 million.

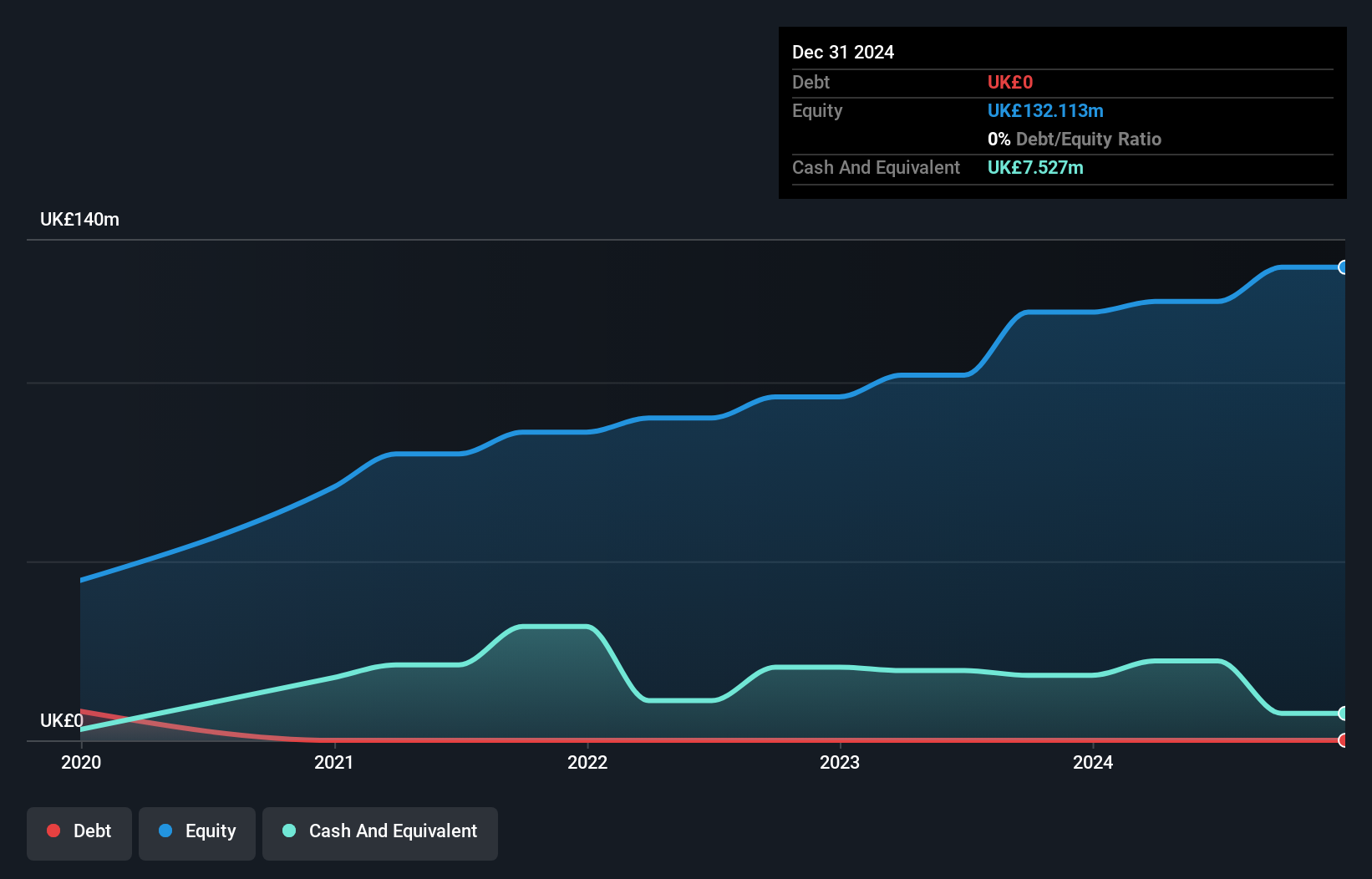

Elixirr International, a nimble player in the consulting space, showcases impressive earnings growth of 32.8% over the past year, outpacing the industry. With no debt on its books and trading at 55.9% below fair value estimates, it stands as an attractive proposition for those seeking undervalued opportunities. Recent partnerships like with Peak Performance Project highlight its innovative edge and potential for future growth, while net income rose to £8.84 million from £7.67 million last year.

Warpaint London (AIM:W7L)

Simply Wall St Value Rating: ★★★★★★

Overview: Warpaint London PLC, with a market cap of £421.37 million, operates in the cosmetics industry by producing and selling beauty products through its subsidiaries.

Operations: Warpaint London generates revenue primarily from its Own Brand segment, contributing £96.72 million, while the Close-Out segment adds £2.12 million.

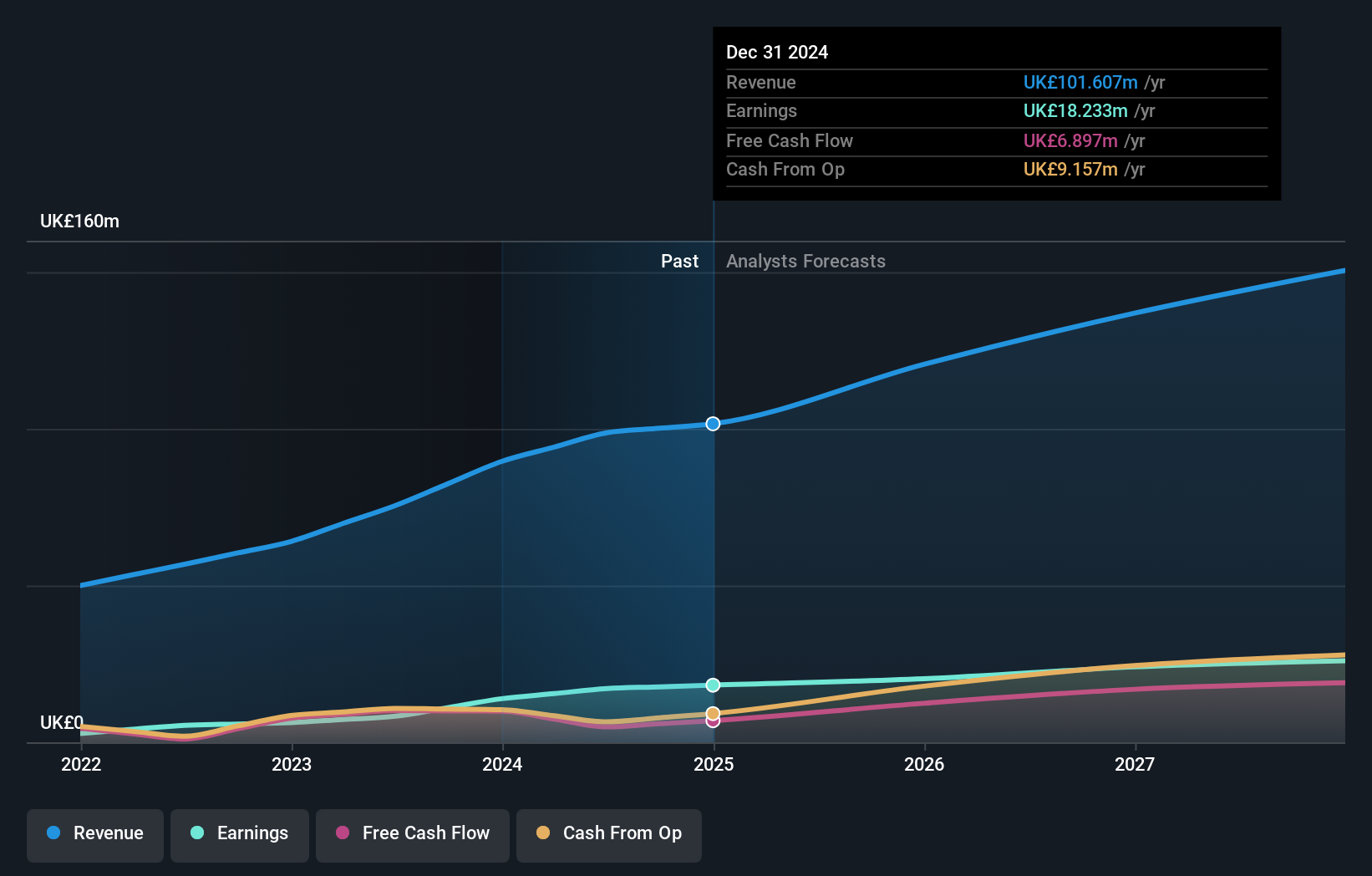

Warpaint London, a nimble player in the cosmetics sector, has shown impressive growth with earnings rising by 106% over the past year, outpacing the broader Personal Products industry. The company reported a half-year net income of £8.02 million, up from £4.78 million last year, and increased its interim dividend to 3.5 pence per share. With no debt on its balance sheet and positive free cash flow standing at £10 million as of September 2023, Warpaint seems well-positioned for continued success.

- Take a closer look at Warpaint London's potential here in our health report.

Explore historical data to track Warpaint London's performance over time in our Past section.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £275.26 million, operates through its subsidiaries to supply energy and utility solutions primarily in the United Kingdom.

Operations: Yü Group generates revenue primarily from supplying energy and utility solutions in the UK. The company has a market cap of £275.26 million.

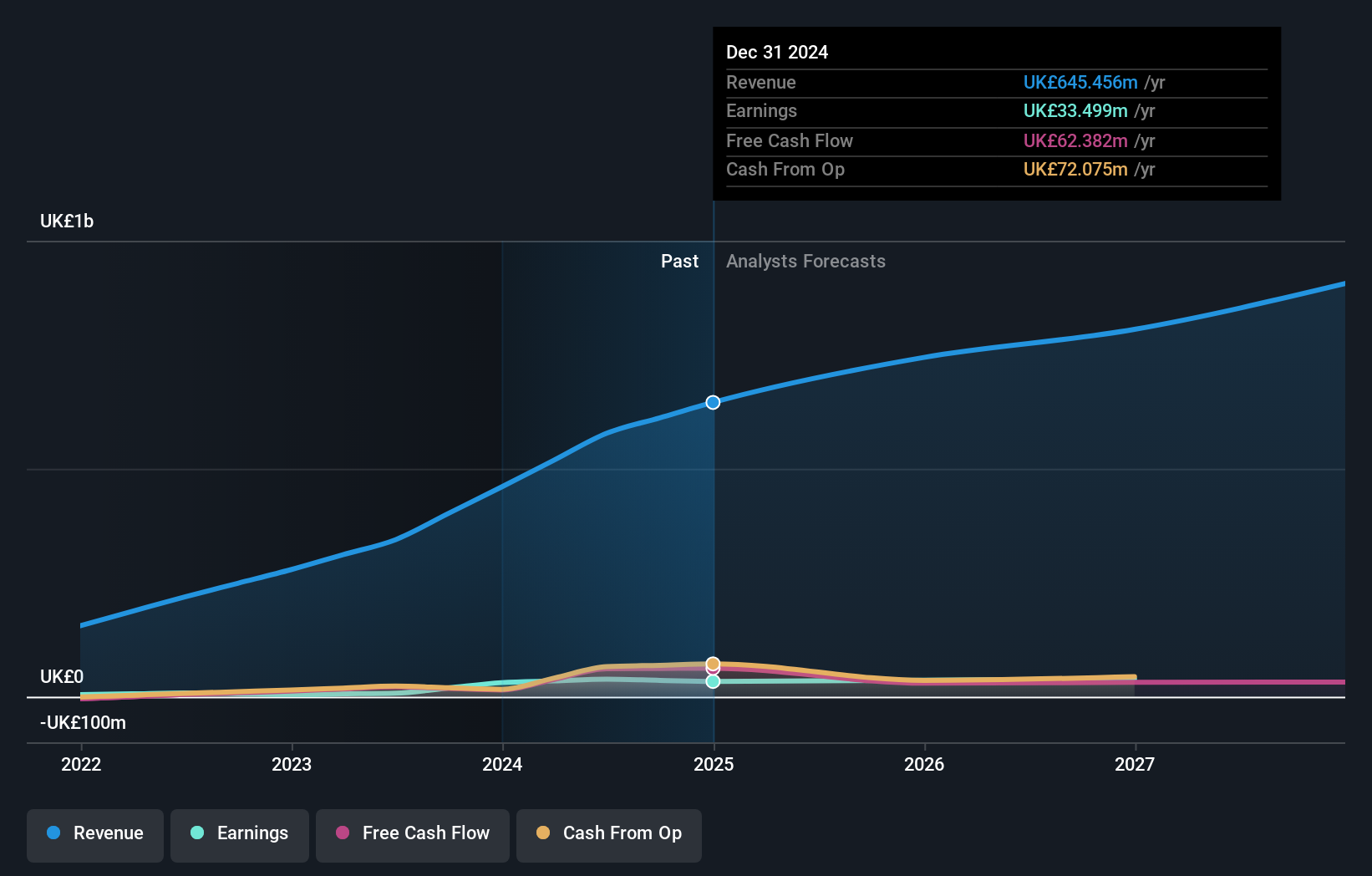

Yü Group, a UK-based energy supplier, has been making waves with its impressive financial performance. The company reported half-year sales of £312.68 million, up from £194.9 million last year, and net income rose to £14.69 million from £7.31 million. Despite a volatile share price recently, Yü Group's earnings surged by 400% over the past year, outpacing the Renewable Energy sector's -10%. Additionally, it completed a share buyback worth £3.99 million for 1.4% of shares in May 2024.

- Dive into the specifics of Yü Group here with our thorough health report.

Evaluate Yü Group's historical performance by accessing our past performance report.

Make It Happen

- Navigate through the entire inventory of 83 UK Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal