October 2024 Chinese Growth Companies With Significant Insider Ownership

In October 2024, Chinese equities experienced a decline as initial optimism about Beijing's stimulus measures faded, with the Shanghai Composite Index and CSI 300 both seeing significant drops. Despite these challenges, growth companies with high insider ownership can offer unique insights into potential resilience and long-term value creation in such fluctuating markets.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 17.9% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.6% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 38.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| UTour Group (SZSE:002707) | 22.8% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Underneath we present a selection of stocks filtered out by our screen.

3Peak (SHSE:688536)

Simply Wall St Growth Rating: ★★★★★☆

Overview: 3Peak Incorporated is a fabless semiconductor company specializing in analog products and technologies, with a market cap of CN¥14.70 billion.

Operations: The company's revenue is primarily generated from the Integrated Circuit Industry, amounting to CN¥988.19 million.

Insider Ownership: 14.8%

Revenue Growth Forecast: 39.3% p.a.

3Peak shows promise with its forecasted revenue growth of 39.3% annually, outpacing the broader Chinese market. However, recent financials reveal a net loss of CNY 65.64 million for H1 2024, contrasting with last year's profit. Insider ownership remains stable without significant trading activity recently, and despite past shareholder dilution, the company completed a share buyback worth CNY 111.79 million this year. Profitability is expected within three years amidst high volatility in share price.

- Delve into the full analysis future growth report here for a deeper understanding of 3Peak.

- Our valuation report here indicates 3Peak may be overvalued.

Shenzhen Envicool Technology (SZSE:002837)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Envicool Technology Co., Ltd. specializes in producing and selling temperature control solutions and products in China, with a market cap of CN¥19.81 billion.

Operations: The company generates revenue from its Precision Temperature Control Energy Saving Equipment segment, amounting to CN¥4.00 billion.

Insider Ownership: 19.7%

Revenue Growth Forecast: 21.7% p.a.

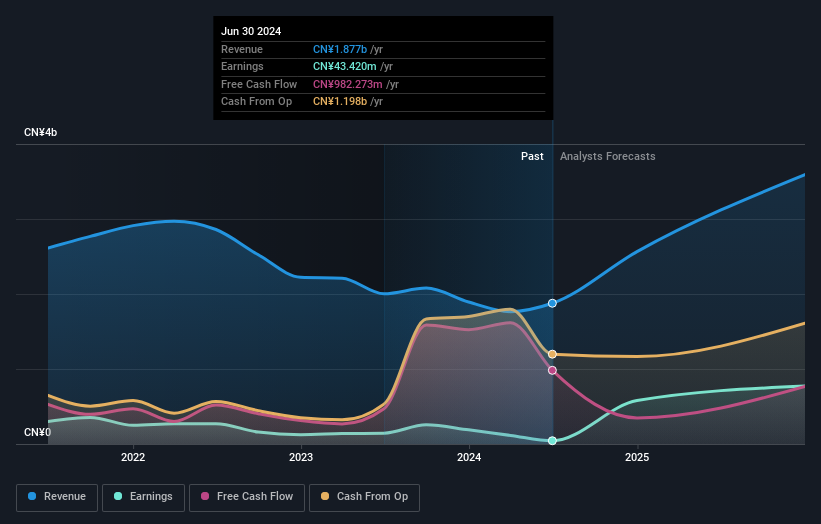

Shenzhen Envicool Technology's recent earnings report highlights robust growth, with revenue rising to CNY 1.71 billion for H1 2024 from CNY 1.24 billion a year prior, and net income doubling to CNY 183.47 million. The company's forecasted annual revenue growth of 21.7% surpasses the Chinese market average of 13.2%, although its expected earnings growth slightly lags behind at 23%. Despite no significant insider trading activity recently, it trades well below estimated fair value, indicating potential undervaluation amidst strong financial performance forecasts.

- Take a closer look at Shenzhen Envicool Technology's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Shenzhen Envicool Technology is priced lower than what may be justified by its financials.

M-Grass Ecology And Environment (Group) (SZSE:300355)

Simply Wall St Growth Rating: ★★★★★☆

Overview: M-Grass Ecology And Environment (Group) Co., Ltd. focuses on ecological restoration and environmental protection services, with a market cap of CN¥8.57 billion.

Operations: M-Grass Ecology And Environment (Group) Co., Ltd. generates revenue primarily from ecological restoration and environmental protection services.

Insider Ownership: 24.4%

Revenue Growth Forecast: 42% p.a.

M-Grass Ecology And Environment (Group) faces challenges despite significant growth prospects, with earnings expected to grow 95.42% annually, outpacing the Chinese market's 23.3%. However, recent financial results show a decline in net income to CNY 25.28 million from CNY 170.99 million year-on-year, and profit margins have decreased to 2.3%. The company trades near fair value but struggles with interest coverage and lacks recent insider trading activity, indicating cautious investor sentiment amidst high growth forecasts.

- Navigate through the intricacies of M-Grass Ecology And Environment (Group) with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of M-Grass Ecology And Environment (Group) shares in the market.

Taking Advantage

- Navigate through the entire inventory of 383 Fast Growing Chinese Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal