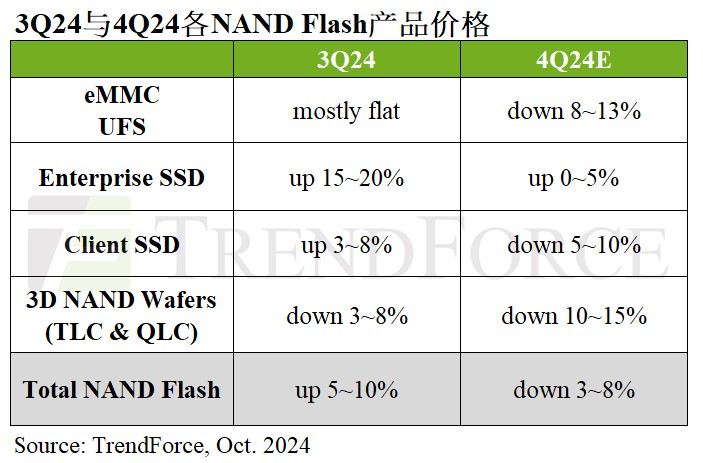

TrendForce Jibang Consulting: 4Q24 NAND Flash contract price is expected to drop by 3% to 8%

The Zhitong Finance App learned that according to the latest survey by TrendForce Jibang Consulting, NAND Flash products were affected by the poor peak season in the second half of 2024. Wafer contract prices fell first in the third quarter, and the decline is expected to expand to more than 10% in the fourth quarter. The module product segment, with the exception of Enterprise SSDs, is expected to rise slightly by 0% to 5% in the fourth quarter due to order momentum; PC SSDs and UFS are more conservative due to buyers' poor sales of terminal products as expected. TrendForce Jibang Consulting estimates that the overall contract price of NAND Flash products in the fourth quarter will drop by 3% to 8% per quarter.

Client SSD prices are estimated to be reduced by 5-10% during the quarter

Analyzed from a demand perspective, even though manufacturers actively launched AI PCs, there was no significant shift due to factors such as inflation and insufficient AI practicality. On the supply side, the operating rate of many original factories returned to full capacity in the third quarter. Coupled with other suppliers promoting process upgrades, production capacity increased slightly. However, apart from stable server-side demand, weak consumer markets are difficult to support price increases. The gap between spot and channel market prices and OEM contract prices has widened, and the original manufacturer's price adjustments have also been blocked. According to this, TrendForce Jibang Consulting estimates that PC client SSD contract prices will be reduced by 5% to 10% in the fourth quarter.

Enterprise SSD price increases have been reduced, and the quarterly increase is expected to increase by 0-5%

Due to delays in the construction of AI servers by some enterprise-level customers, the number of orders from server OEMs dropped markedly in the fourth quarter. Coupled with the fact that the peak of CSP procurement has passed, the overall procurement capacity declined compared to the third quarter. In addition, smartphone and laptop customers are conservative in NAND Flash orders due to inventory removal strategies, but as the original manufacturer continues to increase production, there is an oversupply.

TrendForce Jibang Consulting said that since Enterprise SSD order momentum and unit price are superior to other NAND Flash products, suppliers actively grab orders and increase bit shipments, and this strategy will inhibit price growth. As a result, it is estimated that Enterprise SSD contract prices will be drastically reduced in the fourth quarter, with only a quarterly increase of 0% to 5%.

eMMC bargaining favors buyers, and price estimates are reduced by 8-13% per quarter

Smartphone market conditions, which mainly drive demand, did not improve in the third quarter. Coupled with mobile phone manufacturers actively eliminating eMMC inventories and technical resistance to price increases, eMMC did not show significant transaction volume. In the fourth quarter, Chinese brands launched new models, iPhone 16 series, and Huawei tri-fold machines, which seemed to inject new momentum into the eMMC market, but buyers will adopt more careful stocking strategies to avoid excessive inventory pressure. TrendForce Jibang Consulting said that after the price standoff between buyers and sellers in the third quarter, the original inventory increased, the module factory and spot market had sufficient supplies, and the bargaining balance favoured buyers. It is estimated that the contract price for the fourth quarter will be reduced by 8% to 13% per quarter.

UFS price estimates are reduced by 8-13% per quarter

UFS is mainly used in high-end and flagship smartphones, and the market conditions are the same as eMMC. Slowing overall economic growth has led to an increase in the frequency of replacing new devices from less than 2 to 3 years, and no killer smartphone apps have appeared yet. It is estimated that demand will not change significantly in the fourth quarter. Currently, original manufacturers and module manufacturers compete for supply of UFS products. Due to weakening market demand, the original manufacturer must make price concessions in the fourth quarter to avoid accumulating inventory and achieve performance targets. It is estimated that the contract price will be reduced by 8% to 13% per quarter.

NAND Flash Wafer Quarterly Discounts 10-15%

Demand for client SSDs, flash cards, and USB drives on the retail side has been sluggish since 2024. The back-to-school season and festival effects in Europe and the US have been poor, and demand for NAND Flash Wafers is likely to decline further in the fourth quarter. TrendForce Jibang Consulting pointed out that due to excessive inventory from module manufacturers and price reduction competition from some original manufacturers, NAND Flash wafer contract prices will decline sharply in the fourth quarter. It is estimated that the quarter will decrease by 10% to 15%, and expansion is not ruled out.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal