Is Saudi Arabia increasingly likely to open doors to release oil? This conference could be a tipping point!

Climate and commodity economist Kieran Tompkins (Kieran Tompkins) of KITU Macro wrote in a report released on Monday that “frustration is clearly building up,” and “although the focus of the oil market has shifted to geopolitical risks and potential short-term supply disruptions, it is equally important that we believe that the possibility of Saudi Arabia opening the floodgates has increased in recent weeks as reports of deteriorating cohesion among OPEC+ members.”

He said that the OPEC+ Group, formed by OPEC's allies, has been implementing voluntary production cuts, but currently there is still an excess of 800,000 barrels of production per day.

Earlier this month, the Wall Street Journal reported that Saudi Energy Minister Abdulaziz bin Salman (Abdulaziz bin Salman) warned other oil producers on a conference call that oil prices could drop to $50 per barrel if they don't abide by the agreed production reduction plan. However, OPEC posted on X that the article misreported the holding of the conference call. “The OPEC Secretariat has categorically refuted the claims in the report, calling them completely inaccurate and misleading.”

Tompkins also pointed out that an article in the Financial Times on September 26 shows that Saudi Arabia can easily get through the period of falling oil prices through alternative financing measures. Tompkins said this “is a less subtle reminder of its ability to 'punish' oil-producing countries that 'cheat' (in terms of cutting production).” “It's only a matter of time before Saudi Arabia turns on the faucet,” he wrote in the report's headline.

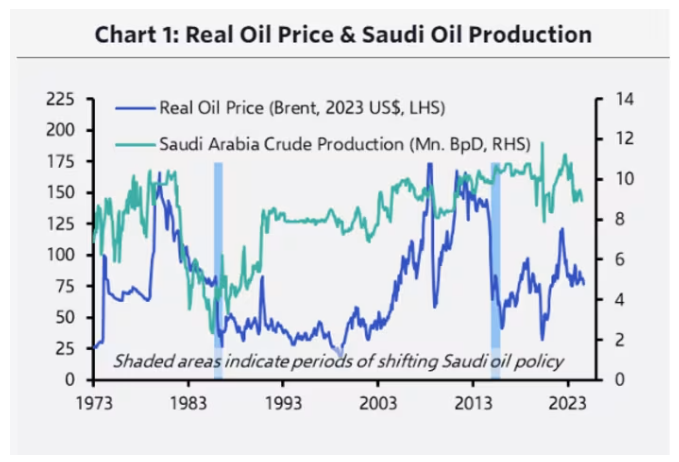

Saudi oil policy also underwent major changes in the mid-80s of the last century and the mid-10s of this century, which led to a sharp drop in oil prices at that time.

James Swanston (James Swanston), a Middle Eastern and North African economist at KITU Macro, also said in a report last month that Saudi Arabia's reasons for increasing oil production are being strengthened. He said the increase in production would cause some economic pain and require Crown Prince Mohammed bin Salman (Mohammed bin Salman) to change the course of oil policy since coming to power, but this would “allow Saudi Arabia to regain market share.”

Tompkins said that the current oil market background may not mean that Saudi oil policy is about to undergo a major shift. He said the current situation in Saudi Arabia is “far from being as bad as it used to be.” Saudi Arabia, for example, cut oil production by 75% before reversing its oil policy in the mid-80s. By contrast, since September 2022, it has cut production by nearly 20%. This shows that Saudi Arabia's “current situation is not that worrisome.”

Tompkins said that if Saudi Arabia actually increases daily production from around 9 million barrels to 12.5 million barrels, then oil prices will need to drop drastically below 50 US dollars per barrel, which will cause its oil export revenue to be “significantly worse than it is now.”

Tompkins said, “All in all, we think the risk of Saudi Arabia turning on the faucet and increasing production at some point has increased, and the possibility of doing so by the end of 2025 may reach around 30%.

The OPEC+ meeting scheduled for December 1 will be key. In September of this year, OPEC+ agreed to extend voluntary production cuts for two months until the end of November, and then gradually cancel production cuts on a monthly basis in early December.

Tompkins said, “One of the lessons of 2014 and 2020 is that the breakdown of negotiations surrounding these meetings caused Saudi Arabia to change its strategy,” and “the December meeting could be a potential tipping point.”

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal