The market has voted! A stronger dollar is a deposit that Trump will win the election

According to a Wall Street strategist, the reason for the strengthening of the dollar is that investors are increasingly convinced that the Republican candidate Trump will win the November 5 presidential election.

Thierry Wizman, a foreign exchange and interest rate strategist at Macquarie, observed that while the US dollar's exchange rate against major rival currencies strengthened in October, the gaming market also showed that Trump's probability of winning on November 5 was rising.

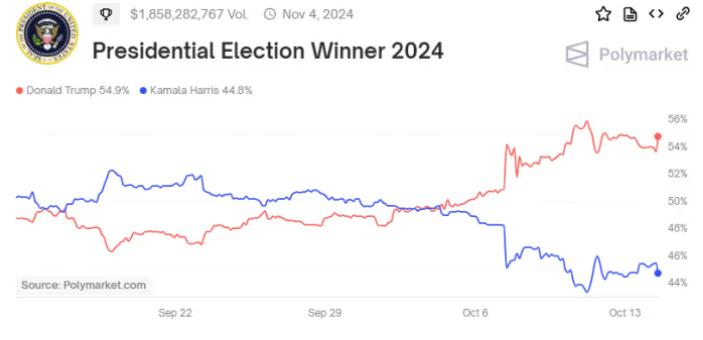

The US dollar index jumped 2.5% in October, turning its returns positive this year. Meanwhile, according to the forecast market Polymarket (chart below), Trump's probability of defeating Democratic candidate Harris rose from about 50% at the end of September to about 55%.

Wizman and his colleague Macquarie strategist Gareth Berry wrote in a report last week: “This is not surprising; our assumption is that Trump's policies (higher tariffs, fewer immigrants, lower taxes) are inflationary, which heats up the more hawkish expectations of the Federal Reserve in 2025-26. ”

The strategists wrote: “Trump's policy is a policy in favor of the dollar.”

Wizman acknowledged that while Trump spent most of his first term complaining that weak foreign currencies weakened America's competitiveness, he is now seen as a candidate to support a strong dollar, which is a significant change.

“I think Trump realizes that inflation is bad for his political opponents, and he recognizes that a weak dollar causes inflation,” Wizman said.

Wizman pointed out that Trump last month threatened to impose 100% tariffs on countries that “gave up the dollar.”

On Sunday, hedge fund manager and Trump's top economic adviser Scott Bessent said that Trump supports the dollar's status as a reserve currency and will not try to depreciate the dollar.

Wizman said that market expectations about Trump's policy path and its potential inflationary impact have been the main driving force behind the recent appreciation of the US dollar.

Wizman said that in theory and in practice, the Trump administration's three core economic policy agendas (higher tariffs, fewer immigrants, lower taxes) will be more inflationary than the corresponding policies under the Harris administration. More importantly, if these inflationary policies are implemented, they will force the Federal Reserve's policy interest rate to be higher than expected.

Of course, the final winners may be constrained by rising US bond yields. Due to concerns about the US fiscal outlook, US bond yields rebounded even though the Federal Reserve cut interest rates by 50 basis points in September.

Analysts said that in several key swing states, the weak gap between Harris and Trump may make gaming market participants more confident that the Republican Party will win the election.

Wizman said that if Harris wins in the end, or if betting market predictions turn in her favor before November 5, then the dollar is likely to recoup some of its recent gains.

Wizman said, “So, at the end of the day, it depends on who wins, but I think what we've seen in the past two weeks (a stronger dollar) is a little 'down' on Trump's chances of winning.”

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal