Origin Enterprises (ISE:OIZ) Is Paying Out A Dividend Of €0.1365

The board of Origin Enterprises plc (ISE:OIZ) has announced that it will pay a dividend on the 14th of February, with investors receiving €0.1365 per share. This makes the dividend yield 5.3%, which will augment investor returns quite nicely.

See our latest analysis for Origin Enterprises

Origin Enterprises' Future Dividend Projections Appear Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Based on the last payment, Origin Enterprises' earnings were much higher than the dividend, but it wasn't converting those earnings into cash flow. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

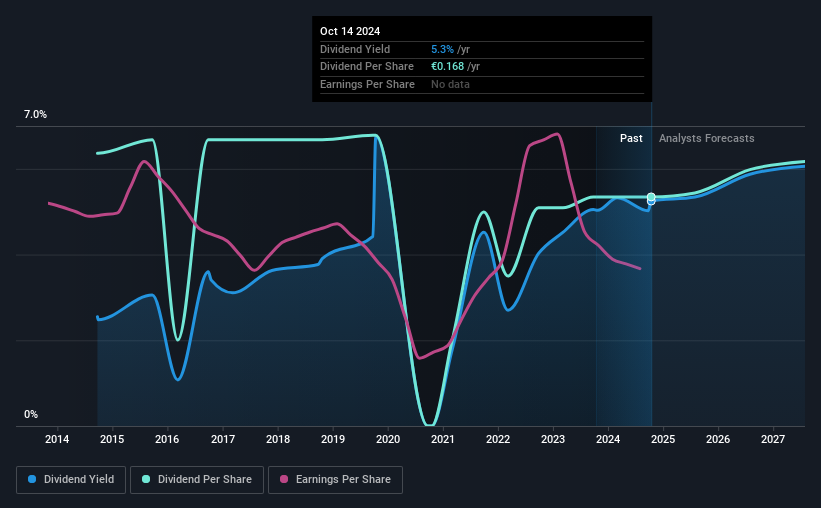

Over the next year, EPS is forecast to expand by 2.9%. If the dividend continues along recent trends, we estimate the payout ratio will be 41%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was €0.20 in 2014, and the most recent fiscal year payment was €0.168. This works out to be a decline of approximately 1.7% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

Origin Enterprises May Find It Hard To Grow The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Although it's important to note that Origin Enterprises' earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Origin Enterprises' payments, as there could be some issues with sustaining them into the future. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would probably look elsewhere for an income investment.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 1 warning sign for Origin Enterprises that investors need to be conscious of moving forward. Is Origin Enterprises not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal