Software Circle plc (LON:SFT) Looks Just Right With A 26% Price Jump

The Software Circle plc (LON:SFT) share price has done very well over the last month, posting an excellent gain of 26%. The last month tops off a massive increase of 110% in the last year.

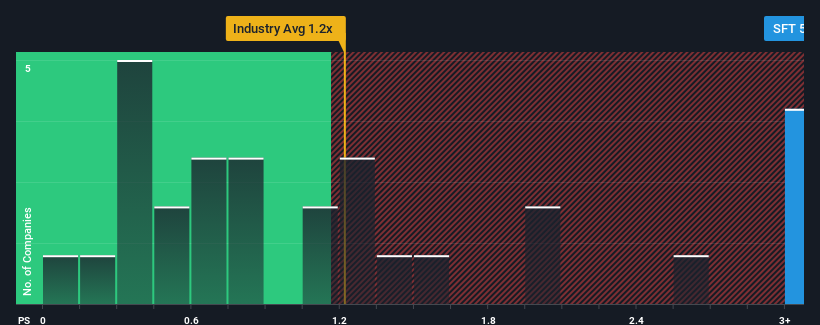

After such a large jump in price, when almost half of the companies in the United Kingdom's Commercial Services industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Software Circle as a stock not worth researching with its 5.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Software Circle

How Has Software Circle Performed Recently?

With revenue growth that's exceedingly strong of late, Software Circle has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Software Circle's earnings, revenue and cash flow.How Is Software Circle's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Software Circle's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 38% gain to the company's top line. The latest three year period has also seen an excellent 133% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 3.1% shows it's noticeably more attractive.

With this information, we can see why Software Circle is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Software Circle's P/S

Software Circle's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Software Circle revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Software Circle with six simple checks on some of these key factors.

If you're unsure about the strength of Software Circle's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal