Exploring Undiscovered Gems in Switzerland October 2024

The Swiss market recently showed resilience, with the SMI closing up by 0.86%, as investors absorbed producer price inflation data and anticipated the European Central Bank's upcoming policy decision. In this context of economic shifts and market dynamics, identifying promising stocks often involves looking for companies that demonstrate strong fundamentals and potential for growth amidst broader economic changes.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 0.24% | 0.63% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Burkhalter Holding AG, with a market cap of CHF970.20 million, operates through its subsidiaries to deliver electrical engineering services to the construction sector in Switzerland.

Operations: Burkhalter Holding generates revenue primarily from electrical engineering services, amounting to CHF1.18 billion. The company's financial performance can be analyzed through its net profit margin trends, which provide insights into profitability relative to revenue.

Burkhalter Holding, a Swiss company with a knack for flying under the radar, has shown solid financial performance. Over the past year, its earnings grew by 10.3%, outpacing the construction industry's 8.7% growth rate. Despite having high-quality earnings and free cash flow positivity, it carries a net debt to equity ratio of 52.9%, which is considered high. Recently reported half-year revenue reached CHF 570 million with net income at CHF 23 million, reflecting steady progress despite being dropped from the S&P Global BMI Index in September 2024.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market capitalization of CHF1.25 billion.

Operations: The company generates revenue primarily from three geographic segments: Europe, Middle East and Africa (CHF452.85 million), Americas (CHF352.67 million), and Asia-Pacific (CHF273.16 million).

Compagnie Financière Tradition, a promising player in the financial sector, showcases robust earnings with a 16% growth over the past year, outpacing industry averages. The company trades at 28.9% below its estimated fair value, suggesting potential undervaluation. Its debt-to-equity ratio improved from 75.7 to 47.1 over five years, reflecting prudent financial management. Recent earnings reports highlight revenue of CHF 538M and net income of CHF 60M for the half-year ending June 2024, indicating solid performance momentum.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

Overview: V-ZUG Holding AG is involved in the development, manufacture, marketing, sale, and servicing of kitchen and laundry appliances for private households both in Switzerland and internationally, with a market capitalization of CHF366.43 million.

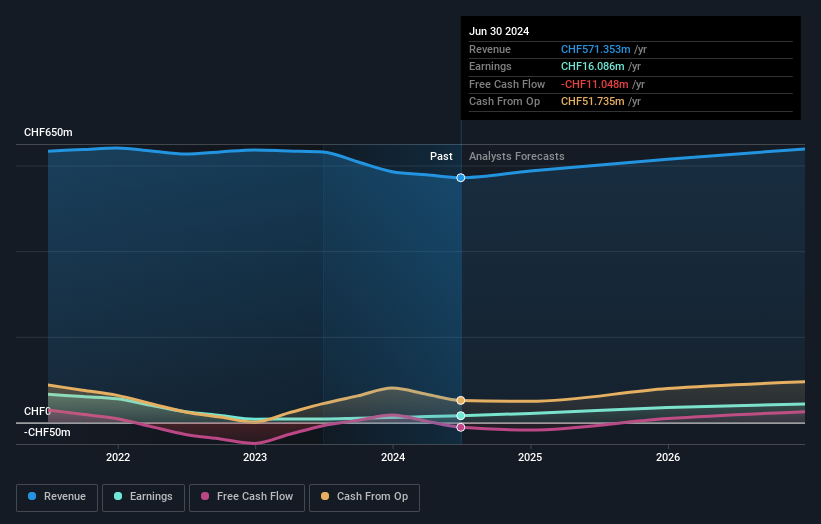

Operations: V-ZUG generates revenue primarily from its Household Appliances segment, amounting to CHF571.35 million. The company's financial performance can be further analyzed by examining its gross profit margin trends over recent periods.

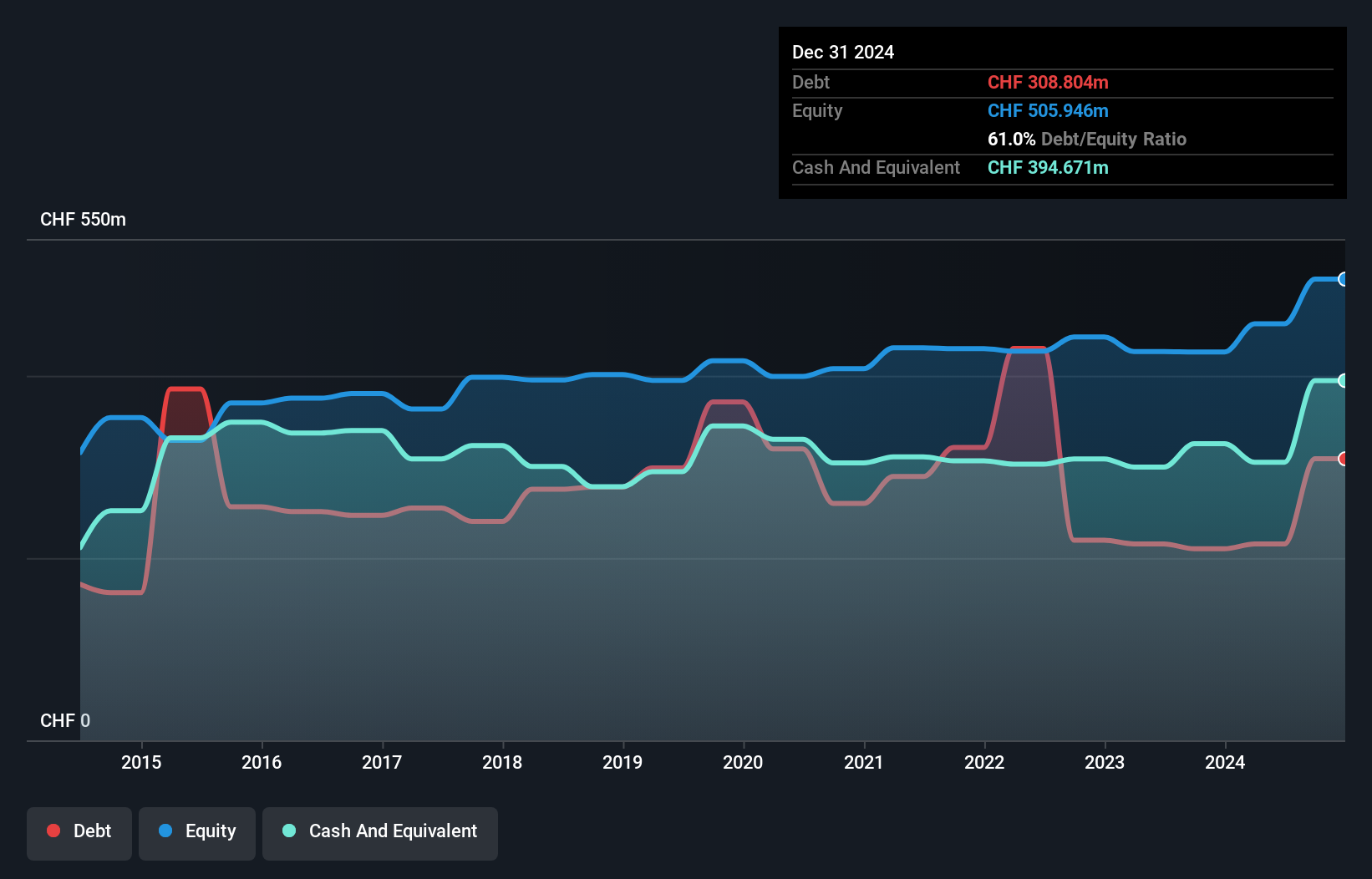

V-ZUG, a player in the consumer durables sector, reported CHF 284.08 million in sales for the first half of 2024, slightly down from CHF 298.15 million last year. However, net income rose to CHF 8.73 million from CHF 4.33 million, with earnings per share increasing to CHF 1.36 from CHF 0.67. The company has no debt now compared to a debt-to-equity ratio of 22% five years ago and is trading at a value significantly below its estimated fair value by our calculations, indicating potential undervaluation opportunities for investors considering this Swiss gem's strong earnings growth trajectory and industry outperformance over the past year (89% vs industry’s less than 1%).

- Unlock comprehensive insights into our analysis of V-ZUG Holding stock in this health report.

Review our historical performance report to gain insights into V-ZUG Holding's's past performance.

Summing It All Up

- Click here to access our complete index of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal