3 Swiss Stocks On SIX Swiss Exchange Estimated To Be Up To 46.1% Below Intrinsic Value

The Swiss market recently showed resilience, closing on a positive note as investors absorbed producer price inflation data and anticipated the European Central Bank's monetary policy announcement. In this environment, identifying undervalued stocks becomes crucial, as they offer potential opportunities for investors seeking value amidst fluctuating economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF145.60 | CHF288.23 | 49.5% |

| Swissquote Group Holding (SWX:SQN) | CHF306.80 | CHF566.62 | 45.9% |

| Georg Fischer (SWX:GF) | CHF59.25 | CHF109.93 | 46.1% |

| lastminute.com (SWX:LMN) | CHF18.90 | CHF29.38 | 35.7% |

| Julius Bär Gruppe (SWX:BAER) | CHF54.02 | CHF104.52 | 48.3% |

| Clariant (SWX:CLN) | CHF12.58 | CHF21.47 | 41.4% |

| Comet Holding (SWX:COTN) | CHF300.50 | CHF525.75 | 42.8% |

| SGS (SWX:SGSN) | CHF96.34 | CHF151.00 | 36.2% |

| Montana Aerospace (SWX:AERO) | CHF18.36 | CHF31.65 | 42% |

| Sensirion Holding (SWX:SENS) | CHF69.10 | CHF117.43 | 41.2% |

Let's explore several standout options from the results in the screener.

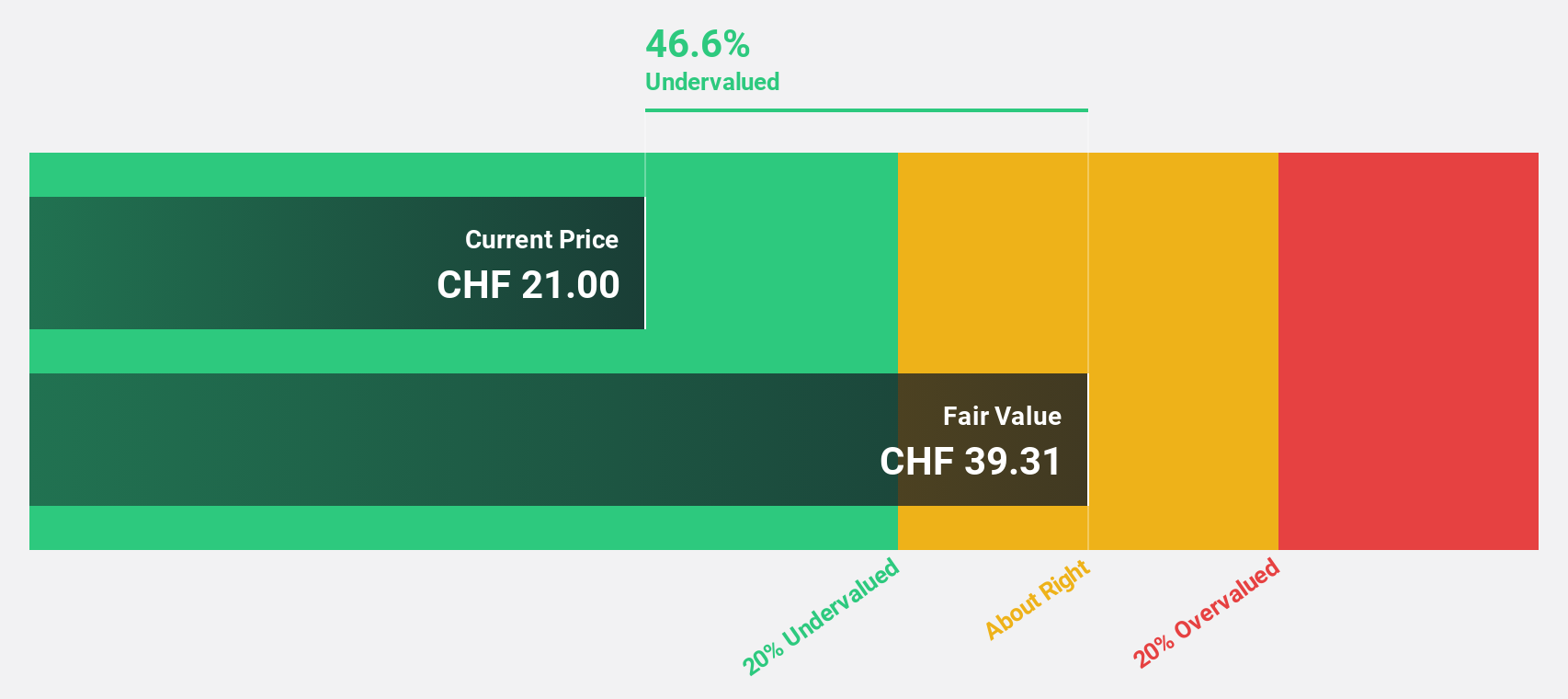

Montana Aerospace (SWX:AERO)

Overview: Montana Aerospace AG designs, develops, and manufactures system components and assemblies globally, with a market cap of CHF1.14 billion.

Operations: The company's revenue segments include Energy (€596.97 million) and Aerostructures (€780.79 million).

Estimated Discount To Fair Value: 42%

Montana Aerospace appears undervalued, trading 42% below its estimated fair value of CHF31.65. Despite reporting a net loss in the recent quarter, sales increased to EUR 366.95 million from EUR 310.59 million year-on-year, with earnings per share improving to EUR 0.08 from a loss previously. The company is expected to achieve profitability within three years and has forecast revenue growth of 8.2% annually, outpacing the Swiss market average of 4.3%.

- The analysis detailed in our Montana Aerospace growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Montana Aerospace.

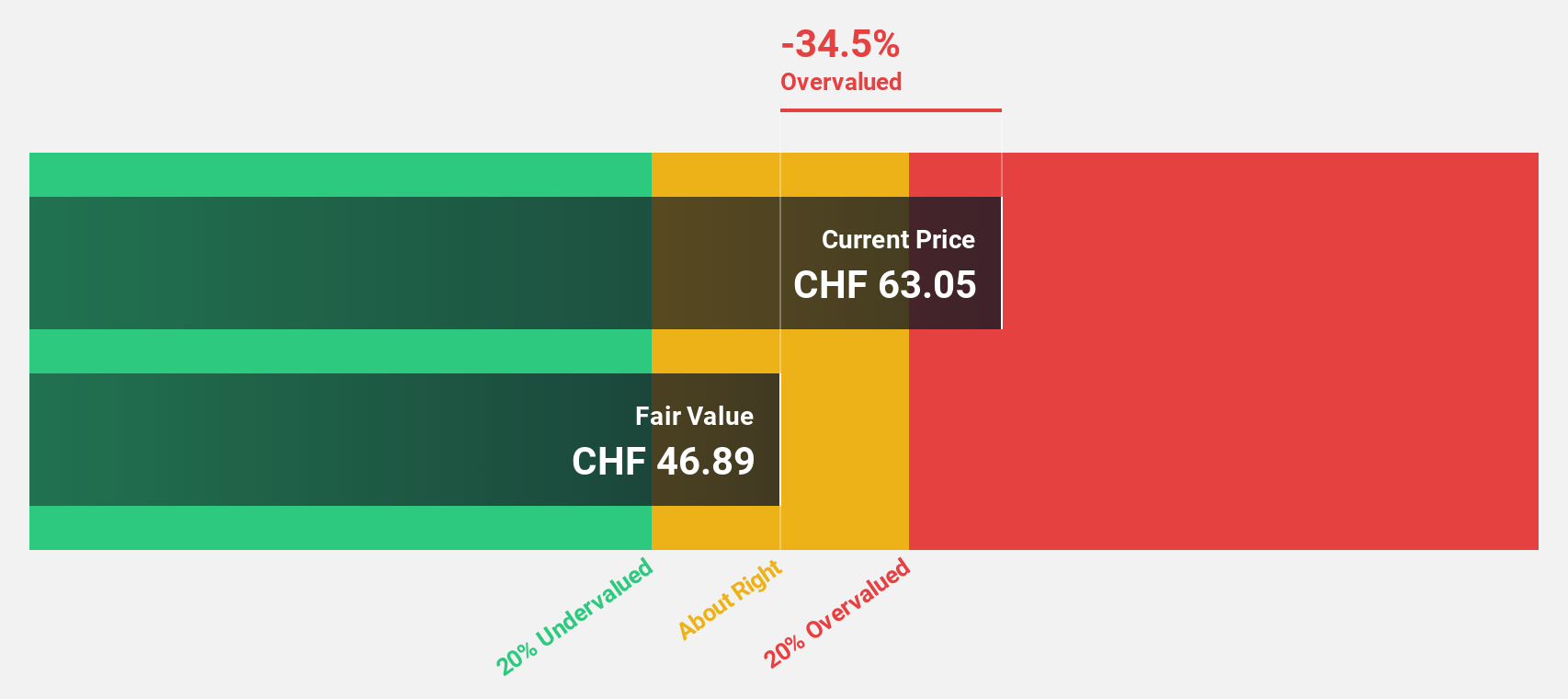

Georg Fischer (SWX:GF)

Overview: Georg Fischer AG is a company that provides piping systems and casting and machining solutions across Europe, the Americas, Asia, and internationally, with a market cap of CHF4.85 billion.

Operations: The company's revenue segments include CHF1.99 billion from GF Piping Systems, CHF901 million from GF Casting Solutions, and CHF853 million from GF Machining Solutions.

Estimated Discount To Fair Value: 46.1%

Georg Fischer is trading at CHF 59.25, significantly below its estimated fair value of CHF 109.93, suggesting undervaluation based on cash flows. Despite a recent drop in net income to CHF 97 million and reduced profit margins, the company's earnings are forecasted to grow by over 22% annually, surpassing market averages. However, debt coverage by operating cash flow remains inadequate. Analysts anticipate a potential stock price increase of over 27%.

- Our expertly prepared growth report on Georg Fischer implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Georg Fischer with our detailed financial health report.

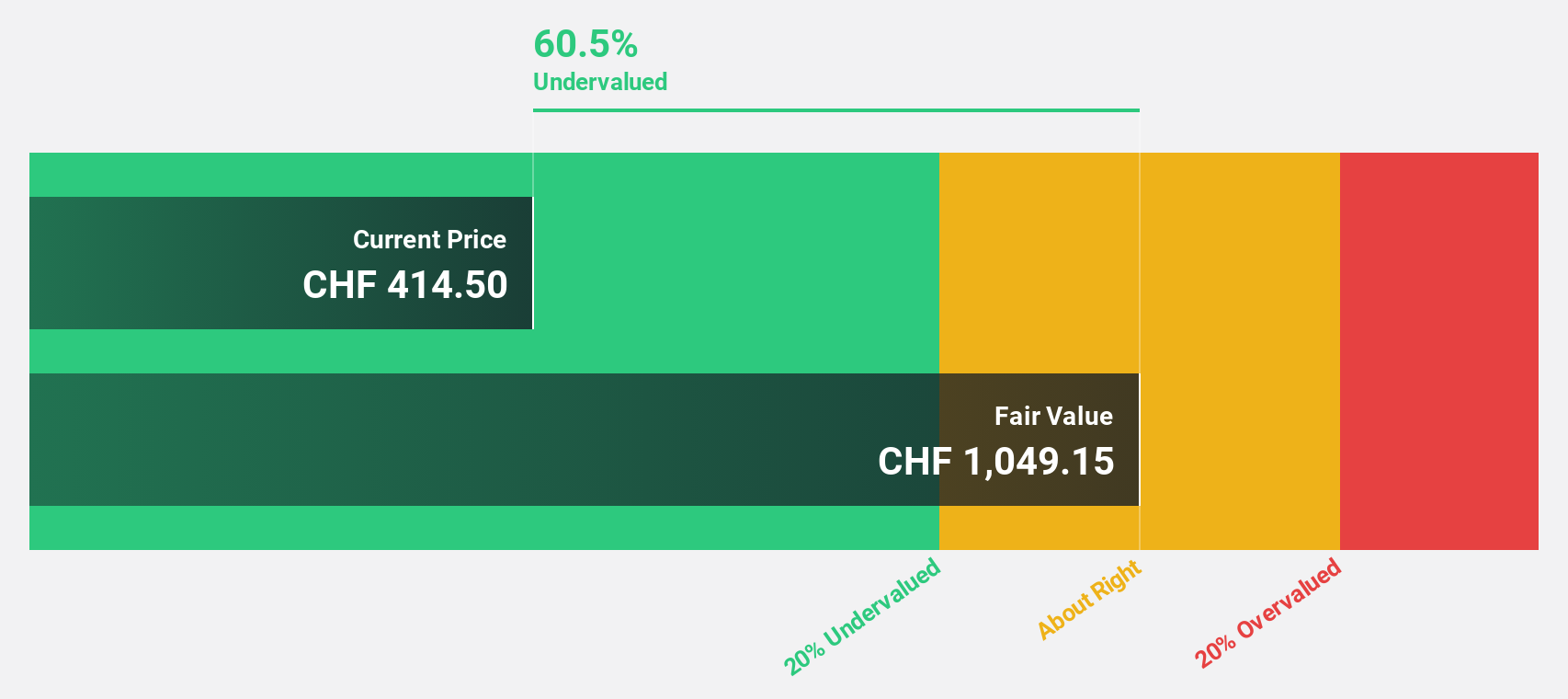

Ypsomed Holding (SWX:YPSN)

Overview: Ypsomed Holding AG, with a market cap of CHF5.54 billion, develops, manufactures, and sells injection and infusion systems for pharmaceutical and biotechnology companies through its subsidiaries.

Operations: The company's revenue is primarily derived from Ypsomed Diabetes Care, contributing CHF151.05 million, and Ypsomed Delivery Systems, which accounts for CHF385.15 million.

Estimated Discount To Fair Value: 24.3%

Ypsomed Holding, trading at CHF 406, is priced significantly below its estimated fair value of CHF 536.2, reflecting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 33.3% annually, outpacing the Swiss market's average growth rate. Recent collaboration with Astria Therapeutics for the STAR-0215 autoinjector could enhance revenue prospects despite a forecasted slower revenue growth rate of 18.4% per year compared to earnings expansion.

- According our earnings growth report, there's an indication that Ypsomed Holding might be ready to expand.

- Get an in-depth perspective on Ypsomed Holding's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Explore the 19 names from our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal