The US stock bull market has entered its third year, and will it inevitably experience a sharp decline?

On Monday, the S&P 500 set a new record, kicking off the US stock market's third year into a bull market, but historical experience shows investors need to prepare for possible setbacks in the next 12 months.

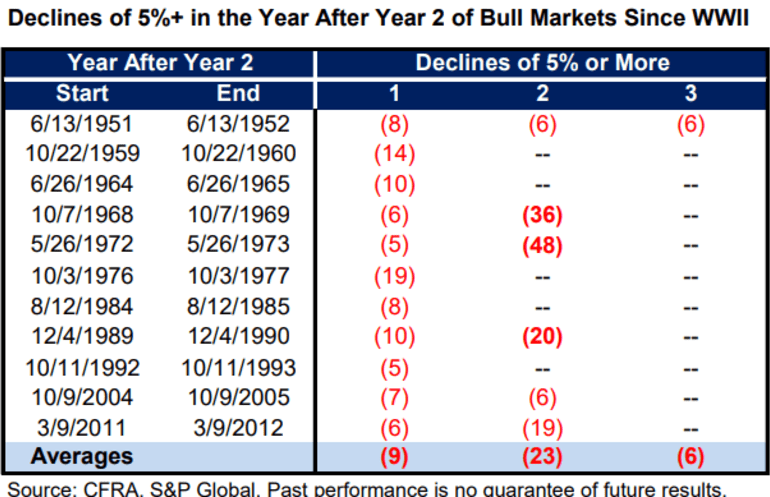

Sam Stovall (Sam Stovall), chief investment strategist at CFRA Research, said that since 1947, all 11 bull markets that have passed their two-year “birthday” experienced at least one fall of 5% or more in the following 12 months, and some have even evolved into new bear markets.

Stover said in a customer note on Monday: “Since 1947, the 11 bull markets have had an average return of only 2% after reaching their second birthday. More importantly (over the next 12 months), they all experienced a 5% drop, while 5 experienced a sharp drop of more than 10% but less than 20%, and 3 succumbed to a new bear market.”

The S&P 500 index has accumulated a cumulative increase of nearly 64% since hitting a bearish closing low of 3577.03 on October 12, 2022. According to FactSet data, the index surged 0.8% to close at 5859.85 points on Monday.

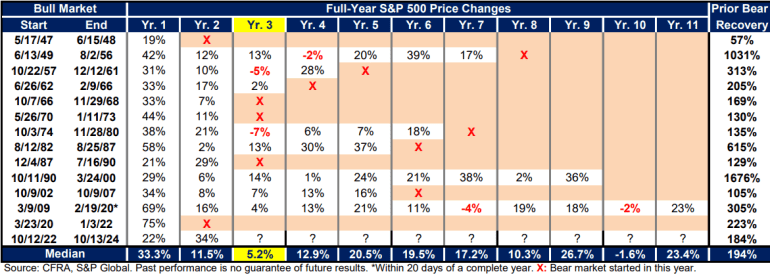

The table below shows that in the first year of the current bull market, the S&P 500 index rose 22%, the third lowest since 1947. However, according to CFRA Research, the index had the highest increase in the second year of the bull market, reaching 34%, compared to a median of 11.5%.

Stover believes that as the bull market enters its third year, the current overvaluation of the US stock market, especially large-cap stocks, is “worrying.”

The S&P 500 currently tracks a price-earnings ratio of 25, the highest valuation in the second year of a bull market since World War II. According to CFRA Research, this level is also 48% higher than the median price-earnings ratio for the second year of any bull market since 1947.

“The price-earnings ratio multiplier usually shrinks in the third year of a bull market because earnings per share tend to accelerate growth and confirm the optimism implied by the sharp rise in prices in the early stages of a bull market,” Stover pointed out.

John Butters (John Butters), senior profit analyst at FactSet Research, said that Wall Street analysts expect profit growth rates of 14.2%, 13.9%, and 13.1% for the fourth quarter of 2024, the first quarter of 2025, and the second quarter, respectively.

Barts said in a statement last Friday that earnings for the 2025 fiscal year are also expected to increase by about 15%, while the expected growth rate for the 2024 fiscal year is about 10%.

The US stock market closed higher on Monday, and investors turned their attention to the next batch of corporate earnings reports.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal