High Growth Tech Stocks in Germany for October 2024

As the German economy faces a projected contraction for the second consecutive year, with factory orders experiencing a significant decline, investors are closely watching how these macroeconomic challenges might impact high-growth tech stocks in the region. In such an environment, identifying companies with strong innovation capabilities and resilience to economic fluctuations becomes crucial for those interested in exploring opportunities within Germany's tech sector.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 32.50% | 30.70% | ★★★★★☆ |

| Ströer SE KGaA | 7.52% | 29.17% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| cyan | 28.13% | 71.37% | ★★★★★☆ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| GK Software | 8.70% | 33.04% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

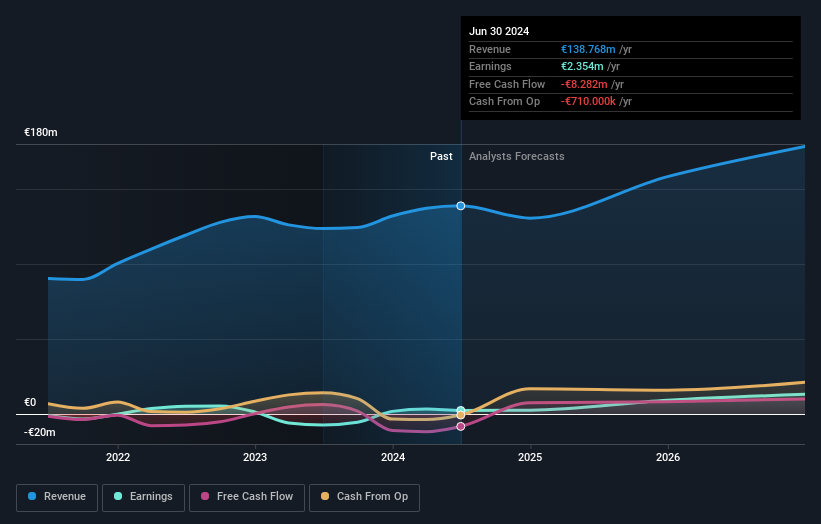

Overview: adesso SE, along with its subsidiaries, offers IT services across Germany, Austria, Switzerland, and internationally, with a market capitalization of approximately €509.23 million.

Operations: The company generates revenue primarily from IT services (€1.39 billion) and IT solutions (€128.12 million). The gross profit margin shows a notable trend at 34%, reflecting the company's efficiency in managing its production costs relative to sales.

Adesso SE, amidst a challenging market, has demonstrated resilience with an 11.7% annual revenue growth, outpacing the German market average of 5.5%. Despite current unprofitability and a net loss widening to €9.86 million from €5.89 million in the previous year, the company is set for future profitability with earnings expected to surge by 46.45% annually. Significant investment in R&D underscores its commitment to innovation, crucial for maintaining competitiveness in the rapidly evolving tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of adesso.

Gain insights into adesso's historical performance by reviewing our past performance report.

LPKF Laser & Electronics (XTRA:LPK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LPKF Laser & Electronics SE, along with its subsidiaries, specializes in developing, manufacturing, and selling laser-based solutions for the technology industry globally, with a market cap of €237.42 million.

Operations: LPKF generates revenue primarily from its four segments: Solar (€48.9 million), Welding (€23.7 million), Development (€28.8 million), and Electronics (€32.4 million). The company focuses on providing laser-based solutions tailored to different technological applications worldwide.

LPKF Laser & Electronics SE, navigating through a tough tech landscape, reported an uptick in sales to EUR 30.84 million in Q2 2024, up from EUR 28.8 million the previous year, reflecting a persistent demand for its precision technologies. Despite this growth and a slight reduction in net loss from EUR 7.56 million to EUR 6.96 million over six months, the company faces challenges with profitability as evidenced by continued losses per share. However, LPKF's significant expected earnings growth of 68.8% annually outpaces the broader German market forecast of 20%, signaling potential for recovery and expansion fueled by innovation and market adaptation strategies showcased during their recent presentation at the Berenberg and Goldman Sachs Conference.

- Unlock comprehensive insights into our analysis of LPKF Laser & Electronics stock in this health report.

Evaluate LPKF Laser & Electronics' historical performance by accessing our past performance report.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

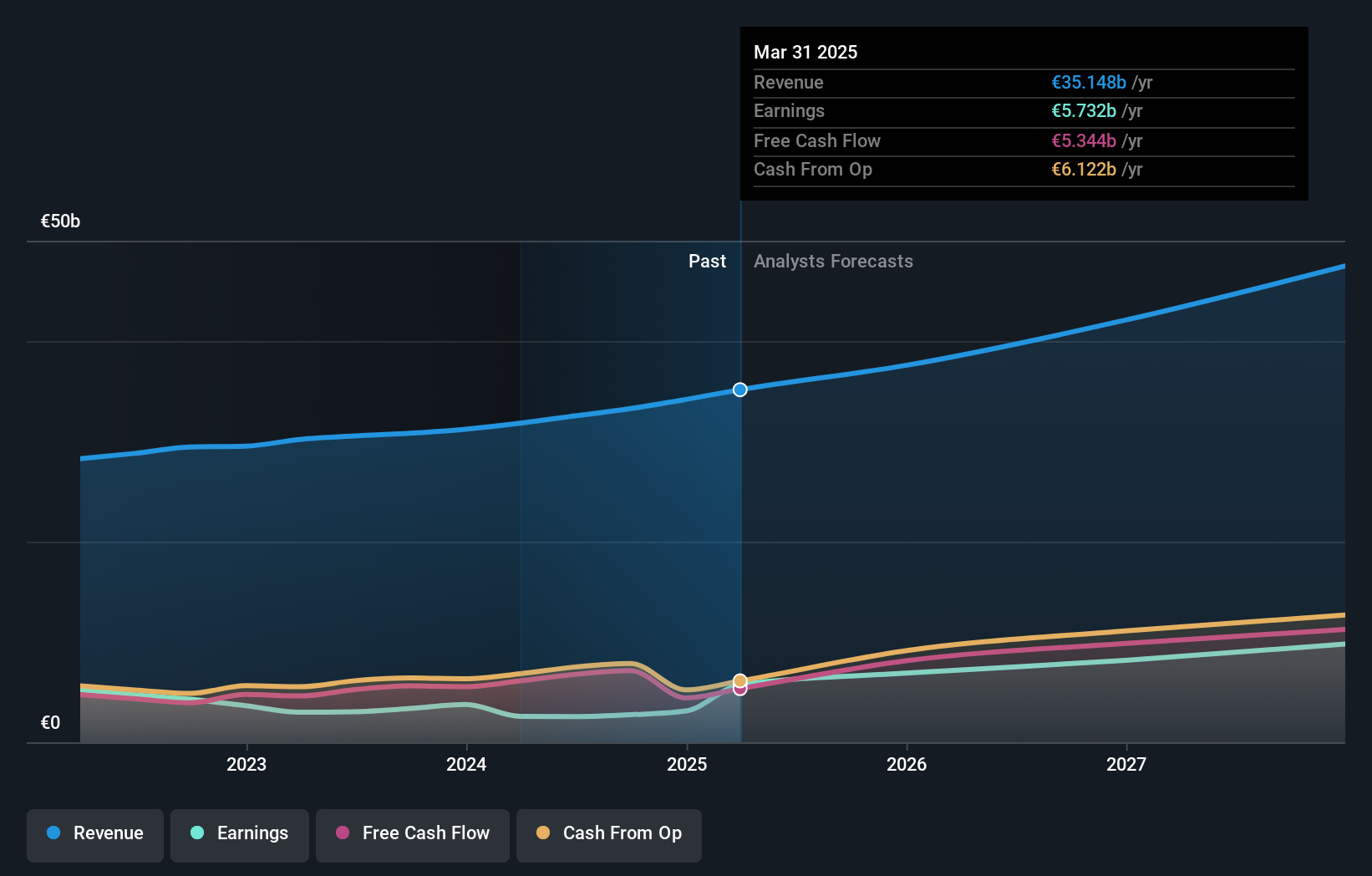

Overview: SAP SE, along with its subsidiaries, delivers a range of applications, technology, and services on a global scale and has a market capitalization of approximately €246.11 billion.

Operations: The company generates revenue primarily from its Applications, Technology & Services segment, which accounts for €32.54 billion. This segment encompasses a broad array of software solutions and related services offered globally.

SAP's strategic focus on AI and technological innovation is evident in its recent unveiling of generative AI capabilities at the SAP TechEd conference, signaling a robust pivot towards integrating AI deeply within its business processes. This move is underscored by a significant 37.9% forecasted annual earnings growth, outpacing the broader German market's 20%. Additionally, SAP's R&D expenditure remains a critical investment area, maintaining a strong alignment with revenue growth which has seen an impressive increase of 9.6% per year. These developments not only enhance SAP’s competitive edge but also solidify its role in shaping future business landscapes through advanced technology solutions.

Where To Now?

- Gain an insight into the universe of 40 German High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal