Undiscovered Gems in Germany Three Stocks to Watch in October 2024

As the German economy faces a challenging year with forecasts indicating a contraction and factory orders experiencing significant declines, investors are increasingly looking towards small-cap stocks for potential opportunities amidst broader market volatility. In this environment, identifying stocks that demonstrate resilience through strong fundamentals and innovative strategies can offer intriguing prospects for those seeking to navigate these uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| EnviTec Biogas | 48.48% | 20.85% | 46.34% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| DFV Deutsche Familienversicherung | NA | 19.63% | 62.92% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Paul Hartmann (DB:PHH2)

Simply Wall St Value Rating: ★★★★★☆

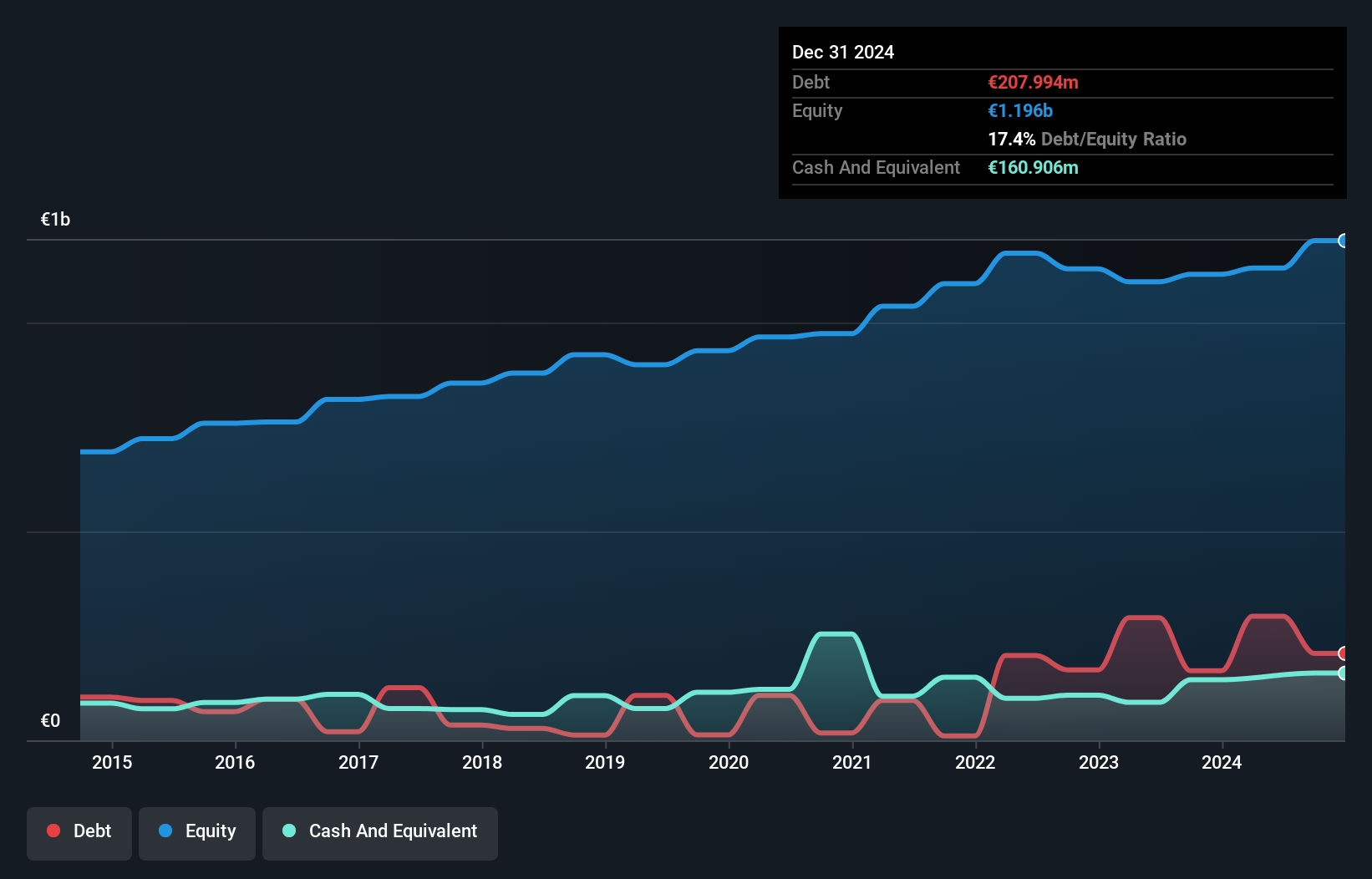

Overview: Paul Hartmann AG is a company that manufactures and sells medical and care products across Germany, the rest of Europe, the Middle East, Africa, Asia-Pacific, and the Americas, with a market cap of approximately €717.45 million.

Operations: Paul Hartmann AG generates revenue primarily from four segments: Wound Care (€597.39 million), Infection Management (€516.66 million), Incontinence Management (€769.70 million), and Complementary Divisions (€499.70 million). The company has a market cap of approximately €717.45 million, reflecting its scale in the medical and care products industry across various regions globally.

Paul Hartmann, a notable player in the medical equipment sector, has shown impressive earnings growth of 156.1% over the past year, significantly outpacing the industry's 16.2%. The company's net debt to equity ratio stands at a satisfactory 13.4%, with interest payments well covered by EBIT at 6.2 times coverage. Recent reports highlight a robust increase in net income to €42.8 million for H1 2024 from €11.69 million last year, reflecting strong operational performance and high-quality earnings potential moving forward.

- Get an in-depth perspective on Paul Hartmann's performance by reading our health report here.

Examine Paul Hartmann's past performance report to understand how it has performed in the past.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

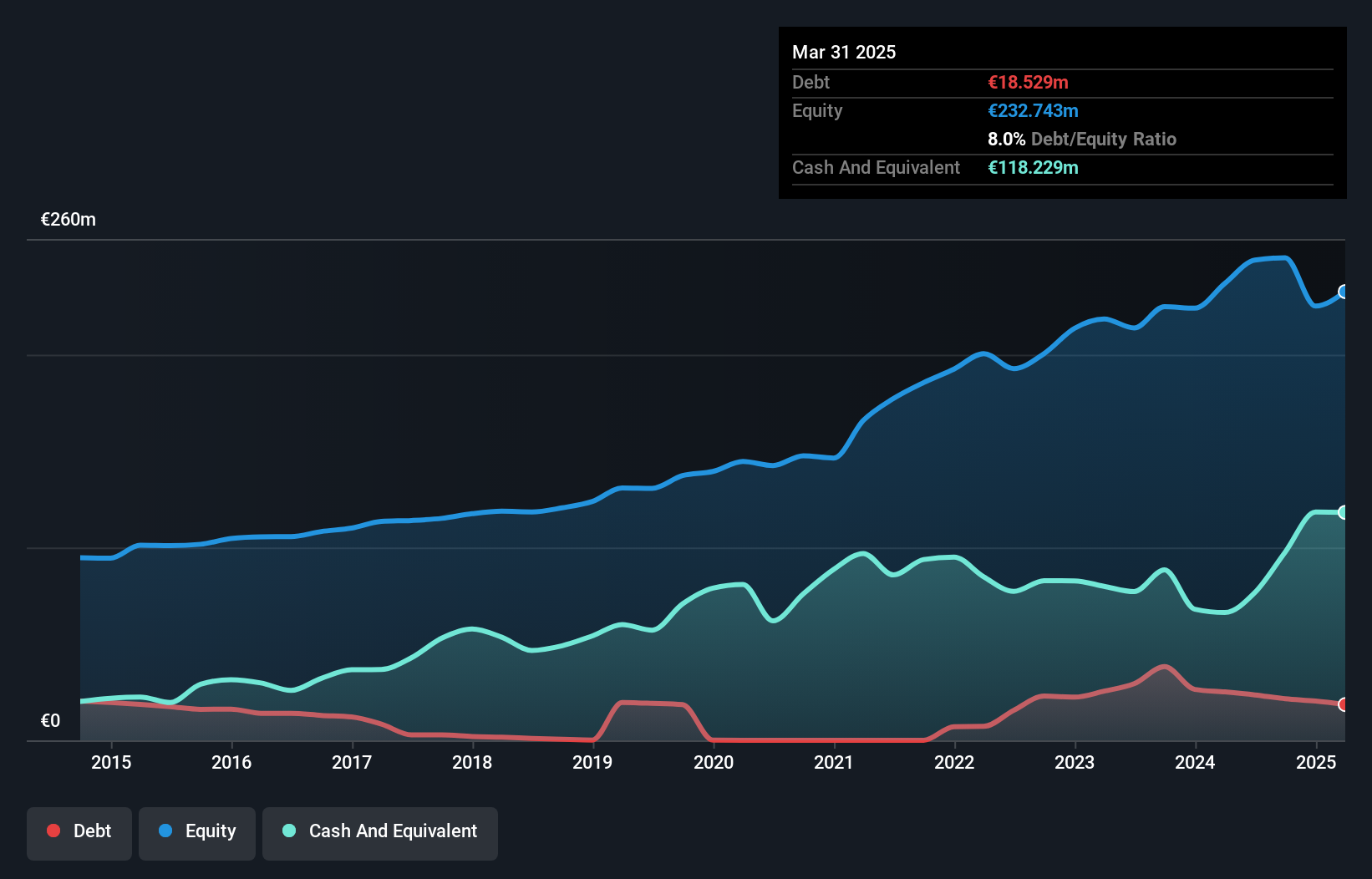

Overview: Eckert & Ziegler SE focuses on manufacturing and selling isotope technology components globally, with a market capitalization of €883.85 million.

Operations: The company generates revenue primarily from its Medical and Isotopes Products segments, with the latter contributing €150.97 million. The net profit margin is a key financial metric to consider when evaluating its profitability.

Eckert & Ziegler, a promising player in the medical equipment sector, has seen its earnings grow by 31.6% over the past year, outpacing industry growth of 16.2%. The company boasts high-quality earnings and has effectively reduced its debt-to-equity ratio from 14.7 to 9.5 over five years. Recent financials reveal significant progress with net income at €9.54 million for Q2 2024, up from €6.17 million last year, reflecting strong operational performance and value potential trading at a notable discount to fair value estimates.

- Take a closer look at Eckert & Ziegler's potential here in our health report.

Gain insights into Eckert & Ziegler's past trends and performance with our Past report.

M1 Kliniken (XTRA:M12)

Simply Wall St Value Rating: ★★★★★☆

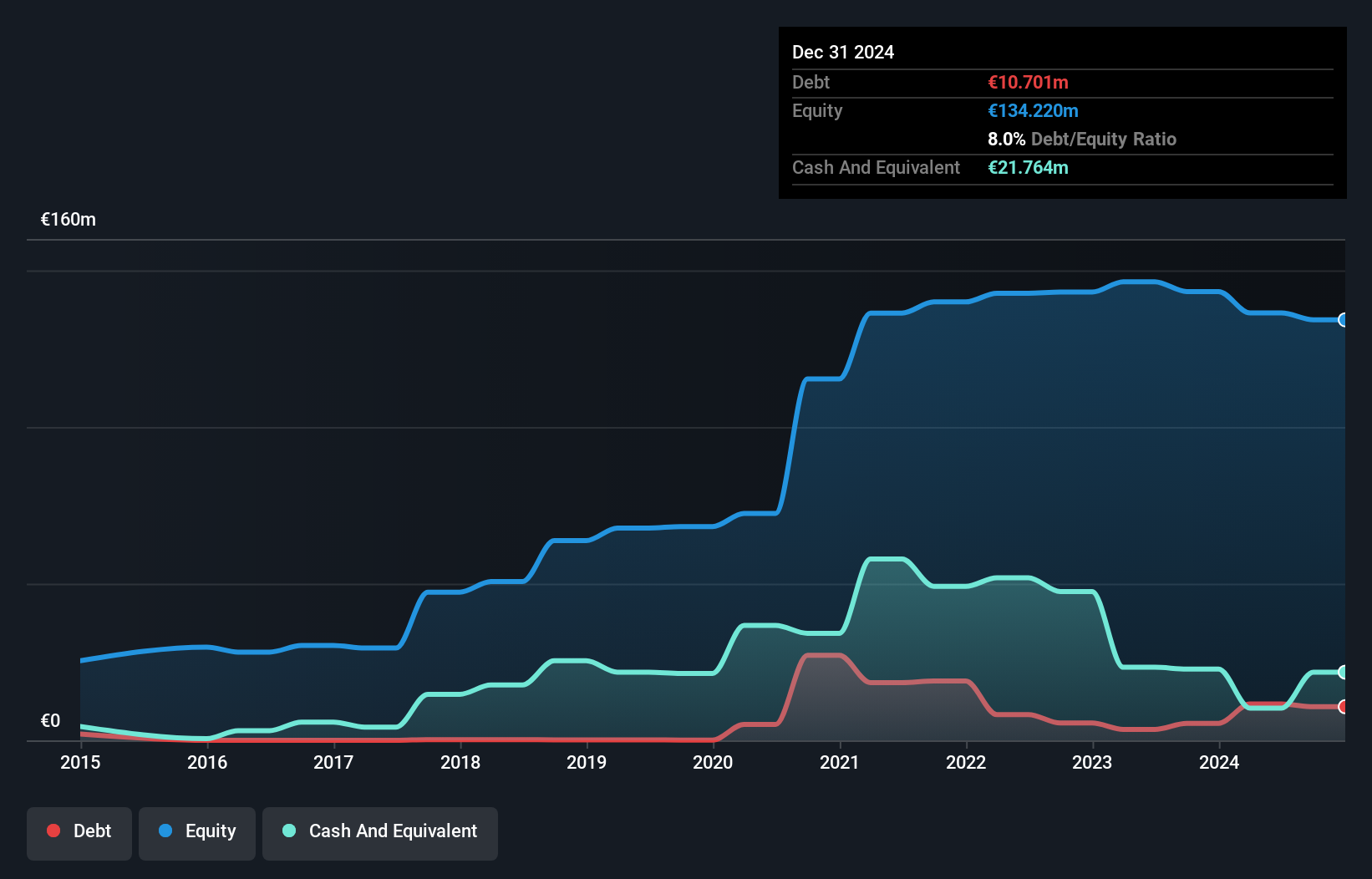

Overview: M1 Kliniken AG, along with its subsidiaries, offers aesthetic medicine and plastic surgery services across several countries including Germany, Austria, the Netherlands, Switzerland, the UK, Croatia, Hungary, Bulgaria, Romania, and Australia; it has a market cap of €323.79 million.

Operations: M1 Kliniken AG generates revenue primarily through its Trade segment (€251.09 million) and Beauty segment (€82.23 million).

M1 Kliniken, a dynamic player in the healthcare sector, reported impressive half-year sales of €167.74 million, up from €150.79 million the previous year. Net income surged to €9.9 million compared to last year's €3.42 million, reflecting strong growth with earnings per share rising to €0.53 from €0.17. Despite an increased debt-to-equity ratio of 8.5% over five years, its net debt level remains satisfactory at 1%, and it trades significantly below estimated fair value by 67%.

- Delve into the full analysis health report here for a deeper understanding of M1 Kliniken.

Explore historical data to track M1 Kliniken's performance over time in our Past section.

Turning Ideas Into Actions

- Investigate our full lineup of 53 German Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal