Discover Three Swedish Undiscovered Gems With Strong Potential

As European markets show a modest uptick, with the pan-European STOXX Europe 600 Index ending higher amid hopes for quicker interest rate cuts by the ECB, investors are increasingly looking towards smaller economies like Sweden for potential opportunities. In this context, identifying stocks that demonstrate resilience and growth potential in uncertain economic climates can be crucial for investors seeking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Creades | NA | -25.97% | -24.74% | ★★★★★★ |

| Investment AB Öresund | NA | 0.07% | 0.45% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

AQ Group (OM:AQ)

Simply Wall St Value Rating: ★★★★★★

Overview: AQ Group AB (publ) is a company that manufactures and sells components and systems for industrial customers both domestically in Sweden and internationally, with a market cap of SEK11.25 billion.

Operations: AQ Group's revenue primarily comes from its Component segment, generating SEK7.87 billion, while the System segment contributes SEK1.78 billion.

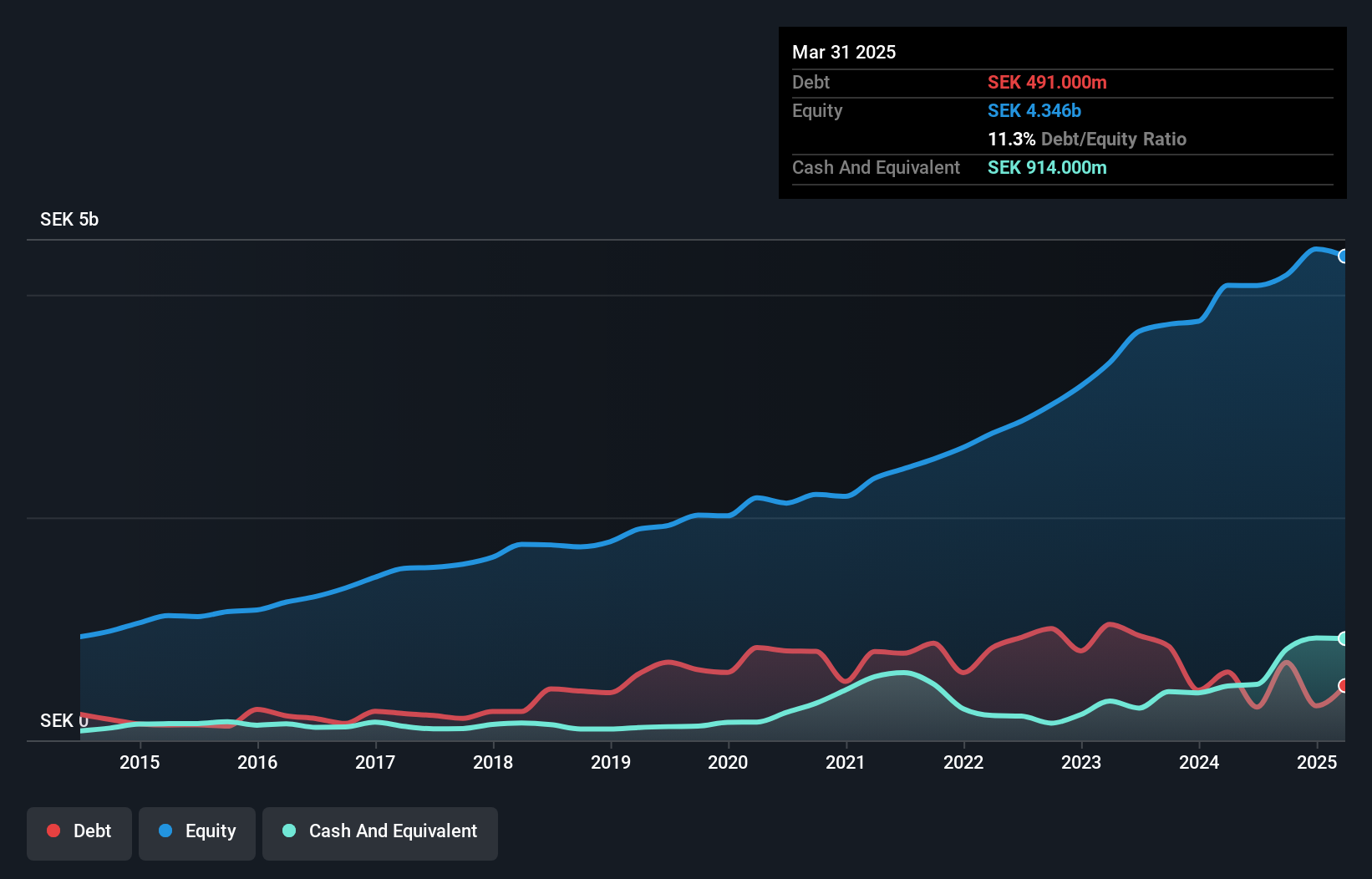

AQ Group, a notable player in Sweden's electrical industry, is gaining attention with its impressive financial metrics. The company has significantly reduced its debt to equity ratio from 36.3% to 7.3% over five years and boasts earnings growth of 19%, outpacing the industry's 2.5%. Trading at an attractive valuation of 88% below estimated fair value, AQ also benefits from high-quality earnings and strong interest coverage at 32 times EBIT. Recently added to the S&P Global BMI Index, AQ shows promising potential in its sector.

- Click here to discover the nuances of AQ Group with our detailed analytical health report.

Understand AQ Group's track record by examining our Past report.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

Overview: engcon AB (publ) is a company that designs, produces, and sells excavator tools across various international markets including Europe, the Americas, and Asia-Pacific regions, with a market cap of SEK17.12 billion.

Operations: engcon AB generates revenue primarily from its Construction Machinery & Equipment segment, amounting to SEK1.54 billion. The company's financial performance is reflected in its gross profit margin, which stands at 41.2%.

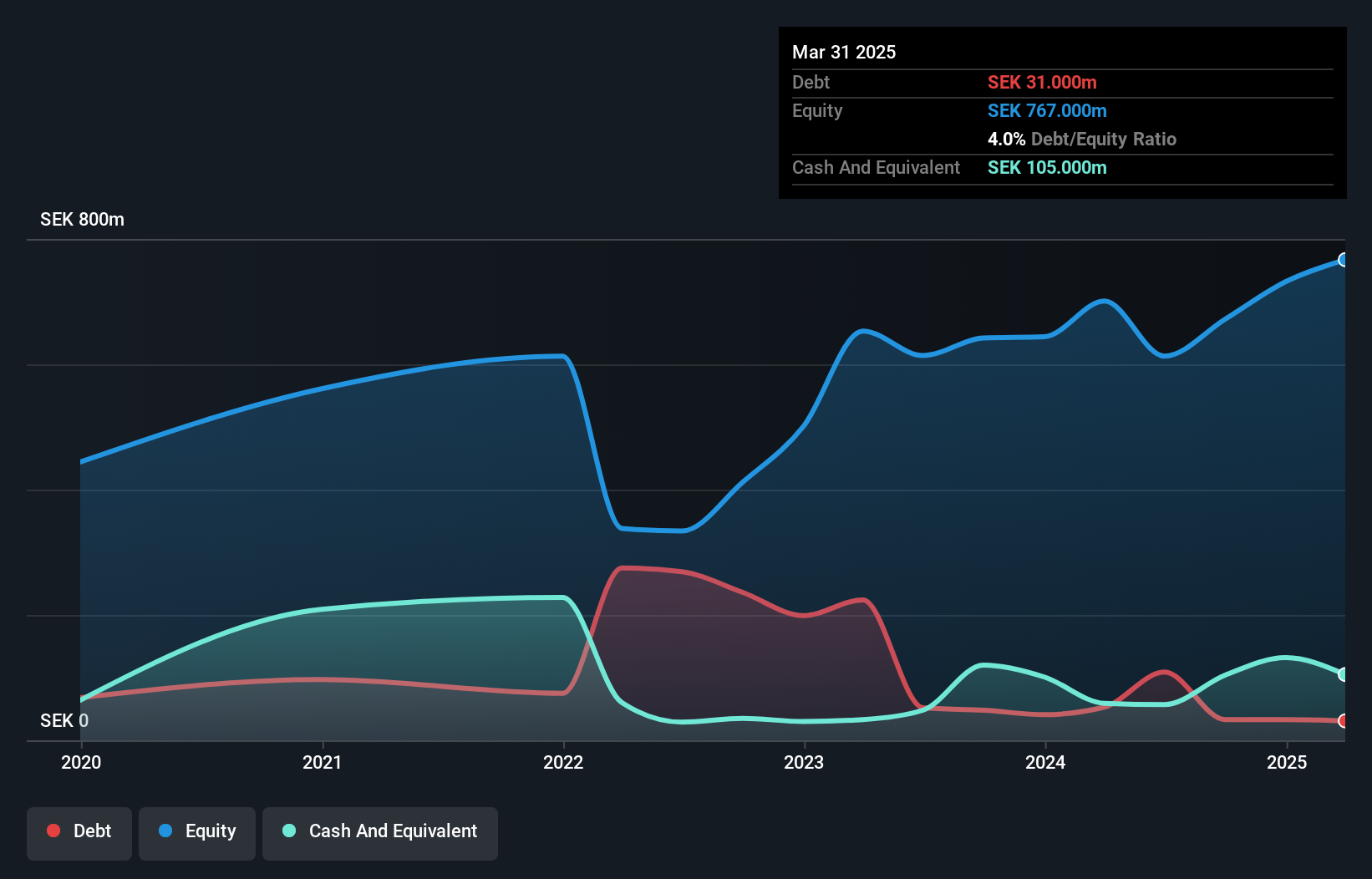

Engcon, a smaller player in the machinery sector, exhibits strong financial health with EBIT covering interest payments 20.4 times over and a satisfactory net debt to equity ratio of 8.5%. Despite high-quality earnings, recent figures show challenges; sales for Q2 2024 were SEK 450 million, down from SEK 508 million last year. Net profit margin also decreased to 9.9% from last year's 18%, indicating room for improvement as they navigate industry hurdles.

- Get an in-depth perspective on engcon's performance by reading our health report here.

Review our historical performance report to gain insights into engcon's's past performance.

Gränges (OM:GRNG)

Simply Wall St Value Rating: ★★★★★★

Overview: Gränges AB (publ) specializes in the development, production, and distribution of rolled aluminum products for thermal management systems, specialty packaging, and niche applications across Europe, Asia, and the Americas with a market cap of approximately SEK12.81 billion.

Operations: Gränges generates revenue primarily from two segments: Gränges Eurasia, contributing SEK12.26 billion, and Gränges Americas, with SEK10.84 billion.

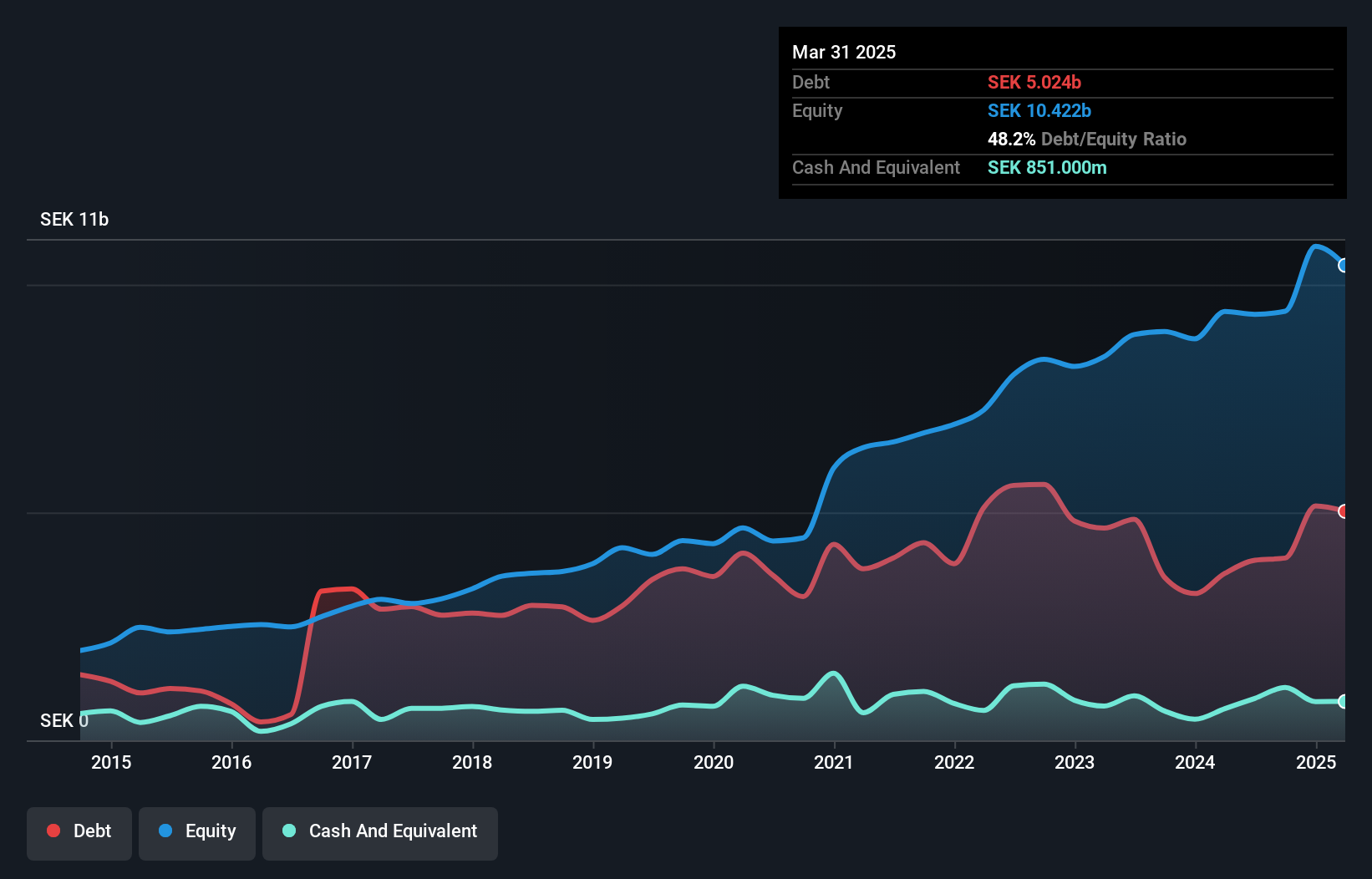

Gränges, a notable player in the metals industry, has seen its debt to equity ratio improve significantly from 86.5% to 42.3% over five years, indicating stronger financial health. Its earnings grew by 31%, outpacing the industry's growth rate of 13.7%. Trading at a substantial discount of 65.6% below estimated fair value, Gränges appears undervalued with high-quality past earnings and robust interest coverage at 6.5 times EBIT, suggesting solid operational performance and potential for future growth.

- Delve into the full analysis health report here for a deeper understanding of Gränges.

Assess Gränges' past performance with our detailed historical performance reports.

Next Steps

- Dive into all 55 of the Swedish Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal