Fagerhult Group And 2 Other Leading Dividend Stocks On Nasdaq Stockholm

As European markets show signs of optimism with the STOXX Europe 600 Index rising amid hopes for quicker interest rate cuts, investors in Sweden are keenly observing how these broader economic trends might impact local dividend stocks. In this context, understanding what makes a strong dividend stock is crucial; typically, these are companies with stable earnings and a history of consistent payouts, which can offer a measure of reliability even amidst fluctuating market conditions.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.69% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 3.87% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.15% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.02% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.60% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.84% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 5.00% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.96% | ★★★★☆☆ |

| Afry (OM:AFRY) | 3.04% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.86% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top Swedish Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

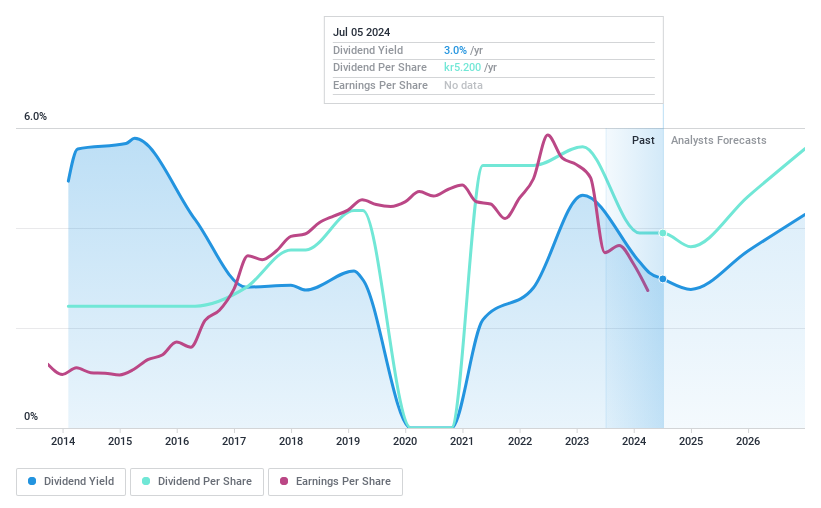

Fagerhult Group (OM:FAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fagerhult Group AB, with a market cap of SEK10.58 billion, manufactures and sells professional lighting solutions globally through its subsidiaries.

Operations: Fagerhult Group AB generates revenue from its segments as follows: Premium (SEK2.93 billion), Collection (SEK3.93 billion), Infrastructure (SEK894 million), and Professional excluding Lighting Innovations (SEK1.08 billion).

Dividend Yield: 3%

Fagerhult Group's dividend payments have been volatile and unreliable over the past decade, despite some growth. The company's payout ratio of 61.8% indicates dividends are covered by earnings, while a cash payout ratio of 39.1% suggests strong coverage by cash flows. However, its dividend yield is lower than the top quartile in Sweden at 3%. Recent earnings reports show mixed results with slight declines in net income compared to last year.

- Get an in-depth perspective on Fagerhult Group's performance by reading our dividend report here.

- According our valuation report, there's an indication that Fagerhult Group's share price might be on the cheaper side.

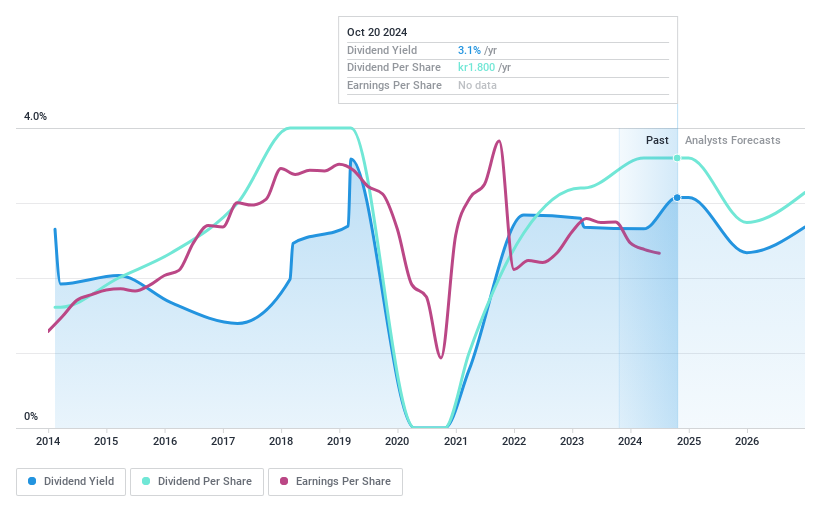

Knowit (OM:KNOW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Knowit AB (publ) is a consultancy company that specializes in developing digital solutions, with a market cap of SEK4.18 billion.

Operations: Knowit AB's revenue is derived from four main segments: Solutions (SEK3.90 billion), Experience (SEK1.44 billion), Connectivity (SEK1.02 billion), and Insight (SEK898.95 million).

Dividend Yield: 3.4%

Knowit's dividend payments have been volatile over the past decade, although they have shown some growth. The payout ratio of 77.3% indicates dividends are covered by earnings, and a cash payout ratio of 41.6% suggests solid coverage by cash flows. However, its dividend yield of 3.4% is below the top quartile in Sweden. Recent earnings reports reveal declines in both revenue and net income compared to last year, which may impact future dividend stability.

- Unlock comprehensive insights into our analysis of Knowit stock in this dividend report.

- Upon reviewing our latest valuation report, Knowit's share price might be too pessimistic.

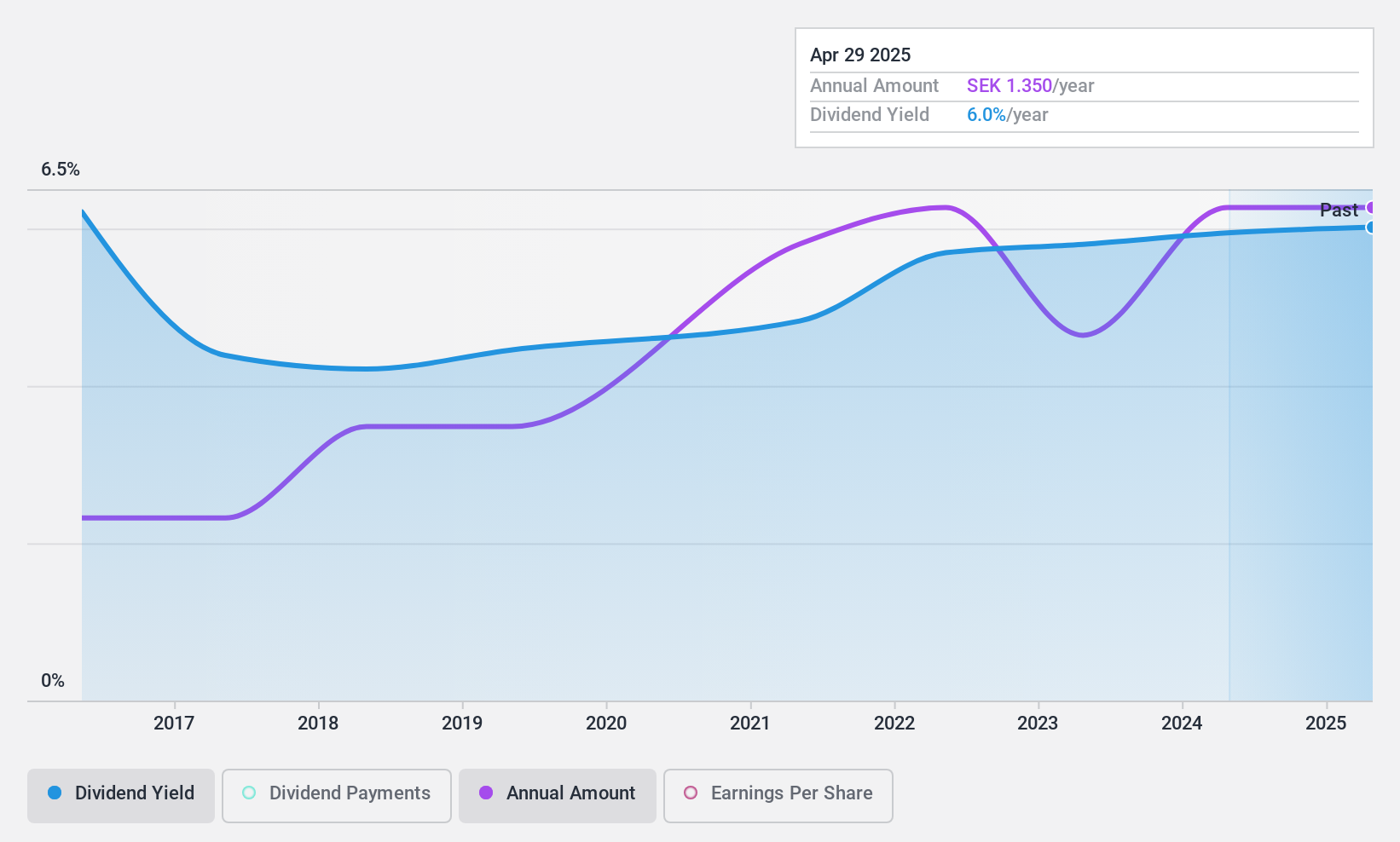

Softronic (OM:SOF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Softronic AB (publ) offers IT and management services mainly in Sweden, with a market cap of SEK1.16 billion.

Operations: Softronic AB generates revenue primarily from its Computer Services segment, amounting to SEK838.92 million.

Dividend Yield: 6.1%

Softronic's dividend yield of 6.11% ranks among the top 25% in Sweden, but its high cash payout ratio of 94.5% raises concerns about sustainability despite earnings coverage at an 85.5% payout ratio. Recent earnings show modest growth, with Q2 net income rising to SEK 14.6 million from SEK 13.5 million the previous year; however, revenue growth remains minimal. While dividends have grown over a decade, their volatility suggests unreliability for consistent income seekers.

- Dive into the specifics of Softronic here with our thorough dividend report.

- Our valuation report unveils the possibility Softronic's shares may be trading at a premium.

Make It Happen

- Unlock our comprehensive list of 23 Top Swedish Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal