3 Indian Stocks Estimated To Be 24.7% To 47.7% Below Intrinsic Value

Over the last 7 days, the Indian market has remained flat, yet it has experienced a remarkable 40% increase over the past year with earnings forecasted to grow by 17% annually. In this context of robust growth potential and recent stability, identifying stocks that are trading below their intrinsic value can offer promising opportunities for investors seeking to capitalize on future gains.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1120.60 | ₹2143.87 | 47.7% |

| RITES (NSEI:RITES) | ₹308.75 | ₹517.42 | 40.3% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹428.45 | ₹762.32 | 43.8% |

| Vedanta (NSEI:VEDL) | ₹499.15 | ₹904.00 | 44.8% |

| Patel Engineering (BSE:531120) | ₹54.10 | ₹91.61 | 40.9% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1364.85 | ₹2142.32 | 36.3% |

| Artemis Medicare Services (NSEI:ARTEMISMED) | ₹285.25 | ₹445.15 | 35.9% |

| Tarsons Products (NSEI:TARSONS) | ₹418.20 | ₹707.69 | 40.9% |

| Manorama Industries (BSE:541974) | ₹942.45 | ₹1665.51 | 43.4% |

| Strides Pharma Science (NSEI:STAR) | ₹1566.15 | ₹2704.30 | 42.1% |

We'll examine a selection from our screener results.

Kalpataru Projects International (NSEI:KPIL)

Overview: Kalpataru Projects International Limited offers engineering, procurement, and construction services across various sectors including power transmission and distribution, buildings and factories, water, railways, oil and gas, and urban infrastructure both in India and globally; the company has a market cap of ₹211.18 billion.

Operations: The company's revenue primarily comes from its Engineering, Procurement and Construction (EPC) segment, which accounts for ₹194.92 billion, followed by Development Projects contributing ₹2.81 billion.

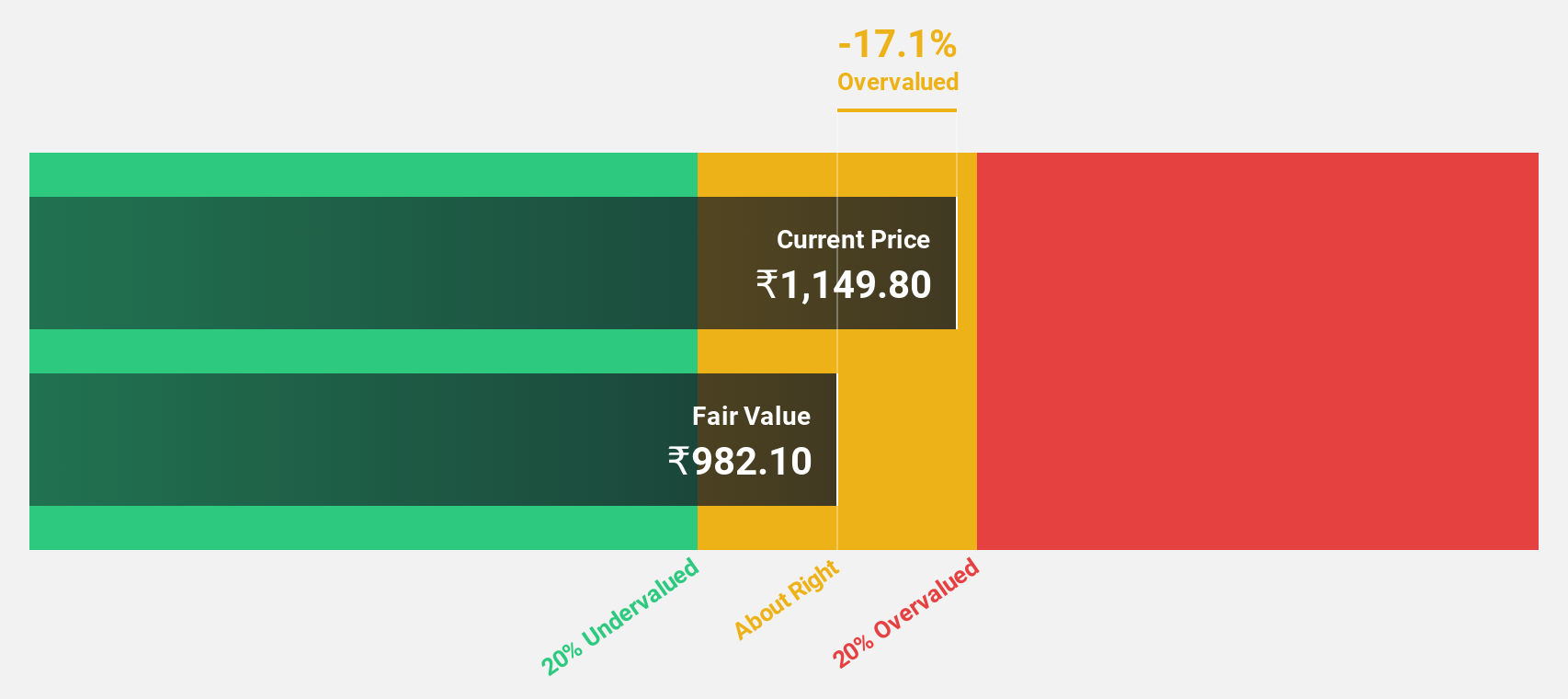

Estimated Discount To Fair Value: 24.7%

Kalpataru Projects International is trading at ₹1300, significantly below its estimated fair value of ₹1726.76, suggesting potential undervaluation based on cash flows. Despite a low forecasted Return on Equity of 17.1%, the company anticipates robust earnings growth of 29.5% annually, outpacing the Indian market's projected growth rate. Recent order wins totaling ₹40.15 billion bolster revenue prospects, though ongoing GST-related regulatory challenges could pose risks to financial performance stability.

- Insights from our recent growth report point to a promising forecast for Kalpataru Projects International's business outlook.

- Click here to discover the nuances of Kalpataru Projects International with our detailed financial health report.

Strides Pharma Science (NSEI:STAR)

Overview: Strides Pharma Science Limited develops, manufactures, and sells pharmaceutical products across various regions including Africa, Australia, North America, Europe, Asia, and India with a market cap of ₹144.02 billion.

Operations: The company's revenue from the Pharmaceutical Business (excluding the Bio-Pharmaceutical Business) amounts to ₹42.09 billion.

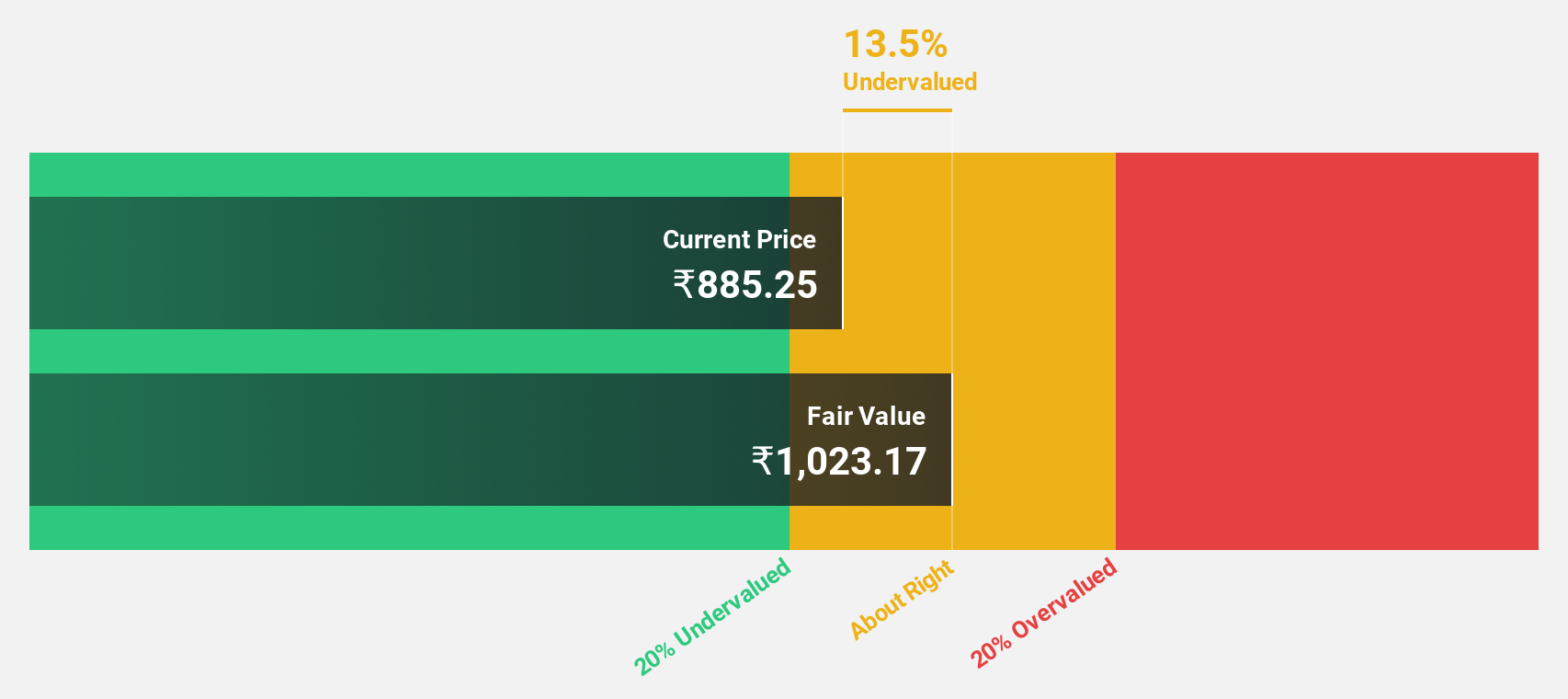

Estimated Discount To Fair Value: 42.1%

Strides Pharma Science, trading at ₹1566.15, is significantly below its estimated fair value of ₹2704.3, indicating potential undervaluation based on cash flows. The company expects earnings to grow substantially at 99.48% annually and aims to become profitable within three years, outpacing market growth rates. Recent debt reduction efforts have decreased outstanding non-convertible debentures to ₹242 million, improving financial stability despite slower revenue growth forecasts compared to the broader Indian market.

- Our comprehensive growth report raises the possibility that Strides Pharma Science is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Strides Pharma Science's balance sheet health report.

Titagarh Rail Systems (NSEI:TITAGARH)

Overview: Titagarh Rail Systems Limited manufactures and sells freight and passenger rail systems both in India and internationally, with a market cap of ₹150.92 billion.

Operations: The company's revenue segments include Passenger Rail Systems generating ₹3.32 billion and Freight Rail Systems (including shipbuilding, bridges, and defense) contributing ₹35.14 billion.

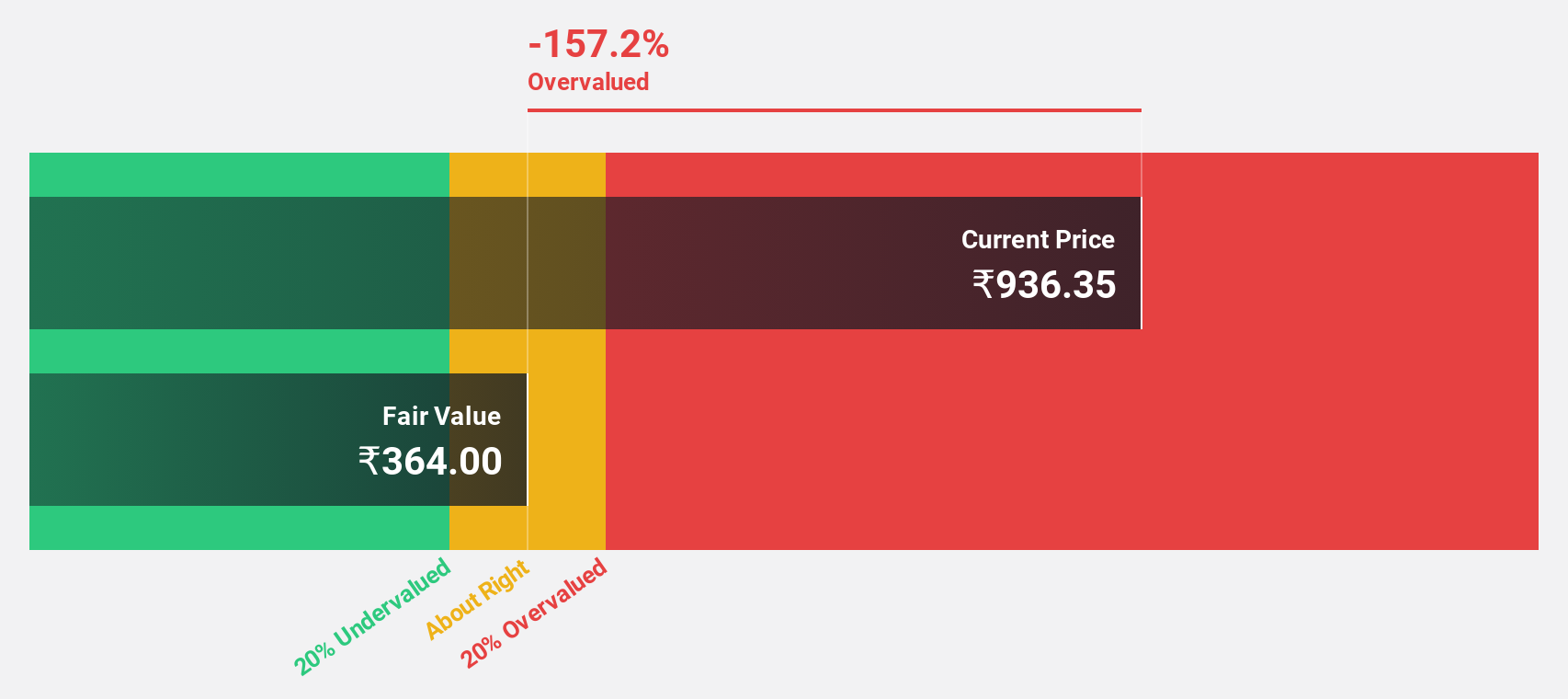

Estimated Discount To Fair Value: 47.7%

Titagarh Rail Systems, currently priced at ₹1120.6, is trading significantly below its estimated fair value of ₹2143.87, reflecting potential undervaluation based on cash flows. The company anticipates annual earnings growth of 30.1%, surpassing the Indian market's rate of 17.3%. Despite recent order adjustments with Indian Railways, Titagarh's revenue is forecast to grow by 25.7% per year, indicating robust future prospects amidst operational challenges and strategic realignments.

- In light of our recent growth report, it seems possible that Titagarh Rail Systems' financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Titagarh Rail Systems stock in this financial health report.

Where To Now?

- Dive into all 26 of the Undervalued Indian Stocks Based On Cash Flows we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal