Golden Ten Data Global Finance Breakfast | October 15, 2024

Mandarin version for boys download mp3

Female voice Mandarin version download mp3

Cantonese version download mp3

Southwestern dialect version download mp3

Northeast dialect version download mp3

Shanghai dialect version download mp3

Today's Top Picks

Waller: The Federal Reserve should be more cautious in cutting interest rates than during the September meeting

For the third month in a row, OPEC lowered its forecast for global oil demand growth this year and next two years

Netanyahu: Israel will attack Iran's military targets, not nuclear facilities or oil targets

Iran: If Israel's response is limited, the round of clashes between the two countries will be considered over

China's broad currency balance increased 6.8% year on year

Xinhua decoded: The scale of the fiscal incremental policy may be above 2.2 trillion yuan

The photovoltaic industry reached a consensus on “strengthening industry self-discipline and preventing 'internal rolling' vicious competition”

The Eastern War Zone successfully completed the “United Sword — 2024B” exercise

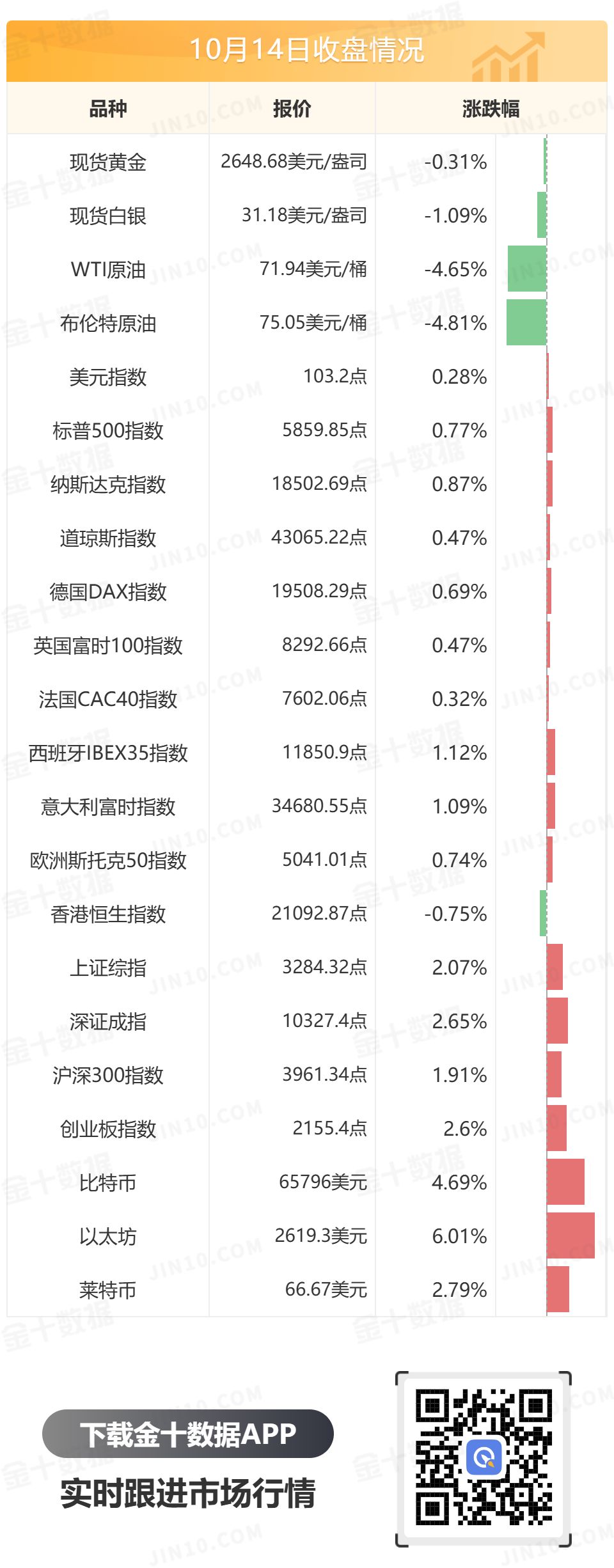

Market inventory

On Monday, as data showed that the US economy was only moderately slowing, in line with the Fed's bet to cut interest rates moderately, the US dollar index hit a 10-week high, continuing its bullish trend for several weeks, and finally closed up 0.28% to 103.20. The benchmark 10-year US Treasury yield closed at 4.1050%; the two-year US Treasury yield, which is more sensitive to monetary policy, closed at 3.9660% .

Due to the continued strengthening of the US dollar index, spot gold continued to recover and eventually closed down 0.31% to $2648.68 per ounce. Spot silver ended up falling 1.09% to 31.18 US dollars/ounce.

As Israeli Prime Minister Binyamin Netanyahu told the US that Israel would attack Iran's military targets, not nuclear facilities or oil targets, international oil prices plummeted by more than 4%. WTI crude oil ended up falling 4.65% to 71.94 US dollars/barrel; Brent crude oil closed down 4.81% to 75.05 US dollars/barrel.

The US stock Dow closed up 0.47% and the S&P 500 index rose 0.78%, all of which hit new closing highs. The NASDAQ rose 0.87%. Nvidia (NVDA.O) rose 2.4%, close to a record high, and Apple (AAPL.O) rose 1.6%. The Nasdaq China Golden Dragon Index closed down 2%, Alibaba (BABA.N) fell 2%, Xiaopeng Motors (XPEV.N) fell nearly 10%, and BILI.O (BILI.O) fell more than 3%.

Major European stock indices closed higher across the board. The German DAX30 Index closed up 0.69%; the UK FTSE 100 Index closed up 0.47%; and the European Stoxx 50 Index closed up 0.74%.

The Hong Kong stock Hang Seng Index briefly turned red in the afternoon, and the trend bottomed out and rebounded throughout the day. The Hang Seng Technology Index fell more than 4.5% during the early trading session, while the Hang Seng Index fell more than 2.5% at one point. By the close, Hong Kong's Hang Seng Index closed down 0.75% and the Hang Seng Technology Index closed down 1.43%; the Hang Seng Index had a market turnover of HK$277.073 billion, with a net inflow of southbound capital of HK$12.17 billion on the same day. In terms of individual stocks, sectors such as gold, domestic bank stocks, and real estate stocks bucked the trend; sectors such as pharmaceuticals, automobiles, semiconductors, and Chinese brokerage firms had the highest declines; SMIC (00981.HK) rose more than 4%; Oriental Selection (01797.HK) and Cathay Pacific Junan (02611.HK) fell more than 8%, Shangtang (00020.HK) fell more than 6%, and Xiaopeng Motor (09868.HK) and Meituan (03690.HK) fell more than 5%.

The three major A-share indices fluctuated upward. By the close, the Shanghai Index was up 2.07%, the Shenzhen Stock Exchange Index was up 2.65%, and the GEM Index was up 2.6%. On the market, the sector generally rose, with the Huawei Hongmeng concept rising and falling; more than 10 individual stocks such as Runhe Software and Softcom Power rose and stopped; AMC concepts were active throughout the day, and Yuxin Technology and others rose and stopped; sectors such as diversified finance, aviation, real estate, and semiconductors registered the highest gains. About 4,800 individual stocks rose in the two markets, with a total turnover of over 1.6 trillion yuan.

International highlights

1. Federal Reserve Governor Waller: The Federal Reserve should be more cautious in cutting interest rates than during the September meeting. If inflation falls below 2%, which is unlikely, or if the labor market deteriorates, the Federal Reserve can cut interest rates early. If inflation unexpectedly rises, the Federal Reserve may suspend interest rate cuts.

2. Federal Reserve Kashkari: Further “moderate” interest rate cuts seem appropriate.

3. Washington Post: Israeli Prime Minister Binyamin Netanyahu told the US that Israel will attack Iran's military targets, not nuclear facilities or oil targets.

4. The EU Foreign Ministers Meeting passed a resolution deciding to impose sanctions on Iran on the grounds that “Iran supplies ballistic missiles to Russia to attack Ukraine.”

5. Iran conveyed news to Israel through secret channels that if Israel's response to Iran's attack was limited, Iran would consider this round of confrontation between the two countries to be over.

6. On October 14, local time, Kim Jong-un, general secretary of the Workers' Party of Korea and chairman of the State Council, presided over a national defense and security conference. After listening to reports from the General Staff on the implementation of relevant work and preparations for mobilizing major coalition forces, Kim Jong-un indicated the current direction of military activities and proposed tasks in activating national defense forces and exercising the right to self-defense to safeguard the country's sovereignty and security interests. Kim Jong-un clarified the tough military and political positions of the North Korean Party and government at the meeting.

7. The 2024 Nobel Prize in Economics was awarded to Daron Acemoglu, Simon Johnson, James A, and Robinson in recognition of their research on “how institutions form and influence prosperity.”

8. For the third month in a row, OPEC lowered the global oil demand growth forecast for this year and next two years.

9. India and Canada expel diplomats from each other.

Domestic highlights

1. Central Bank: The increase in the scale of social financing in January-September was 25.66 trillion yuan, 3.68 trillion yuan less than the same period last year. At the end of September, the broad currency (M2) balance was 309.48 trillion yuan, up 6.8% year on year. China's RMB loans increased by 16 trillion yuan in the first three quarters, of which household loans increased by 1.94 trillion yuan.

2. Decoded by Xinhua: The fiscal incremental policy is coming soon, and the scale may be above 2.2 trillion yuan.

3. Li Qiang and Vietnamese Prime Minister Pham Ming Zheng attended a symposium of Chinese and Vietnamese business representatives.

4. According to customs statistics, in the first three quarters of this year, China's imports and exports of goods trade amounted to 32.33 trillion yuan, an increase of 5.3% over the previous year.

5. The Beijing Stock Exchange recently guided the industry on how to disclose and verify information on the innovative characteristics of companies to be listed.

6. The photovoltaic industry reached a consensus on “strengthening industry self-discipline and preventing 'internal rolling' vicious competition”.

7. The Eastern War Zone successfully completed the “United Sword — 2024B” exercise.

8. The Fujian Maritime Police Force carried out comprehensive law enforcement inspections in the waters near Dongyin Island and Matsu Island.

Risk warning

☆ At 20:30, the US announced the New York Federal Reserve Manufacturing Index for October. The market expected value was 3.6, and the previous value was 11.5;

☆ At 23:00, the US announced the New York Federal Reserve's 1-year inflation forecast for September. The previous value was 3.00%;

☆ At the same time, the 2024 FOMC voting committee and San Francisco Federal Reserve Chairman Daly delivered a speech and attended a dialogue session at an event hosted by NYU Stern School of Business;

☆ At 01:00 the next day, Federal Reserve Governor Kugler delivered a speech.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal