Three Hidden Chinese Stocks With Promising Potential

As Chinese equities recently experienced a decline amid fading optimism about Beijing's stimulus measures, the Shanghai Composite Index and the CSI 300 both saw significant losses. In this context, identifying promising stocks within such a dynamic market requires careful consideration of companies that demonstrate resilience and potential for growth despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Changsha Tongcheng HoldingsLtd | 8.27% | -12.36% | -6.10% | ★★★★★★ |

| Shanghai Chlor-Alkali Chemical | 7.56% | 3.92% | 3.37% | ★★★★★★ |

| Shandong Sinoglory Health Food | 1.96% | -5.12% | 9.16% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 30.34% | 9.84% | -2.45% | ★★★★★☆ |

| Guangdong Delian Group | 29.25% | 8.50% | -28.27% | ★★★★★☆ |

| Shenzhen Longtech Smart Control | 3.15% | 11.65% | 17.16% | ★★★★★☆ |

| Qijing Machinery | 46.41% | 3.46% | -1.40% | ★★★★★☆ |

| Haimo Technologies Group | 39.19% | 2.21% | 24.33% | ★★★★★☆ |

| Shanghai Feilo AcousticsLtd | 36.01% | -17.85% | 55.43% | ★★★★☆☆ |

| Suzhou Chunqiu Electronic Technology | 52.50% | 9.15% | -17.36% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shenzhen Forms Syntron InformationLtd (SZSE:300468)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Forms Syntron Information Ltd (SZSE:300468) specializes in providing software and information services, with a market cap of CN¥11.84 billion.

Operations: The company generates revenue primarily from its software and information services segment, amounting to CN¥725.52 million.

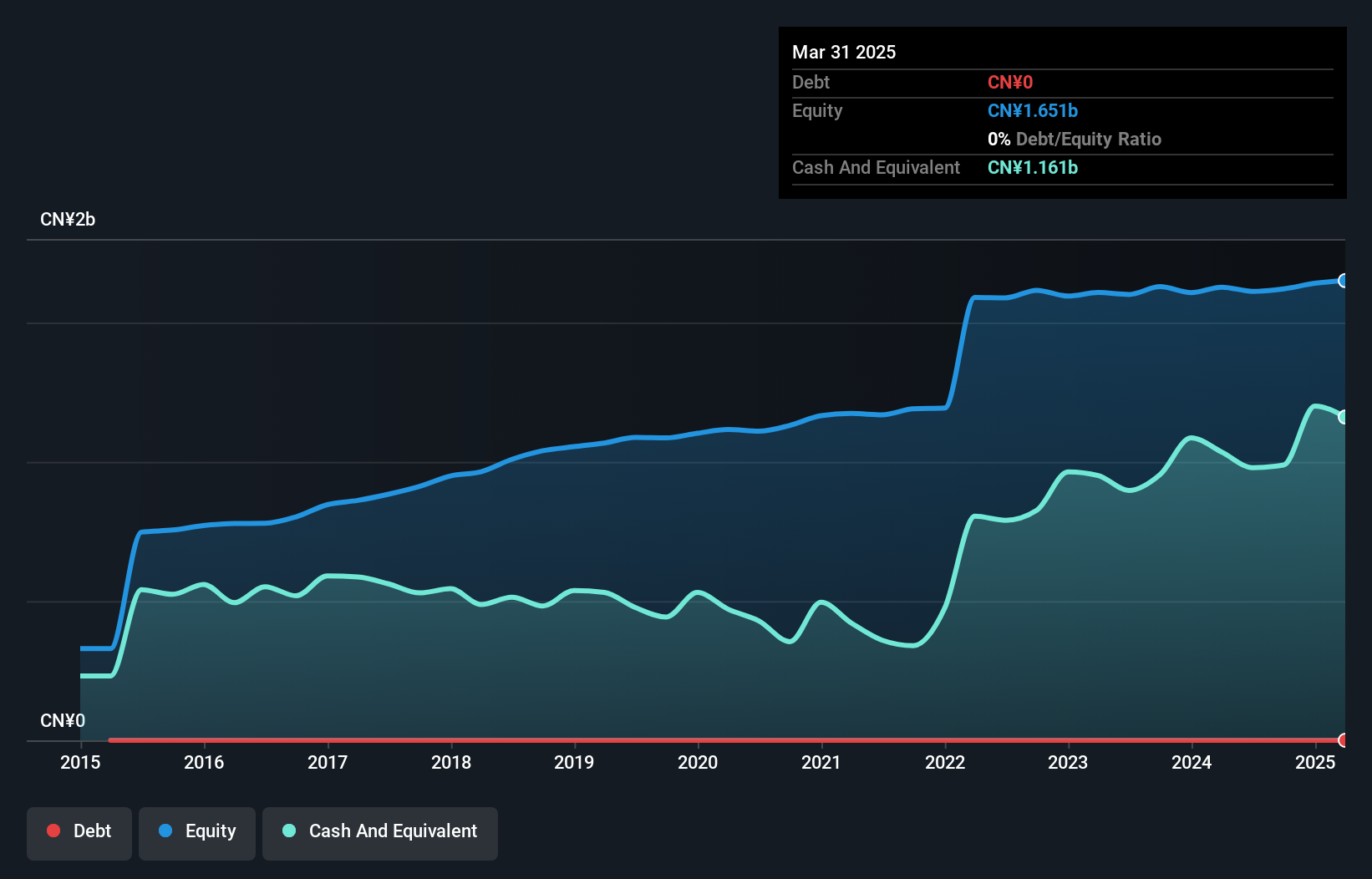

Shenzhen Forms Syntron showcases a compelling profile with no debt over the past five years, reflecting strong financial discipline. The company reported CNY 36.8 million in net income for the half-year ending June 2024, slightly up from CNY 35.44 million the previous year, and earnings per share rose to CNY 0.0694 from CNY 0.0668. Despite a volatile share price recently, its earnings growth of 12% last year outpaced the IT industry average by a significant margin, suggesting resilience in challenging market conditions.

Shenyu Communication Technology (SZSE:300563)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenyu Communication Technology Inc. focuses on the research, development, production, and sale of radio frequency coaxial cables in China with a market capitalization of CN¥10.02 billion.

Operations: Shenyu Communication Technology generates revenue primarily from the production and sales of coaxial cable products, amounting to CN¥816.30 million.

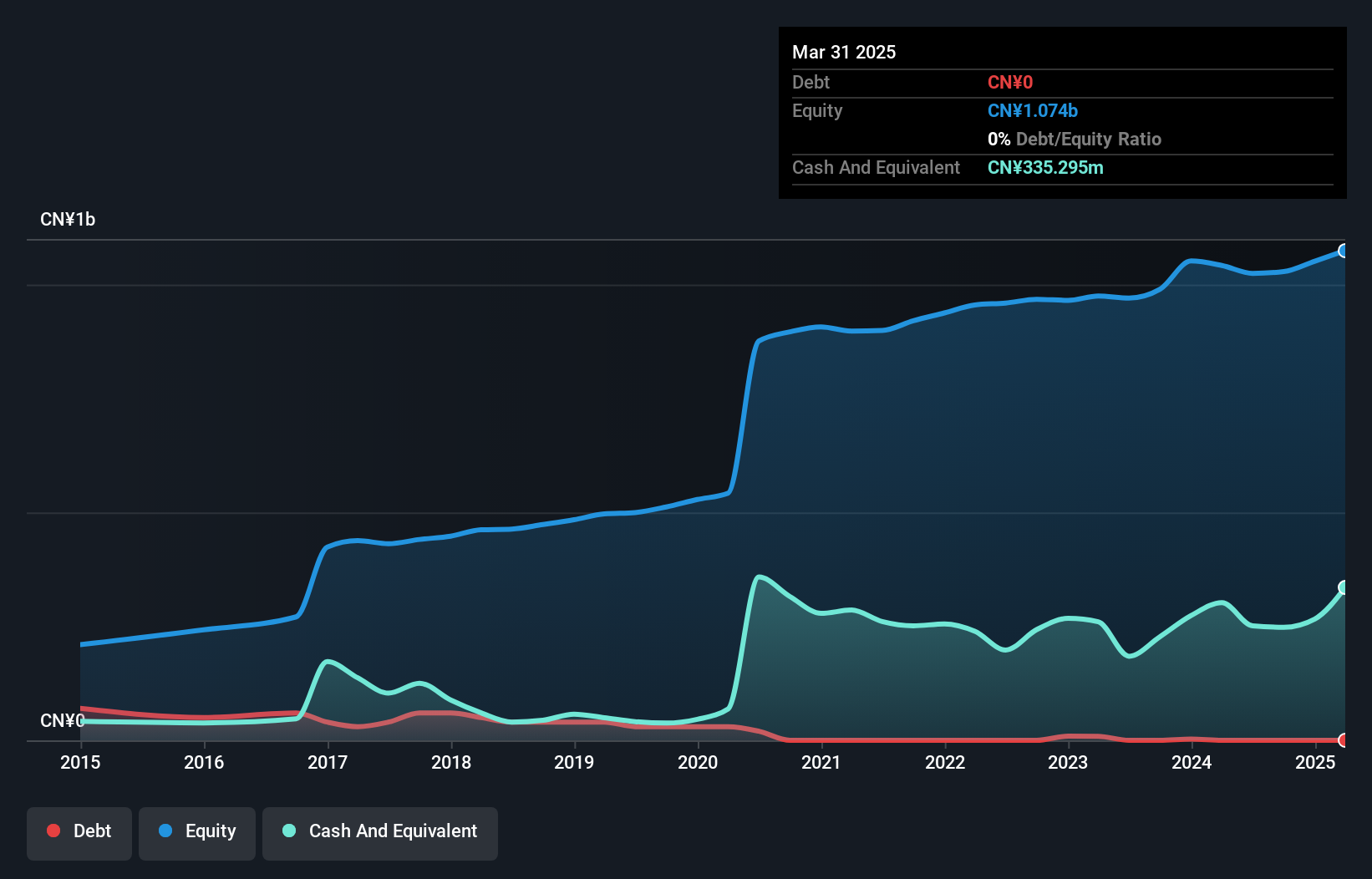

Shenyu Communication Technology, a nimble player in its sector, has shown impressive earnings growth of 226.8% over the past year, outpacing industry averages. Its net income for the first half of 2024 reached CNY 57.21 million, up from CNY 20.79 million the previous year, with basic earnings per share climbing to CNY 0.32 from CNY 0.12. The company is debt-free and recently affirmed a cash dividend of CNY 0.70 per ten shares for its A shares, reflecting robust financial health despite recent share price volatility.

Shenzhen Farben Information TechnologyLtd (SZSE:300925)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Farben Information Technology Co., Ltd. operates in the technology sector and has a market capitalization of CN¥12.57 billion.

Operations: Farben Information Technology generates revenue primarily from its technology-related services and products. The company's gross profit margin is notable, standing at 47.5%, indicating a strong ability to manage production costs relative to sales.

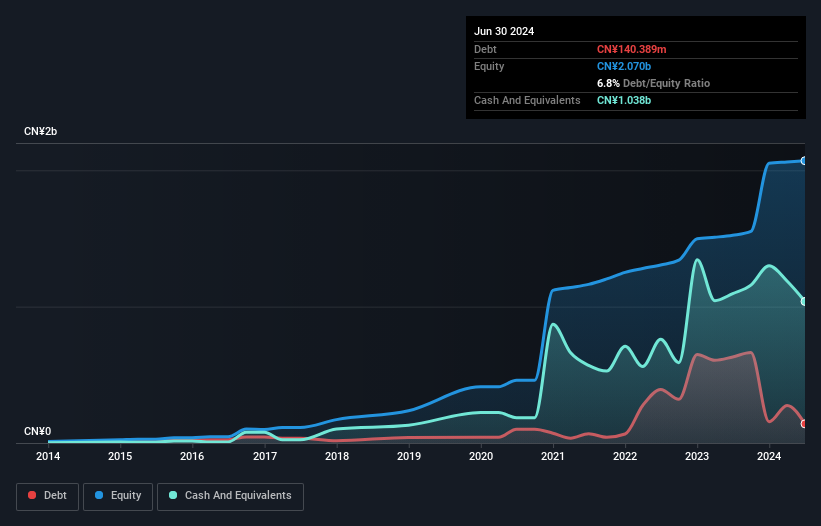

Shenzhen Farben Information Technology, a smaller player in the tech industry, has shown resilience with earnings growth of 4.9% over the past year, outpacing the IT sector's -11.5%. The company reported half-year sales of CNY 2.09 billion and net income of CNY 73.96 million, reflecting steady progress from last year's figures. With a reduced debt-to-equity ratio from 12.7% to 6.8% over five years and positive free cash flow at CNY 64.89 million as of October 2024, it seems financially sound despite recent share price volatility and shareholder dilution concerns earlier this year.

Summing It All Up

- Explore the 897 names from our Chinese Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal