China GlazeLtd (TWSE:1809) shareholders are still up 80% over 5 years despite pulling back 13% in the past week

China Glaze Co.,Ltd. (TWSE:1809) shareholders might be concerned after seeing the share price drop 22% in the last quarter. On the bright side the share price is up over the last half decade. Unfortunately its return of 66% is below the market return of 143%.

Although China GlazeLtd has shed NT$509m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for China GlazeLtd

We don't think that China GlazeLtd's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

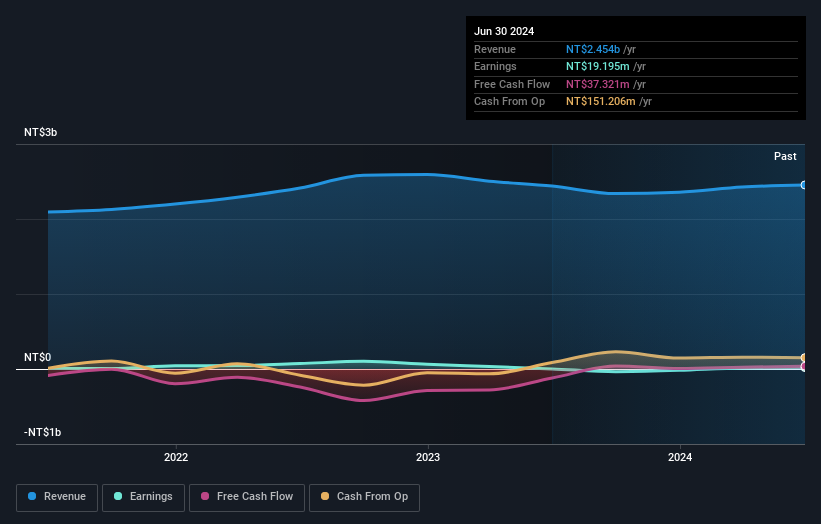

In the last 5 years China GlazeLtd saw its revenue grow at 3.4% per year. That's not a very high growth rate considering the bottom line. It's probably fair to say that the modest growth is reflected in the modest share price gain of 11% per year. It seems likely that we'll have to zoom in on the data, including profits, to understand if there is an opportunity here.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling China GlazeLtd stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, China GlazeLtd's TSR for the last 5 years was 80%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that China GlazeLtd has rewarded shareholders with a total shareholder return of 49% in the last twelve months. And that does include the dividend. That's better than the annualised return of 13% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You could get a better understanding of China GlazeLtd's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like China GlazeLtd better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal