Why Investors Shouldn't Be Surprised By China Leadshine Technology Co., Ltd.'s (SZSE:002979) 34% Share Price Surge

The China Leadshine Technology Co., Ltd. (SZSE:002979) share price has done very well over the last month, posting an excellent gain of 34%. The last 30 days bring the annual gain to a very sharp 39%.

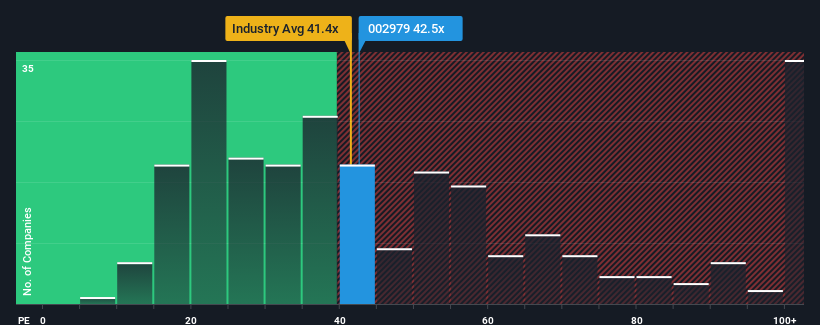

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 31x, you may consider China Leadshine Technology as a stock to potentially avoid with its 42.5x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

China Leadshine Technology certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for China Leadshine Technology

Is There Enough Growth For China Leadshine Technology?

China Leadshine Technology's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with earnings down 14% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 48% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 37% growth forecast for the broader market.

In light of this, it's understandable that China Leadshine Technology's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From China Leadshine Technology's P/E?

China Leadshine Technology's P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of China Leadshine Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for China Leadshine Technology with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on China Leadshine Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal