Shanghai Junshi Biosciences Co., Ltd.'s (HKG:1877) Price Is Right But Growth Is Lacking After Shares Rocket 35%

Shanghai Junshi Biosciences Co., Ltd. (HKG:1877) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

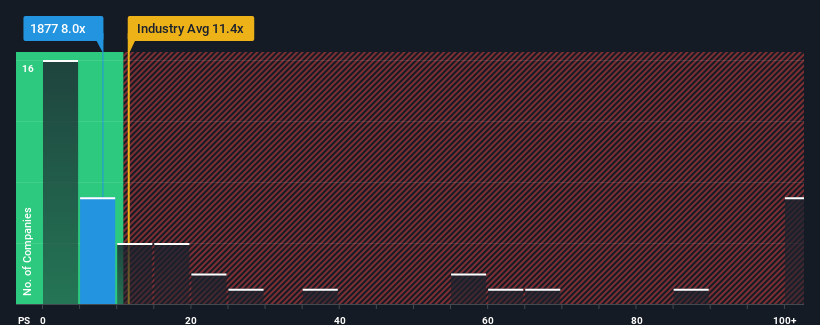

In spite of the firm bounce in price, Shanghai Junshi Biosciences may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 8x, since almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios greater than 11.4x and even P/S higher than 58x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Shanghai Junshi Biosciences

What Does Shanghai Junshi Biosciences' Recent Performance Look Like?

Shanghai Junshi Biosciences could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai Junshi Biosciences.How Is Shanghai Junshi Biosciences' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shanghai Junshi Biosciences' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 38% gain to the company's top line. Still, revenue has fallen 48% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 31% as estimated by the two analysts watching the company. With the industry predicted to deliver 84% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Shanghai Junshi Biosciences' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Despite Shanghai Junshi Biosciences' share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Shanghai Junshi Biosciences' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Shanghai Junshi Biosciences you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal