Further Upside For Bichamp Cutting Technology (Hunan) Co., Ltd. (SZSE:002843) Shares Could Introduce Price Risks After 39% Bounce

The Bichamp Cutting Technology (Hunan) Co., Ltd. (SZSE:002843) share price has done very well over the last month, posting an excellent gain of 39%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 28% over that time.

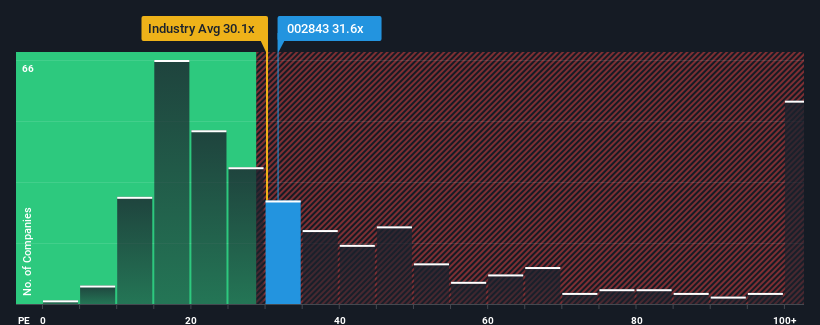

Although its price has surged higher, there still wouldn't be many who think Bichamp Cutting Technology (Hunan)'s price-to-earnings (or "P/E") ratio of 31.6x is worth a mention when the median P/E in China is similar at about 31x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Bichamp Cutting Technology (Hunan) has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Bichamp Cutting Technology (Hunan)

How Is Bichamp Cutting Technology (Hunan)'s Growth Trending?

The only time you'd be comfortable seeing a P/E like Bichamp Cutting Technology (Hunan)'s is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. Even so, admirably EPS has lifted 109% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 25% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 19% per year, which is noticeably less attractive.

In light of this, it's curious that Bichamp Cutting Technology (Hunan)'s P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Bichamp Cutting Technology (Hunan)'s P/E?

Bichamp Cutting Technology (Hunan)'s stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Bichamp Cutting Technology (Hunan) currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Bichamp Cutting Technology (Hunan) that you need to be mindful of.

If you're unsure about the strength of Bichamp Cutting Technology (Hunan)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal