The Market Lifts Beijing Oriental Jicheng Co., Ltd. (SZSE:002819) Shares 35% But It Can Do More

Despite an already strong run, Beijing Oriental Jicheng Co., Ltd. (SZSE:002819) shares have been powering on, with a gain of 35% in the last thirty days. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

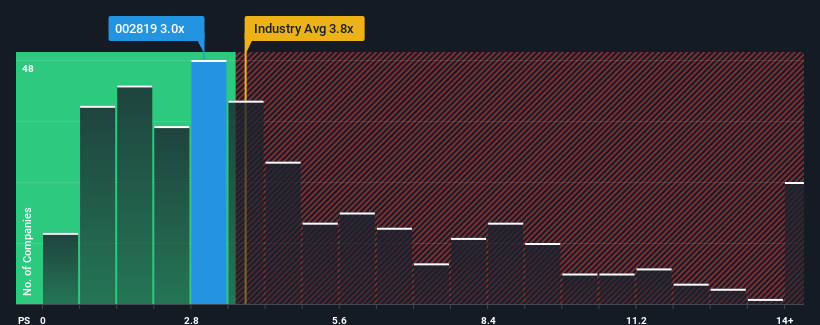

In spite of the firm bounce in price, Beijing Oriental Jicheng may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3x, since almost half of all companies in the Electronic industry in China have P/S ratios greater than 3.8x and even P/S higher than 8x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Beijing Oriental Jicheng

What Does Beijing Oriental Jicheng's P/S Mean For Shareholders?

For example, consider that Beijing Oriental Jicheng's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Beijing Oriental Jicheng's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Beijing Oriental Jicheng's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.5%. Still, the latest three year period has seen an excellent 125% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is only predicted to deliver 27% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it odd that Beijing Oriental Jicheng is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Beijing Oriental Jicheng's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Beijing Oriental Jicheng revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Beijing Oriental Jicheng that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal