Three Days Left To Buy Ping An Insurance (Group) Company of China, Ltd. (SHSE:601318) Before The Ex-Dividend Date

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Ping An Insurance (Group) Company of China, Ltd. (SHSE:601318) is about to go ex-dividend in just three days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. In other words, investors can purchase Ping An Insurance (Group) Company of China's shares before the 18th of October in order to be eligible for the dividend, which will be paid on the 18th of October.

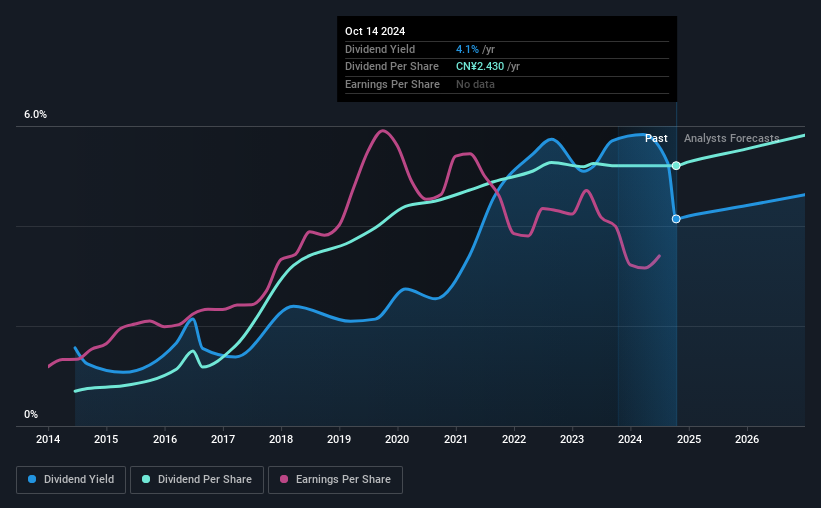

The company's next dividend payment will be CN¥0.93 per share, and in the last 12 months, the company paid a total of CN¥2.43 per share. Based on the last year's worth of payments, Ping An Insurance (Group) Company of China stock has a trailing yield of around 4.1% on the current share price of CN¥58.67. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Ping An Insurance (Group) Company of China can afford its dividend, and if the dividend could grow.

See our latest analysis for Ping An Insurance (Group) Company of China

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. That's why it's good to see Ping An Insurance (Group) Company of China paying out a modest 48% of its earnings.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. So we're not too excited that Ping An Insurance (Group) Company of China's earnings are down 3.7% a year over the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Ping An Insurance (Group) Company of China has delivered 22% dividend growth per year on average over the past 10 years.

The Bottom Line

From a dividend perspective, should investors buy or avoid Ping An Insurance (Group) Company of China? Ping An Insurance (Group) Company of China's earnings per share are down over the past five years, although it has the cushion of a low payout ratio, which would suggest a cut to the dividend is relatively unlikely. We think there are likely better opportunities out there.

Ever wonder what the future holds for Ping An Insurance (Group) Company of China? See what the 14 analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal