Insider Buying Highlights 3 Undervalued Small Caps In Australia

The Australian market has experienced a flat week but remains robust with a 17% increase over the past year, and earnings are projected to grow by 12% annually. In this environment, identifying stocks that combine strong fundamentals with potential insider confidence can be key to uncovering investment opportunities.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Magellan Financial Group | 7.8x | 4.9x | 35.85% | ★★★★★☆ |

| GWA Group | 17.0x | 1.6x | 39.77% | ★★★★★☆ |

| Tabcorp Holdings | NA | 0.5x | 20.55% | ★★★★★☆ |

| SHAPE Australia | 14.4x | 0.3x | 33.32% | ★★★★☆☆ |

| Collins Foods | 18.0x | 0.7x | 7.96% | ★★★★☆☆ |

| Centuria Capital Group | 22.7x | 5.1x | 43.01% | ★★★★☆☆ |

| Bapcor | NA | 0.9x | 45.42% | ★★★★☆☆ |

| Mader Group | 22.4x | 1.5x | 46.28% | ★★★☆☆☆ |

| Dicker Data | 21.3x | 0.8x | -75.32% | ★★★☆☆☆ |

| Coventry Group | 236.1x | 0.4x | -16.93% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

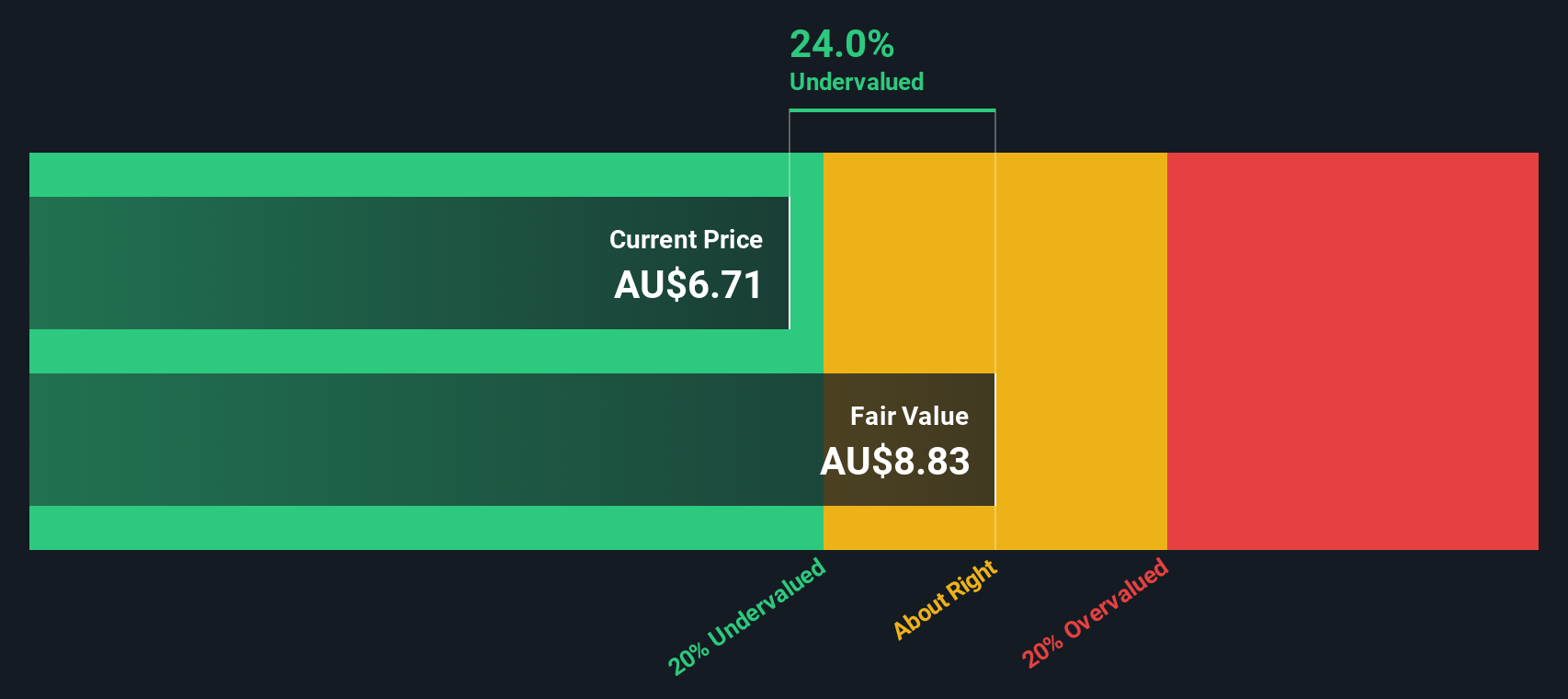

Mader Group (ASX:MAD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Mader Group operates in the staffing and outsourcing services sector, with a focus on providing skilled labor solutions, and has a market capitalization of A$1.14 billion.

Operations: The company primarily generates revenue from its Staffing & Outsourcing Services, with a recent gross profit margin of 20.92%. Operating expenses, including general and administrative costs, significantly impact the financial structure.

PE: 22.4x

Mader Group, a small Australian company, has been added to the S&P Global BMI Index as of September 2024. This inclusion reflects a growing recognition in the market. With fiscal 2025 revenue forecasted at A$870 million and net profit after tax expected to rise by 13%, Mader shows strong growth potential. Insider confidence is evident with recent share purchases, indicating belief in future prospects despite reliance on external borrowing for funding.

- Click to explore a detailed breakdown of our findings in Mader Group's valuation report.

Gain insights into Mader Group's historical performance by reviewing our past performance report.

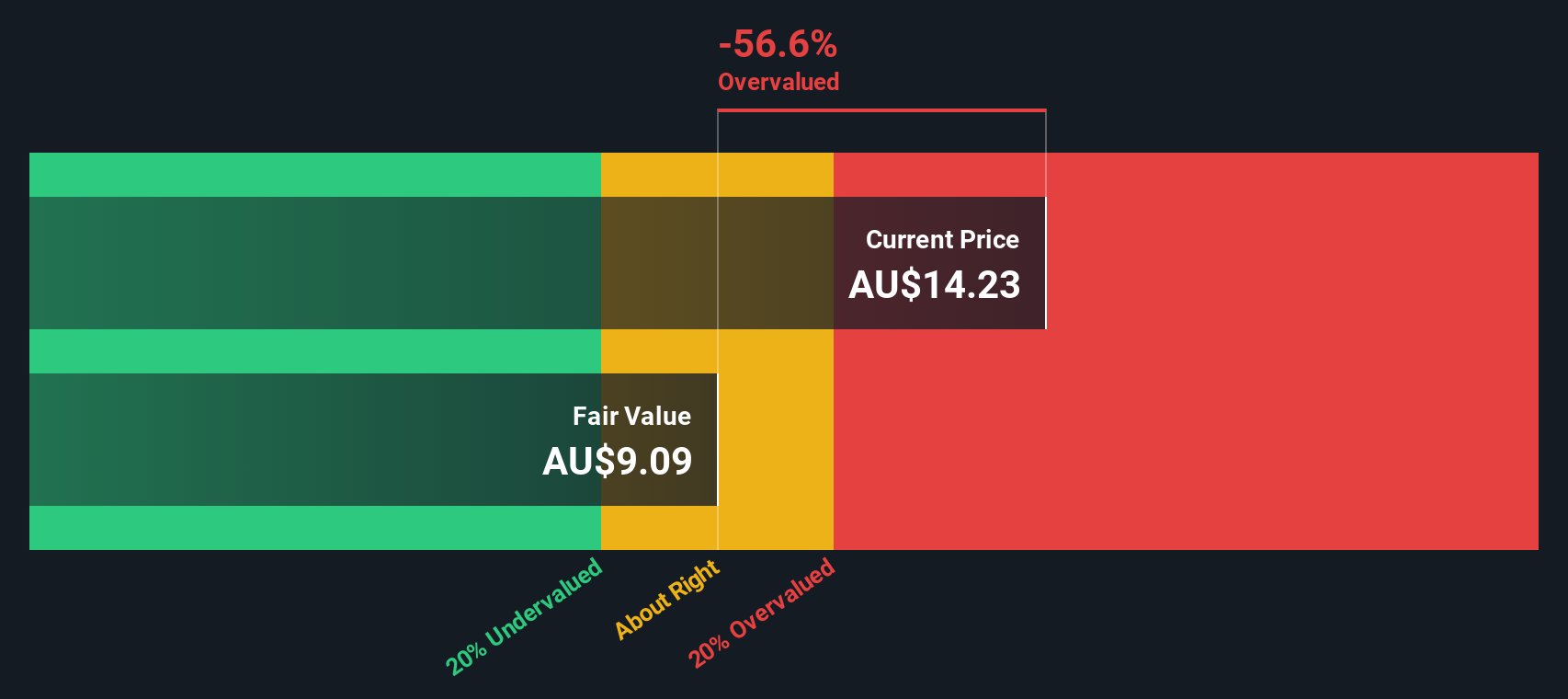

Sims (ASX:SGM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sims is a company involved in metal recycling and electronics lifecycle services, with operations spanning global trading, North America Metals, Australia/New Zealand Metals, and Sims Lifecycle Services.

Operations: Sims generates revenue primarily from its North America Metals (NAM) and Australia/New Zealand (ANZ) Metals segments, with significant contributions from Global Trading and Sims Lifecycle Services (SLS). The company's cost of goods sold (COGS) is a major expense, impacting its gross profit margins, which have fluctuated between 8.37% and 14.38% over the provided periods. Operating expenses also play a critical role in determining net income outcomes.

PE: 1393.6x

Sims, a company with a small market presence in Australia, recently reported sales of A$7.22 billion for the year ending June 30, 2024, marking an increase from A$6.66 billion the previous year. However, they faced a net loss of A$57.8 million compared to last year's net income of A$181.1 million due to substantial one-off items impacting results. Despite this setback, insider confidence is evident through recent share purchases over the past months, indicating potential optimism about future growth prospects as earnings are forecasted to grow by 41% annually.

- Unlock comprehensive insights into our analysis of Sims stock in this valuation report.

Explore historical data to track Sims' performance over time in our Past section.

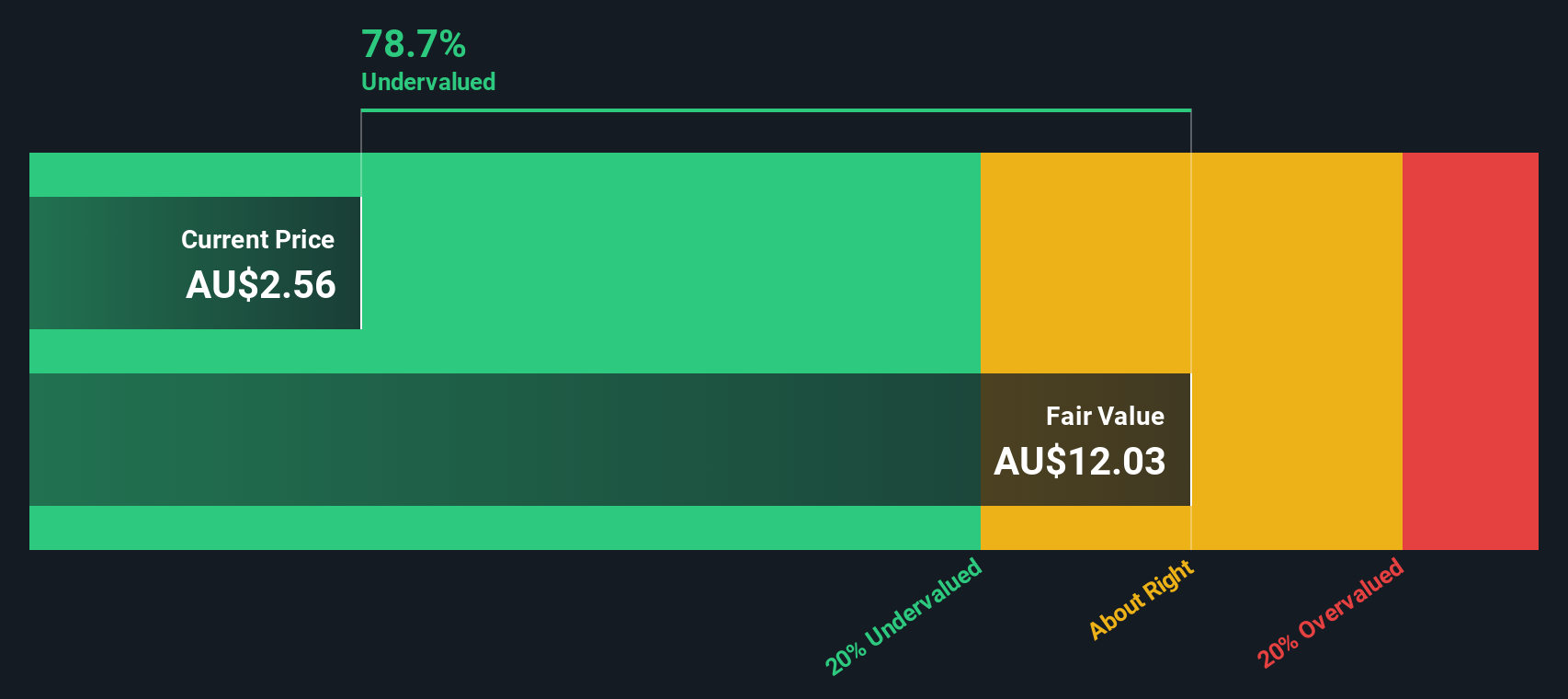

Westgold Resources (ASX:WGX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Westgold Resources is a mining company focused on gold production, primarily operating in the Bryah and Murchison regions, with a market capitalization of A$1.05 billion.

Operations: Westgold Resources generates revenue primarily from its Bryah and Murchison segments, with recent figures showing A$716.47 million in total revenue. The company's cost of goods sold (COGS) was A$559.50 million, resulting in a gross profit margin of 21.91%. Operating expenses and non-operating expenses were reported at A$30.02 million and A$31.72 million, respectively, impacting the net income margin which stood at 13.29%.

PE: 25.4x

Westgold Resources, a dynamic player in the Australian mining sector, has recently shown promising developments. With a record production of 77,369 ounces of gold in Q1 FY25 and an average sale price of A$3,723/oz, their merger with Karora Resources is already bearing fruit. The company forecasts significant growth with production guidance increased to 400-420k oz for FY25. Despite high-risk funding reliance and past shareholder dilution, insider confidence is reflected through recent stock purchases by executives.

- Dive into the specifics of Westgold Resources here with our thorough valuation report.

Examine Westgold Resources' past performance report to understand how it has performed in the past.

Where To Now?

- Explore the 23 names from our Undervalued ASX Small Caps With Insider Buying screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal