Discover 3 High Growth Companies With Significant Insider Ownership On The Chinese Exchange

As Chinese equities recently experienced a downturn amid fading optimism about government stimulus measures, investors are increasingly focused on identifying resilient growth opportunities within the market. In this context, companies with significant insider ownership often attract attention due to the potential alignment of interests between management and shareholders, which can be particularly appealing in a fluctuating economic environment.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 17.9% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.6% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 38.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| UTour Group (SZSE:002707) | 22.8% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's explore several standout options from the results in the screener.

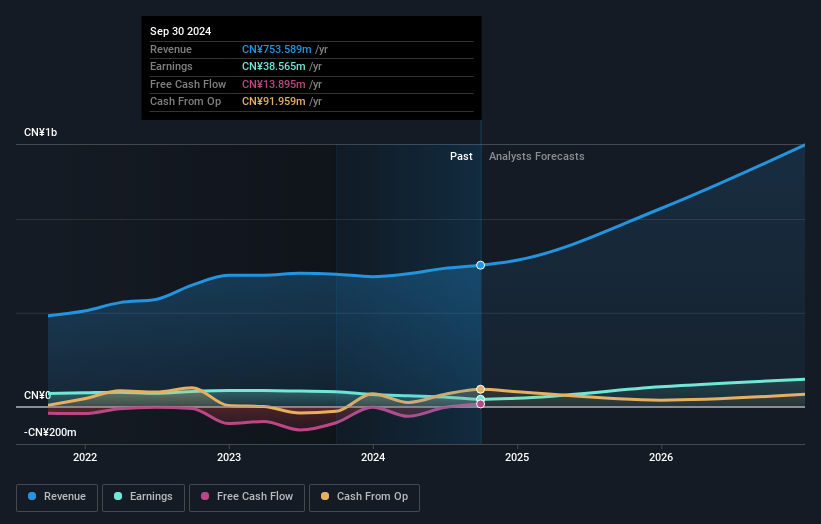

Kunshan GuoLi Electronic Technology (SHSE:688103)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kunshan GuoLi Electronic Technology Co., Ltd. operates in the electronics sector and has a market cap of CN¥3.80 billion.

Operations: The company's revenue primarily comes from its Research and Development, Production, and Sales of Vacuum Devices segment, which generated CN¥736.65 million.

Insider Ownership: 30.2%

Earnings Growth Forecast: 75.6% p.a.

Kunshan GuoLi Electronic Technology shows strong growth potential with forecasted annual revenue and earnings growth significantly outpacing the Chinese market at 57.6% and 75.6%, respectively. Despite a recent decline in net profit margins from 11.6% to 6.9%, the company completed a share buyback worth CNY 14.99 million, indicating confidence in its future prospects amidst high insider ownership, although no substantial insider trading was reported recently.

- Dive into the specifics of Kunshan GuoLi Electronic Technology here with our thorough growth forecast report.

- Our expertly prepared valuation report Kunshan GuoLi Electronic Technology implies its share price may be too high.

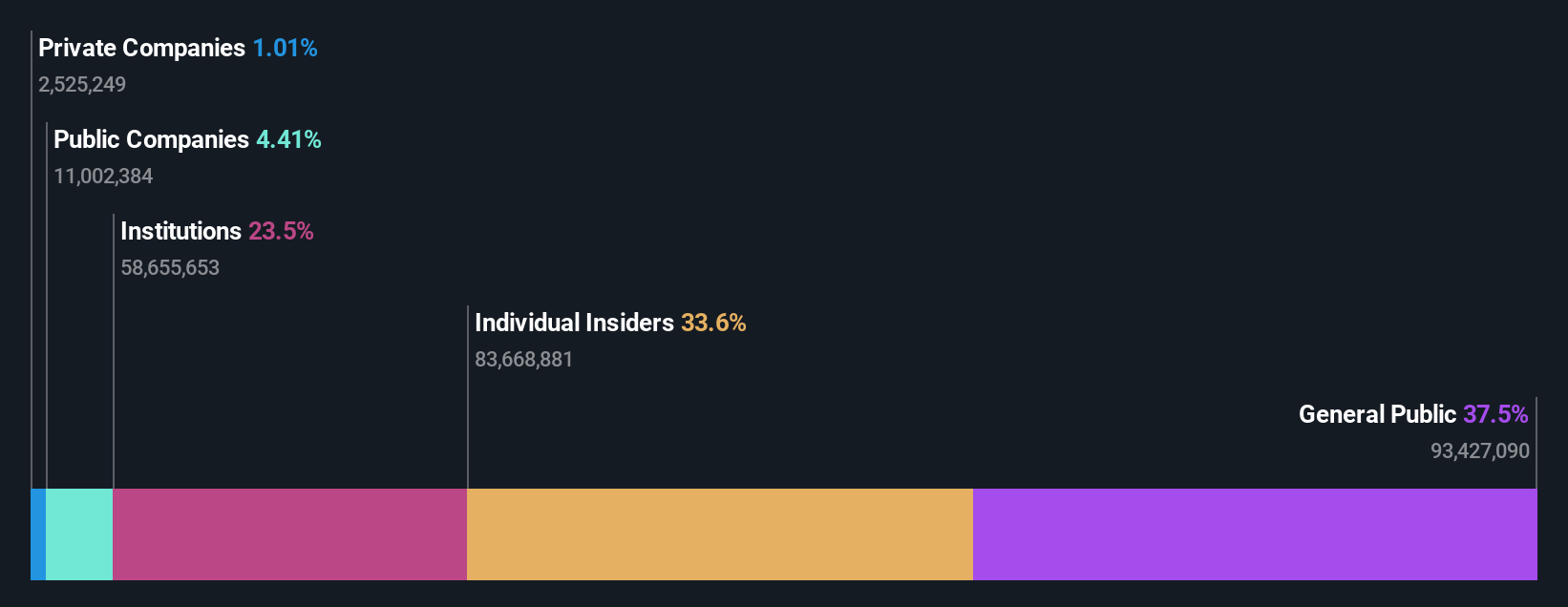

Jilin OLED Material Tech (SHSE:688378)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin OLED Material Tech Co., Ltd. focuses on the research, development, production, and sale of organic electroluminescent materials and equipment for China's new display industry, with a market cap of CN¥4.31 billion.

Operations: Jilin OLED Material Tech Co., Ltd. generates revenue through its involvement in the research, development, production, and sale of organic electroluminescent materials and equipment for China's new display industry.

Insider Ownership: 10.8%

Earnings Growth Forecast: 46.4% p.a.

Jilin OLED Material Tech is positioned for substantial growth, with forecasted annual earnings and revenue increases of 46.4% and 42.2%, respectively, outpacing the Chinese market. Despite a recent dip in net income to CNY 91.81 million, the company trades at a favorable price-to-earnings ratio of 37x compared to its industry peers. However, its dividend yield of 2.76% lacks coverage by earnings or free cash flow, and share price volatility remains high without recent insider trading activity noted.

- Take a closer look at Jilin OLED Material Tech's potential here in our earnings growth report.

- Our valuation report here indicates Jilin OLED Material Tech may be undervalued.

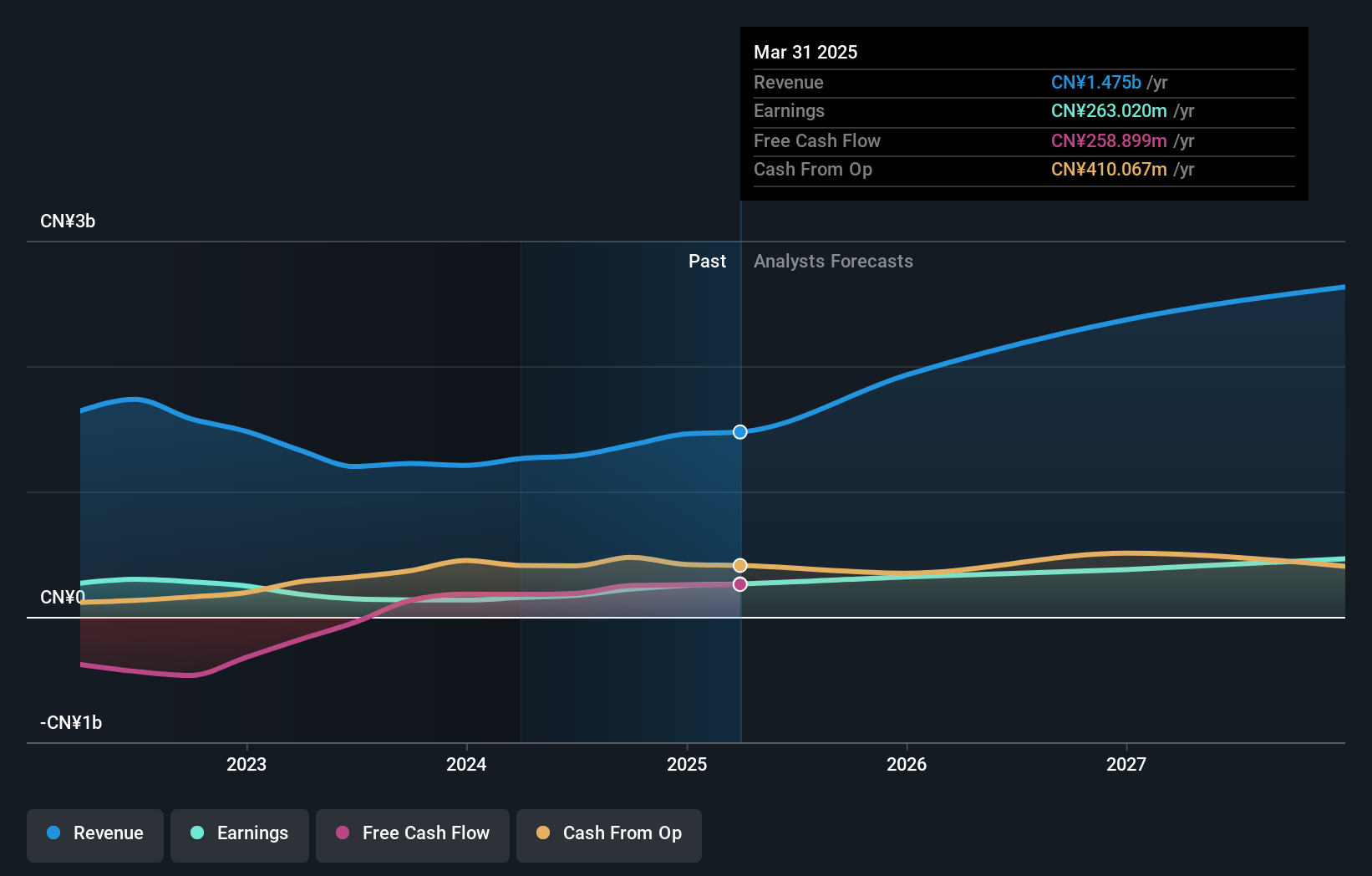

Xi'an Manareco New MaterialsLtd (SHSE:688550)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xi'an Manareco New Materials Co., Ltd specializes in the production and sale of liquid crystal materials, OLED materials, and drug intermediates with a market capitalization of CN¥4.64 billion.

Operations: The company generates revenue of CN¥1.29 billion from its Electronic Components & Parts segment.

Insider Ownership: 13%

Earnings Growth Forecast: 29.4% p.a.

Xi'an Manareco New Materials Ltd. is positioned for significant growth, with forecasted annual earnings and revenue increases of 29.4% and 22.8%, respectively, surpassing the Chinese market averages. The company trades at 65.1% below its estimated fair value, enhancing its investment appeal despite a low future return on equity forecast of 9.3%. Recent buybacks totaling CNY 61.42 million reflect management's confidence, though dividend stability remains uncertain due to an unstable track record.

- Unlock comprehensive insights into our analysis of Xi'an Manareco New MaterialsLtd stock in this growth report.

- In light of our recent valuation report, it seems possible that Xi'an Manareco New MaterialsLtd is trading behind its estimated value.

Summing It All Up

- Embark on your investment journey to our 383 Fast Growing Chinese Companies With High Insider Ownership selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal