3 High Growth Companies With Strong Insider Ownership

As global markets navigate a complex landscape marked by record highs in U.S. indices and mixed economic signals, investors are increasingly focused on identifying opportunities that can withstand volatility and deliver long-term growth. In this context, companies with strong insider ownership often attract attention due to the alignment of interests between management and shareholders, which can be particularly appealing during periods of market uncertainty.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.5% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.8% | 49.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Here's a peek at a few of the choices from the screener.

Central Puerto (BASE:CEPU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Central Puerto S.A. is involved in electric power generation in Argentina and has a market cap of ARS1.86 trillion.

Operations: The company's revenue segments include ARS273.39 billion from electric power generation from conventional sources, ARS63.26 billion from renewable sources, ARS184.47 billion from the transportation, distribution, and marketing of natural gas, and ARS10.82 billion from forest activities.

Insider Ownership: 27.4%

Earnings Growth Forecast: 84.2% p.a.

Central Puerto's earnings are forecast to grow significantly at 84.19% annually, outpacing the Argentinian market's growth rate. The company's revenue is also expected to rise by 46.9% per year, exceeding market averages. Despite a substantial increase in earnings last year, recent financial results show a decline in quarterly net income compared to the previous year. However, Central Puerto trades at a favorable price-to-earnings ratio of 11.3x relative to its peers and industry standards.

- Click here and access our complete growth analysis report to understand the dynamics of Central Puerto.

- Upon reviewing our latest valuation report, Central Puerto's share price might be too pessimistic.

MBC Group (SASE:4072)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MBC Group is a media company operating in the United Arab Emirates, Saudi Arabia, Egypt, Iraq, North Africa, and internationally with a market cap of SAR15.26 billion.

Operations: The company's revenue segments include Television Broadcasting at SAR4.75 billion, Digital Media at SAR2.30 billion, and Content Production at SAR1.85 billion.

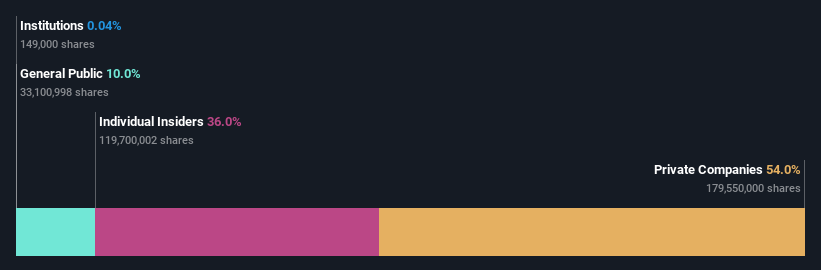

Insider Ownership: 36%

Earnings Growth Forecast: 33.9% p.a.

MBC Group's earnings are forecast to grow significantly at 33.9% annually, surpassing the South African market's growth rate. Revenue is expected to increase by 20.6% per year, also exceeding market averages. Despite a substantial 76.5% earnings growth last year, the company's return on equity is projected to be low in three years at 11%. Recent financial results have been impacted by large one-off items, with no significant insider trading activity reported recently.

- Unlock comprehensive insights into our analysis of MBC Group stock in this growth report.

- Our comprehensive valuation report raises the possibility that MBC Group is priced higher than what may be justified by its financials.

Jahez International Company for Information Systems Technology (SASE:9526)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jahez International Company for Information Systems Technology operates an online food delivery platform under the Jahez brand name in Saudi Arabia, with a market cap of SAR5.22 billion.

Operations: The company's revenue segments include SAR1.93 billion from delivery platforms and SAR405.74 million from logistics activity.

Insider Ownership: 10.5%

Earnings Growth Forecast: 23.7% p.a.

Jahez International Company for Information Systems Technology's earnings are forecast to grow significantly at 23.67% annually, outpacing the South African market's growth rate of 7.2%. Despite a recent decline in net income, with SAR 30.24 million reported for Q2 compared to SAR 50.36 million last year, sales increased to SAR 540.96 million from SAR 421.04 million. The share price has been volatile recently, and no significant insider trading activity was observed in the past three months.

- Dive into the specifics of Jahez International Company for Information Systems Technology here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Jahez International Company for Information Systems Technology is trading beyond its estimated value.

Summing It All Up

- Reveal the 1484 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal