3 Japanese Growth Companies With Insider Ownership Up To 23%

Japan's stock markets have been on the rise, with the Nikkei 225 Index gaining 2.45% over the past week, supported by yen weakness that has boosted the profit outlook for exporters. As investors navigate these favorable conditions, growth companies with significant insider ownership often attract attention due to their potential alignment of interests between management and shareholders, making them compelling considerations amidst current market dynamics.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 26.1% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 40.2% |

| Medley (TSE:4480) | 34% | 30.4% |

| Inforich (TSE:9338) | 19.1% | 29.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Loadstar Capital K.K (TSE:3482) | 33.8% | 24.3% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

Let's dive into some prime choices out of the screener.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★★

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations primarily in Japan, with a market cap of approximately ¥340.35 billion.

Operations: The company generates revenue primarily through its Platform Services Business, which accounts for ¥36.16 billion.

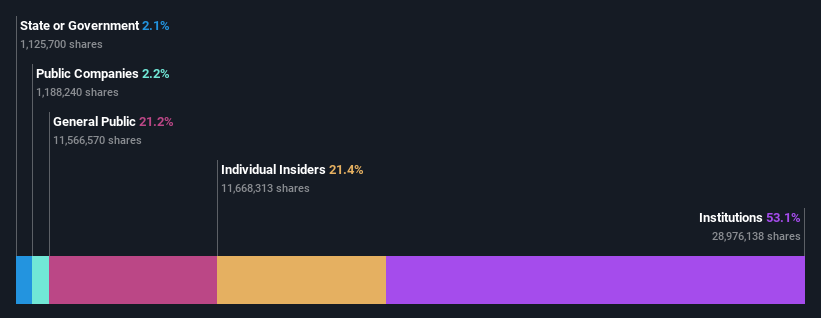

Insider Ownership: 21.4%

Money Forward is poised for significant growth, with earnings forecasted to grow 68.12% annually and revenue expected to rise 20.7% per year, outpacing the JP market. The company is projected to become profitable within three years, with a high return on equity of 20.6%. Trading at 47.1% below its estimated fair value, Money Forward recently considered agreements with Sumitomo Mitsui Card Company and restructured its fintech business operations through subsidiary transfers.

- Click here and access our complete growth analysis report to understand the dynamics of Money Forward.

- Our valuation report unveils the possibility Money Forward's shares may be trading at a premium.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥197.19 billion.

Operations: Revenue Segments (in millions of ¥): freee K.K. generates revenue through its cloud-based accounting and HR software solutions in Japan.

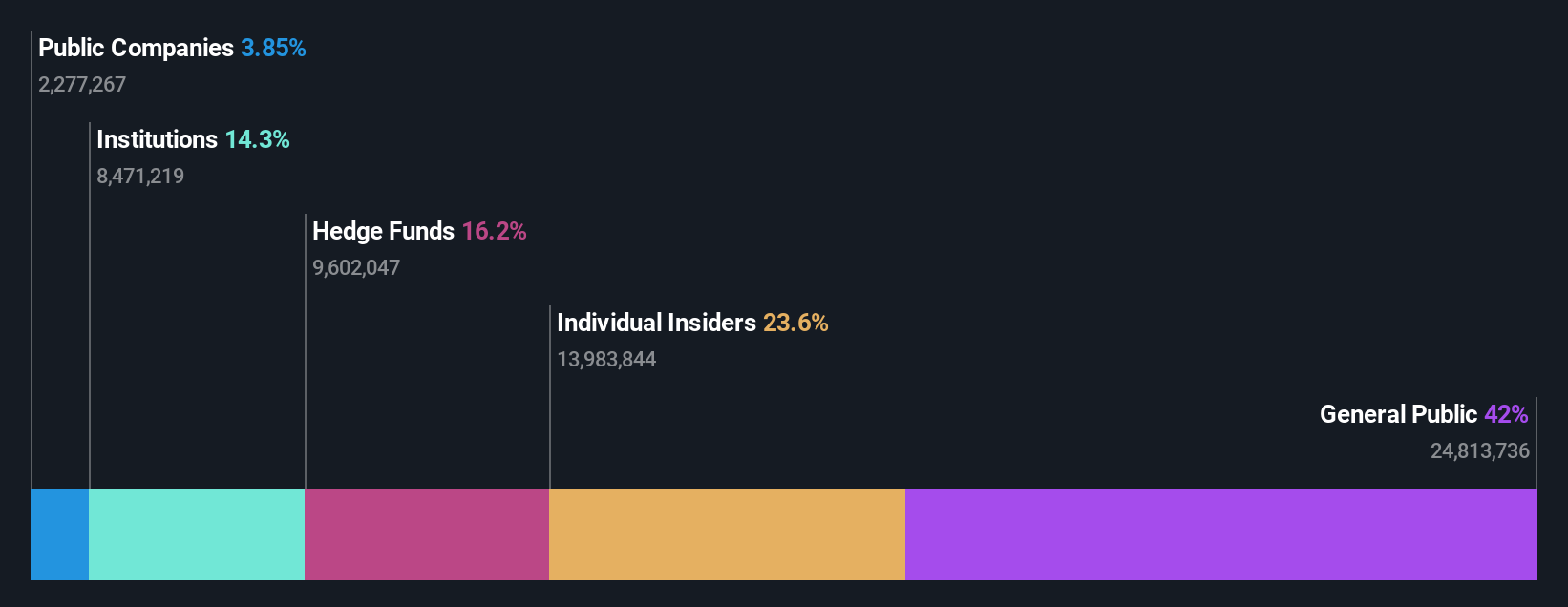

Insider Ownership: 23.9%

freee K.K. demonstrates potential for growth, with earnings projected to increase by 74.08% annually and revenue expected to grow at 18.2% per year, surpassing the Japanese market average. The company is anticipated to achieve profitability within three years, with a forecasted return on equity of 21.9%. Recent executive changes include Yasuhiro Kimura's appointment as CPO, following Sumito Togo's resignation, while proposed amendments aim to expand business activities further.

- Click here to discover the nuances of freee K.K with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, freee K.K's share price might be too pessimistic.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications services both in Japan and internationally with a market cap of ¥20.40 billion.

Operations: Rakuten Group's revenue segments include Mobile at ¥382.95 million, Fin Tech at ¥772.29 million, and Internet Services at ¥1.24 billion.

Insider Ownership: 17.3%

Rakuten Group is poised for significant growth, with earnings projected to increase by 79.35% annually and revenue expected to grow at 7.5% per year, outpacing the Japanese market average of 4.3%. The company is anticipated to become profitable within three years, although its forecasted return on equity remains low at 9.7%. Despite recent share price volatility, Rakuten trades significantly below its estimated fair value and recently presented at a healthcare showcase in New York.

- Get an in-depth perspective on Rakuten Group's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Rakuten Group implies its share price may be lower than expected.

Make It Happen

- Click this link to deep-dive into the 101 companies within our Fast Growing Japanese Companies With High Insider Ownership screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal