Even after rising 15% this past week, Regis Resources (ASX:RRL) shareholders are still down 47% over the past five years

Regis Resources Limited (ASX:RRL) shareholders should be happy to see the share price up 20% in the last month. But that doesn't change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 52% in that time, significantly under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

View our latest analysis for Regis Resources

Regis Resources isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Regis Resources grew its revenue at 13% per year. That's a fairly respectable growth rate. The share price, meanwhile, has fallen 9% compounded, over five years. It seems probably that the business has failed to live up to initial expectations. That could lead to an opportunity if the company is going to become profitable sooner rather than later.

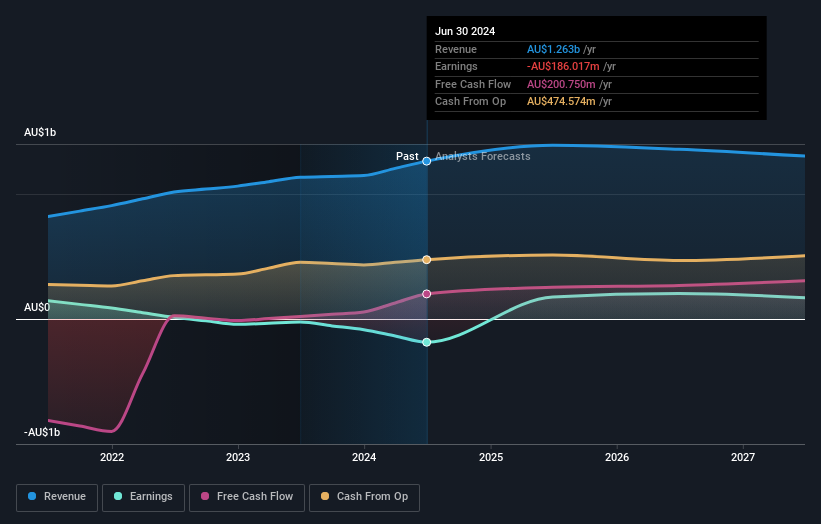

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Regis Resources is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Regis Resources will earn in the future (free analyst consensus estimates)

What About The Total Shareholder Return (TSR)?

We've already covered Regis Resources' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Regis Resources' TSR, which was a 47% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We're pleased to report that Regis Resources shareholders have received a total shareholder return of 40% over one year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Before spending more time on Regis Resources it might be wise to click here to see if insiders have been buying or selling shares.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal