High Growth Tech Stocks In Australia For October 2024

The Australian market has remained flat over the past week but has experienced a significant 17% increase over the past year, with earnings anticipated to grow by 12% annually in the coming years. In this context, identifying high-growth tech stocks involves looking for companies that not only align with these robust growth expectations but also demonstrate strong innovation and competitive positioning within their sector.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| Telix Pharmaceuticals | 20.10% | 38.31% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| SiteMinder | 19.65% | 60.64% | ★★★★★☆ |

Click here to see the full list of 64 stocks from our ASX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

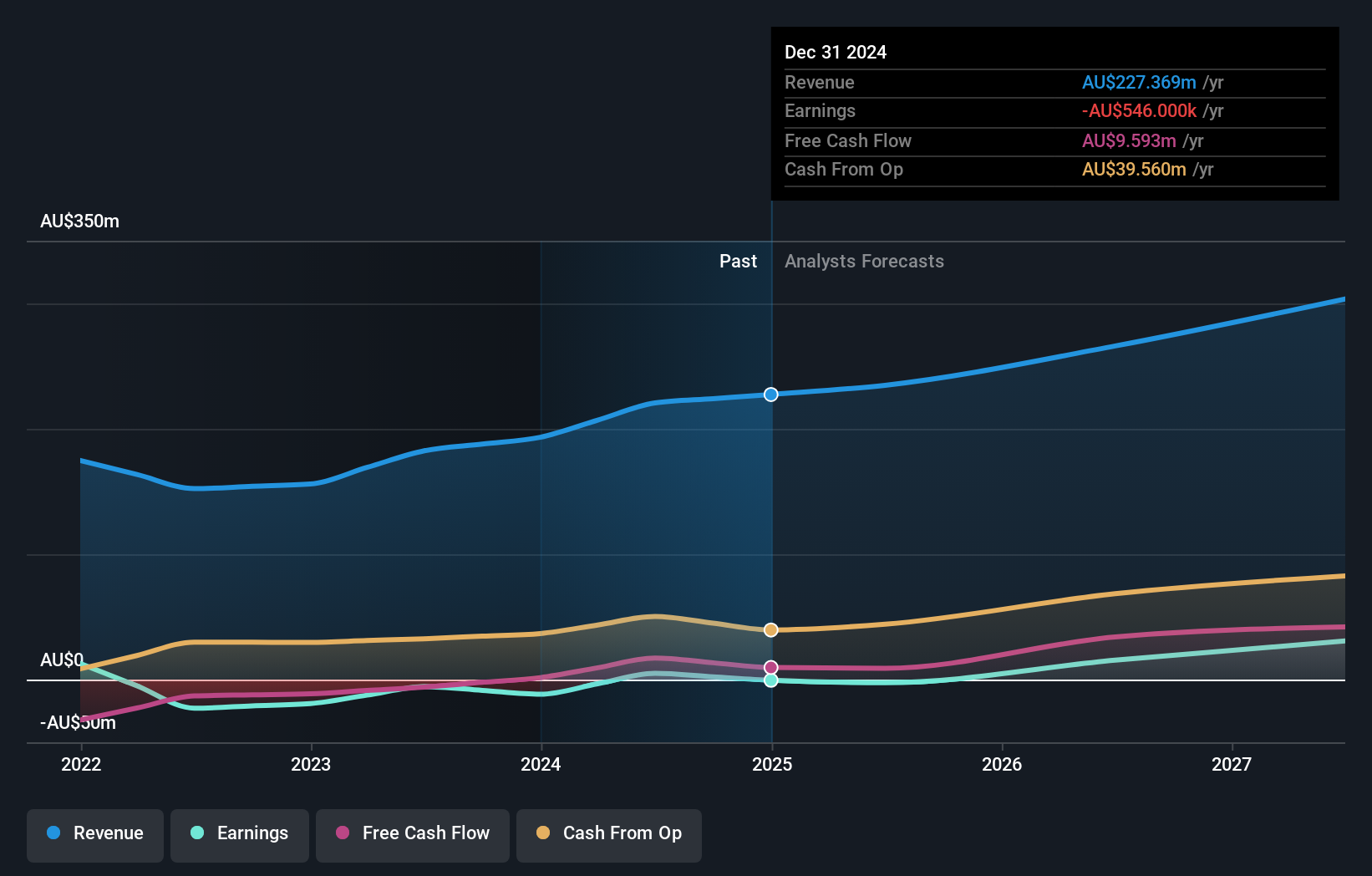

Nuix (ASX:NXL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nuix Limited is a company that offers investigative analytics and intelligence software solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa, with a market cap of A$2.31 billion.

Operations: Nuix generates revenue primarily from its Software & Programming segment, which accounted for A$220.62 million. The company operates in multiple regions, providing specialized software solutions for investigative analytics and intelligence.

Nuix, recently added to the S&P/ASX 300 and Small Ordinaries Indexes, is navigating a transformative phase with strategic alliances like the one with Veritone, enhancing its eDiscovery and compliance platforms through AI integration. This collaboration aims to streamline complex data analysis, crucial as digital evidence volumes grow. Financially, Nuix turned a profit this year with earnings of AUD 5.03 million from a loss last year and reported an 11.8% revenue increase to AUD 220.62 million. The company's commitment to innovation is evident in its R&D spending which supports its forecasted earnings growth of 40.2% per annum, positioning it favorably in the tech sector despite slower market growth projections.

- Click here and access our complete health analysis report to understand the dynamics of Nuix.

Assess Nuix's past performance with our detailed historical performance reports.

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system services to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe, with a market cap of A$19.51 billion.

Operations: The company generates revenue primarily through the production of integrated software applications for the healthcare industry, amounting to A$161.50 million. Its operations span Australia, North America, and Europe.

Pro Medicus demonstrates robust growth with a revenue increase to AUD 166.33 million and net income surging to AUD 82.79 million, reflecting a strong year-over-year performance. The company's strategic emphasis on R&D is evident from its significant investment, aligning with an 18.9% forecasted annual earnings growth, outpacing the Australian market's average of 12.2%. This focus not only fuels innovation but also positions Pro Medicus distinctively in the tech landscape, particularly as it capitalizes on trends like increased demand for advanced medical imaging solutions.

- Click to explore a detailed breakdown of our findings in Pro Medicus' health report.

Examine Pro Medicus' past performance report to understand how it has performed in the past.

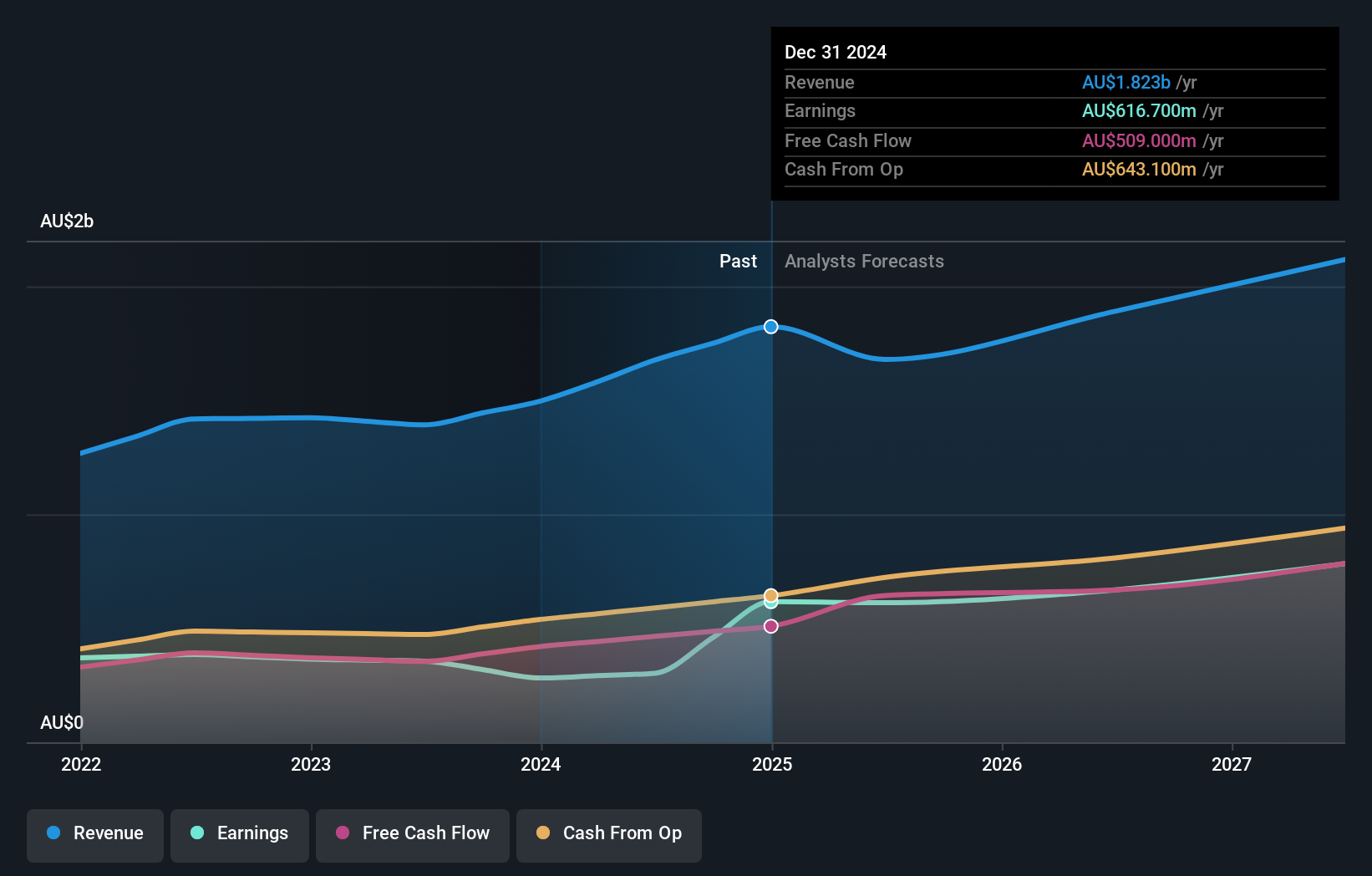

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market capitalization of approximately A$28.91 billion.

Operations: The company generates revenue primarily through its property and online advertising segment in Australia, contributing A$1.25 billion, followed by financial services at A$320.6 million and operations in India at A$103.1 million. The focus on digital advertising across diverse markets supports its business model, with a notable emphasis on the Australian market for substantial revenue generation.

REA Group, navigating through a challenging fiscal year with a net income drop to AUD 302.8 million from AUD 356.1 million, still managed to declare an increased dividend of 102 cents per share, up by 23%. This resilience is underscored by its R&D commitment, crucial in the tech-driven real estate sector. Despite a revenue growth forecast at 6.5%, below the high-growth benchmark of 20%, REA's earnings are expected to climb by 16.8% annually, outperforming the Australian market's average of 12.2%. This juxtaposition of declining profits against robust dividends and promising earnings growth highlights REA’s strategic balancing act in enhancing shareholder value while investing in innovation to stay competitive in the evolving digital landscape.

Turning Ideas Into Actions

- Access the full spectrum of 64 ASX High Growth Tech and AI Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal